Ethereum Faces Defining 2026 Moment As It Approaches Technical Turning Point

December 30, 2025

Matrixport did not set price targets for Ethereum, but noted that the price could move significantly in either direction.

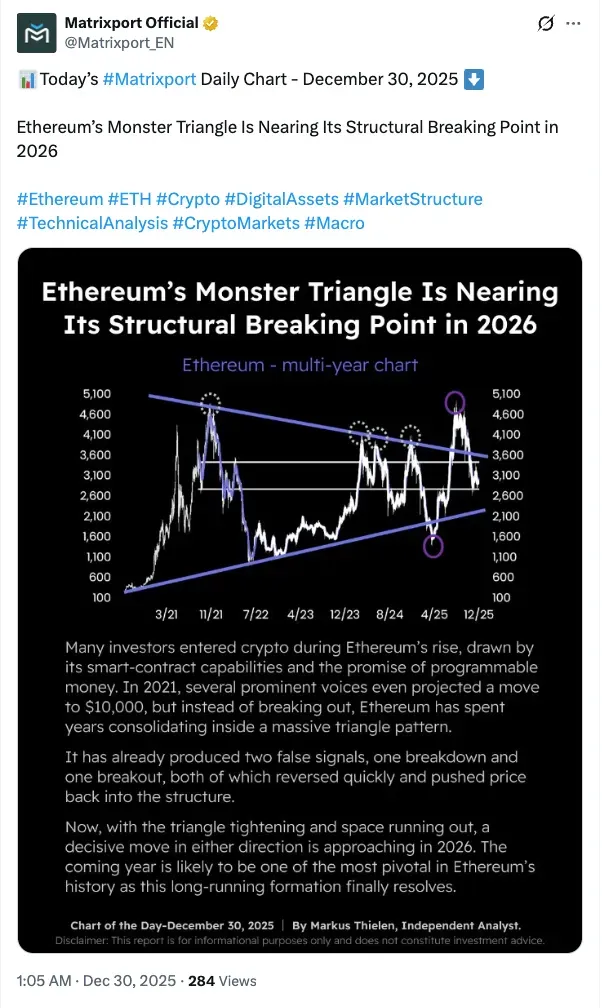

- Matrixport analysts believe Ethereum is getting closer to a structural tipping point in 2026 as a multi-year triangle pattern emerging from the post-2021 peak is consolidated.

- Analysts observed that the structure has had two unsuccessful break signals and that global liquidity, ETF flows, and on-chain activity could influence the outcome.

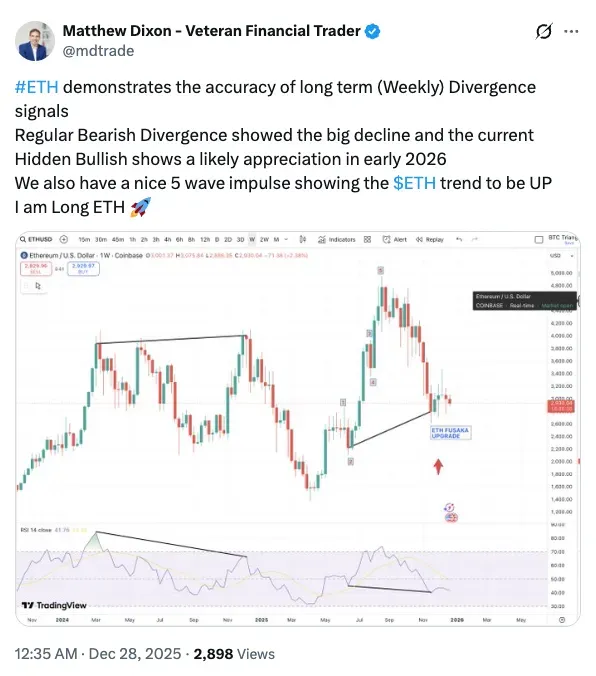

- Bullish higher-timeframe divergence and early five-wave impulses suggest a larger recovery period, said Mathhew Dixxon.

Matrixport analysts said on Tuesday that Ethereum (ETH) is nearing a key inflection point in 2026 as it tightens a multi-year consolidation pattern, which keeps no scope for sideways motion.

On X, analysts at Matrixport noted that Ethereum’s long-term triangle price structure has been forming since the 2021 cycle peak. Despite repeated attempts to break higher, especially amid strong narrative support around smart contracts, decentralized finance (DeFi), and tokenization, ETH has still been range-bound for a long period. The firm pointed out that the pattern has led to two failed signals — one on a breakdown and one on a breakout — which reversed quickly and forced prices back into consolidation.

Ethereum (ETH) was trading at $2,979, down 1.2% over the past day. On Stocktwits, retail sentiment around the coin dropped from ‘bearish’ to ‘extremely bearish’ over the past day, with chatter remaining at ‘low’ levels.

The extended nature of the compression is, in the analysts’ estimate, a reflection of a market that has already withstood several macro shocks and regulatory curveballs, as well as changing liquidity conditions, without really developing a firm price trend. Matrixport predicts significant expansion when the above and lower trendlines meet, making 2026 a key year for Ethereum’s long-term market structure.

Although the firm did not cite any specific price targets, it noted how resolution could be a substantial addendum in either direction when you take into account the distance and length of time that made up the pattern. Analysts further noted that broader market vectors like global liquidity, ETF flows, and on-chain activity should play a significant role in determining whether or not Ethereum finally shatters higher or resolves lower after years of consolidation.

Beyond Matrixport’s structural view, long-time trader Matthew Dixon emphasized a bullish divergence in the higher timeframes, recalling that this type of setup in previous cycles tends to lead to significant upside potential. Dixon also noted initial signs of a developing five-wave impulse structure, which he believes suggests prices are part of a larger recovery phase, not continuation.

Read also: US Spot Altcoin ETFs Log $12M Inflows, Bucking Bitcoin And Ethereum ETF Outflows

For updates and corrections, email newsroom[at]stocktwits[dot]com

Search

RECENT PRESS RELEASES

Related Post