The dark side of solar energy

January 4, 2026

•

Macro

In today’s Finshots, we take a look at some of the uncomfortable downsides of the renewable energy transition.

But before that: How Strong Is Your Financial Plan?

You’ve likely ticked off mutual funds, savings, and maybe even a side hustle. But if Life Insurance isn’t a part of it, your financial pyramid isn’t as secure as you think.

Life insurance is the crucial base that holds all your wealth together. It ensures that your family stays financially protected when something unpredictable happens.

If you’re unsure where to begin, Ditto’s IRDAI-Certified insurance advisors can help. Book a FREE 30-minute consultation and get honest, unbiased advice. No spam, no pressure.

Now onto today’s story.

The Story

Over the last few weeks, silver prices have returned to the spotlight. There’s news about a supply crunch as industrial demand is climbing upward for the metal that usually lives in the shadow of gold.

At first glance, that seems odd. Silver isn’t oil. It isn’t coal. It isn’t even copper. But its resurgence says something important about how the world is trying to fix its energy problem.

Because every major energy transition in history has followed the same pattern. It solves the problem we are worried about at the moment, but creates a new set of problems that only become visible later.

Coal replaced wood and saved forests, but filled cities with smoke. Oil replaced coal and made transport affordable, but it made the world more dependent on fossil fuels. Natural gas cleaned up the air around cities, but didn’t really solve the climate problem. Each transition felt like progress, and each came with trade-offs that only became obvious at scale.

Solar energy sits in the same lineage, promising cleaner air, lower emissions, and energy independence. And in many ways, it delivers. But like every transition before it, there is a hidden downside that only becomes apparent at scale.

For years, solar energy has been sold as the cleanest solution to our climate problem. No smoke, no fuel, no moving parts. Just sunlight turning into electricity.

And to be fair, that story isn’t wrong. Once installed, a solar panel generates power with almost zero emissions. Costs have fallen sharply over the past decade, and installations are scaling rapidly. Governments, too, around the world are embracing solar because it seems to hit two birds with one stone. It helps meet climate targets and reduces dependence on imported fuels.

This is why solar is often framed as a silver bullet. The underlying narrative is simple and comforting. Replace coal plants with solar panels, add some batteries, and the energy problem largely takes care of itself.

These systems, though, don’t operate on narratives, but on physics, materials, and reliability. And that’s where the solar story starts to become more complicated.

Solar energy’s biggest limitation is also its most obvious one. The sun doesn’t follow demand.

Solar power generation peaks around midday, when the sun is at its brightest. But electricity demand usually peaks after sunset, when people return home, switch on lights, cook dinner, and run appliances. That mismatch creates a fundamental problem for power grids. The electricity is generated when it’s least needed and disappears when demand is at its highest.

To deal with this, grids need either extensive transmission infrastructure to move power from solar-surplus regions to solar-deficient ones or they need storage and backup generation. Either of these is expensive, stores power only for short durations, and degrades over time.

As a result, even countries with heavy solar adoption continue to rely on fossil fuels, hydroelectric power, or nuclear energy to maintain stability once the sun goes down or when weather conditions turn unfavourable.

So if we truly need a renewable energy source, it is something that must be predictable, scalable, and have low carbon emissions. Nuclear is arguably the only thing that ticks all three. But that’s a topic for another day.

Then, there’s another issue with solar that receives far less attention and yet looms just as large. And that is manufacturing the panels itself.

