Should You Forget AGNC Investment and Buy Realty Income Instead?

December 28, 2025

AGNC Investment’s dividend yield is more than twice as large as Realty Income’s, but the lower yield could still be the better choice.

One of the big risks for dividend lovers is focusing too much on yield. A great example of the problem here comes from comparing ultra-high AGNC Investment (AGNC +0.09%) and its 13.5% dividend yield to Realty Income (O +0.04%) and its 5.7% yield. AGNC Investment isn’t a bad company, per se, but Realty Income is likely to be the better dividend stock if you are trying to live off the income your portfolio generates.

First decide on your investing goal

Investing isn’t easy; it requires focus and commitment. Before you start buying stocks, define your goal, so you have a target to aim for and a measure to track your performance. The goal of most dividend investors is to generate a substantial and sustainable income stream from their portfolio, allowing them to use that money to cover living expenses.

Image source: Getty Images.

The two most important words there are substantial and sustainable. It is actually fairly easy to find substantial dividend yields. All you need to do is run a simple stock screen. The bigger problem is finding a dividend-paying company that can sustain its dividend, if not grow it, over the long term.

If you focus only on buying the highest-yielding stocks, you are likely to end up facing a lot of dividend cuts. In fact, an extremely high yield is often a sign that investors are concerned about the reliability of a company’s dividend. That’s likely one of the reasons mortgage real estate investment trust (mREIT) AGNC Investment has such a large yield.

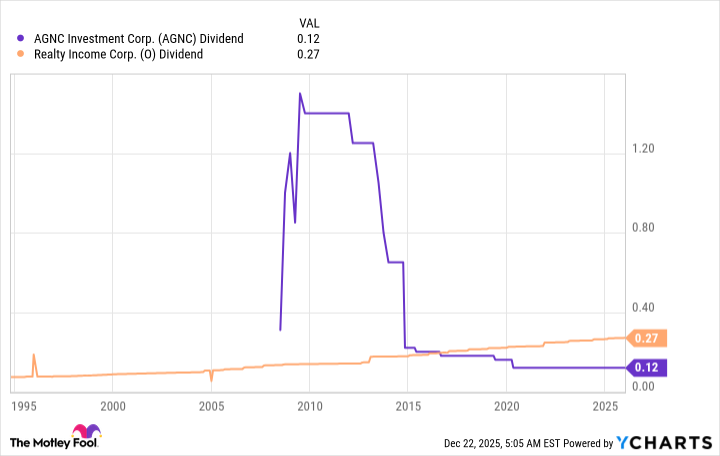

AGNC Dividend data by YCharts

AGNC Investment is well run

As the chart above highlights, AGNC Investment’s dividend has been highly volatile over its history. Realty Income, by comparison, epitomizes stability with a steadily rising dividend. In fact, Realty Income’s dividend has increased annually for three decades. If you need your dividend income to pay for living expenses, Realty Income is going to be a much better choice for your portfolio.

Advertisement

The difference here boils down to each company’s goal and business approach. AGNC Investment owns a portfolio of mortgages that have been pooled together into bond-like securities. The company manages those securities in an effort to maximize total return, assuming the reinvestment of dividends. From that perspective, the company has done a commendable job over time. However, if you are looking for a reliable income stream, focusing just on AGNC’s huge dividend yield will lead you astray.

Realty Income

Today’s Change

(0.04%) $0.02

Current Price

$56.69

Realty Income is a more traditional property-owning real estate investment trust (REIT). It owns single-tenant properties, the tenants being responsible for most property-level operating costs (an arrangement known as a net lease in the industry). It is focused on retail properties, but it also owns industrial assets and other things, such as casinos and vineyards. Its portfolio is also geographically diverse, with properties located across the United States and Europe.

Realty Income is basically designed to provide investors with a reliable and growing dividend stream. For those who need dividends to supplement their Social Security income in retirement, Realty Income’s lower yield will be more suitable. However, it is essential to acknowledge that the stock’s 5.7% yield remains highly attractive. It compares very favorably to the S&P 500 index’s tiny 1.1% yield and is higher than the average REIT yield of 3.9%.

Realty Income isn’t risk-free

AGNC Investment’s lofty yield comes with the risk of dividend cuts, which are fairly common in the mREIT space. Realty Income’s lofty yield also comes with its own caveats. The trade-off investors need to consider is that dividend growth is modest, coming in at only 4.2% a year over the past 30 years.

That is enough to keep up with the long-term growth rate of inflation, which is good, but the buying power of your dividends isn’t growing quickly. The yield is the big draw. So long as that’s OK with you, Realty Income will be a more appealing choice for investors seeking reliable dividend stocks.

Search

RECENT PRESS RELEASES

Related Post