India power sector review 2025: Record clean energy deployment drives historic decline in

January 6, 2026

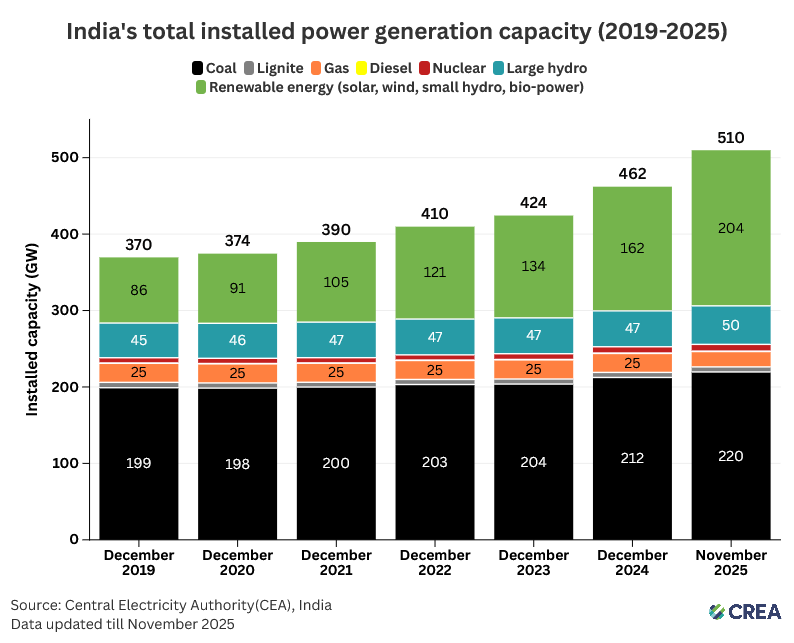

India’s power sector is experiencing rapid change as renewable energy deployment accelerates year after year. India added 41 GW of renewable energy in the first eleven months of 2025, already making a record for capacity additions during a full year, and raising the share of renewables to 40% of the country’s installed capacity. At the same time, rising electricity demand is increasingly being met by renewable generation, particularly during daytime hours when solar power is available. This further eases the replacement of coal power with renewables.

Despite the rapid acceleration of renewable energy, the government intends to add 100 GW of new coal-based capacity over the next seven years. However, India’s existing and under-construction coal fleet is already exceeding the coal capacity requirement projected by multiple resource adequacy assessments for 2030.

The challenge is not capacity adequacy but system flexibility. Most coal plants in India operate at minimum technical loads of around 55%, which forces them to run even during periods when low-cost renewable electricity is available. Long-term coal power purchase agreements continue to bind utilities to higher-cost thermal generation even when lower-cost renewable electricity is available.

This operational rigidity results in avoidable curtailment of solar and wind generation. Enabling higher renewable penetration will therefore require structural reforms that reduce flexibility constraints in the coal fleet, accelerate deployment of battery energy storage, and grid upgradation.

This annual power brief evaluates these shifting dynamics through reviewing India’s generation capacity, ongoing thermal capacity construction, electricity demand trends, source-wise generation patterns, and plant utilisation levels. It also examines the structural reforms required to effectively integrate high renewable penetration, including coal flexibilisation, storage expansion, and grid strengthening, as well as outlines what must be done to prioritise renewable energy over new coal additions.

Figure 1 — India’s total installed power capacity (2019-2025)

Key findings

- India’s coal-fired power generation fell in 2025 by 3%, only the second drop for a full calendar year in at least half a century, with the first one being associated with the Covid-19 pandemic.

- The drop in coal and gas-fired power generation was caused by record growth in clean power generation, which contributed to 44% of the drop, less demand for air conditioning due to milder weather (36%), and a longer-term slowdown in power demand growth for other reasons (20%), compared to the trend in 2019-24.

- Meeting India’s 500 GW non-fossil capacity target means that there is no headroom for coal-based power generation to grow between now and 2030, even if power demand growth picks up in the coming years.

- Clean electricity sources are also increasingly covering demand peaks, making coal power capacity additions redundant.

- If under-construction coal power projects (36 GW) are completed, capacity utilisation could fall to unprecedented lows, causing financial distress for generators and excessive cost burden on power users.

Search

RECENT PRESS RELEASES

Related Post