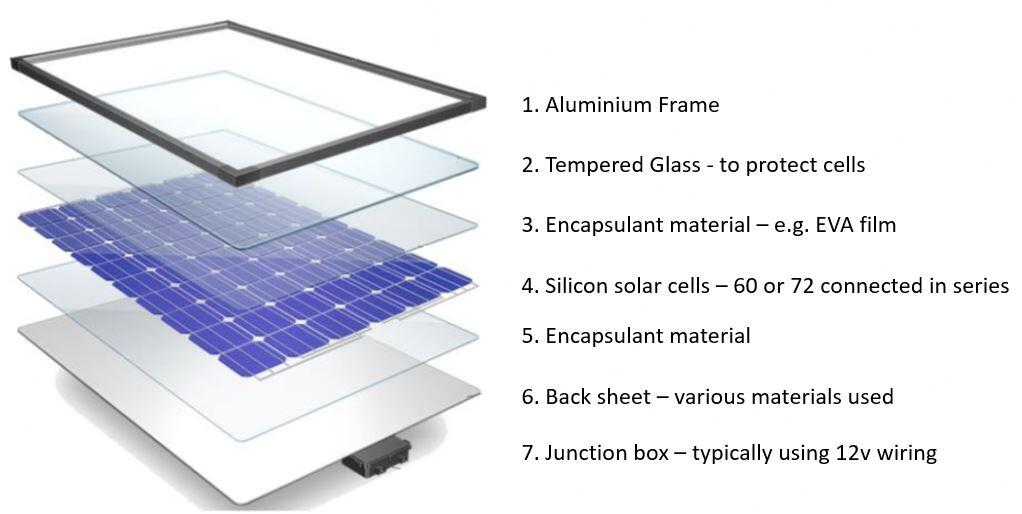

Solar power does not burn fuel, but it consumes an enormous amount of physical resources. Silicon is needed for the cells.

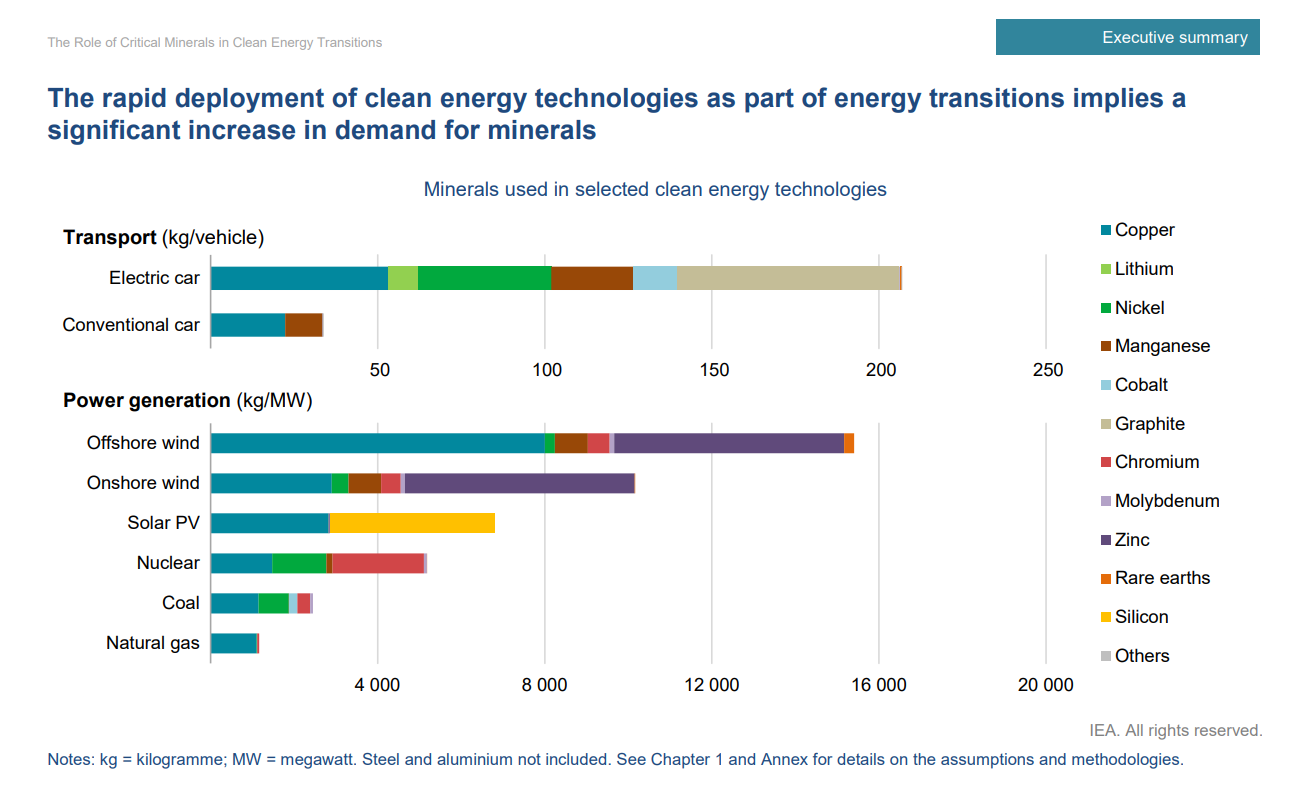

Aluminium for frames and mounting structures. Copper for wiring and inverters. Silver for electrical contacts. Glass made from high-purity sand to protect the cells. When you add all this up, solar ends up being far more material-intensive per unit of electricity capacity than coal or natural gas. Here’s an infographic to help you understand:

And mining those materials is neither clean nor low-carbon. From extraction to processing, the entire supply chain is highly energy-intensive. On top of that, components are transported across continents before a panel ever reaches a rooftop or a solar farm. Most of this activity still runs on fossil fuels. As a result, a significant portion of a solar panel’s lifetime emissions are front-loaded during mining and manufacturing. That said, we do agree that panels repay this carbon debt over time, but that repayment is gradual rather than instant.

Apart from this, as solar installations scale globally, demand for both silver and copper is increasing. Photovoltaic cells (the individual solar cell in a solar panel) manufacturing alone accounted for about 14% of global silver consumption in 2023, driven by its use in photovoltaic cells.

Copper demand is even more widespread, as we need it not just for solar panels but also for inverters, transmission lines, electric vehicles, charging infrastructure, and the necessary grid upgrades to support a renewable-heavy system.

Naturally, when demand grows faster than supply, prices increase. So part of the recent strength in silver and copper prices isn’t just driven by speculation or short-term cycles; it could also be because of this increased demand.

There is also a geographic imbalance embedded in this transition. The environmental damage caused by mining is local and immediate. Communities near mines deal with land degradation, water pollution, and waste. Meanwhile, the benefits of clean electricity are enjoyed far away, often in cities and industries thousands of kilometres from the point of extraction.

Once you add this to the cost of upgrading grids, recycling challenges for aging panels, and policy uncertainty into the equation, solar starts to look less black-and-white and more complex.

However, none of this makes solar a bad idea. Countries aren’t wrong to invest heavily in it. Solar is cheap, scalable, and far cleaner than the fossil fuels it replaces. It will almost certainly remain one of the pillars of the energy transition.

But it is clean only at the point of generation, not at the point of extraction. It reduces emissions gradually over time. And while it lowers fossil fuel consumption, it does not replace reliable, always-on power capacity one-for-one at an industrial level. Instead, it sits atop grids that still need storage, backup, and careful balancing to function smoothly.

The real risk isn’t overinvestment in solar. It’s underestimating everything else the transition demands. It’s that they might convince themselves that solar alone can do the heavy lifting, without fully grappling with the trade-offs, such as a poor electricity grid and subpar storage capacity, that come with it.

That said, apart from just investing in solar farms, countries should also allocate a portion of their budgets to these additional, but necessary, upgrades. Unless that gap is acknowledged, solar will remain both a solution and a source of new constraints.

Until then…

If this story helped you understand the nuances of the renewable energy transition, feel free to share this with your friends, family, or even strangers on WhatsApp, LinkedIn, and X.

For the third year in a row, we present Finshots’ Current Affairs Round up 2025!

A FREE and comprehensive compilation of our most impactful financial, economic, tech and business highlights of the year is here. Get our classic 3-min reads in an easy to access PDF eBook.

Plus, we made sure to add our signature infographics too! Click here to access the PDF resource now.

And don’t forget to share this with your peers, friends, and anyone in your network who might benefit from it.

Happy Reading 🙂

Search

RECENT PRESS RELEASES

Related Post