Why Investors Should Stop Overlooking This Top Stock

January 17, 2026

If you’re looking for companies that return value to shareholders, you’d be making a mistake to look at dividend yields only — here’s why.

Companies have two primary ways to return value to shareholders, beyond stock price appreciation. Those two things are dividends and share buybacks. A dividend is simply a consistent payment, often quarterly, of a portion of company profits to shareholders, and share buybacks are the company repurchasing and often retiring shares, increasing the value of each remaining share.

While high dividend yields are often lauded, that doesn’t take into account other factors, such as share buybacks. That’s why investors shouldn’t overlook General Motors (GM 0.11%) and its total yield, which shows how dramatic repurchasing shares can be.

Image source: General Motors.

“X” marks the spot

Roughly one year ago, General Motors made a significant move to return more value to shareholders. It announced a 25% increase in its quarterly dividend to $0.15 cents per share, which matches its crosstown rival Ford Motor Company (F 1.52%), and initiated a new $6 billion share repurchase program.

The move to return value to shareholders comes at an intriguing time for the Detroit icon, as the company is performing strongly with its strategy to reinvest in profitable growth, improving its balance sheet, and returning value to shareholders — as the broader industry is showing signs of slowing sales, profits, and electric vehicle enthusiasm.

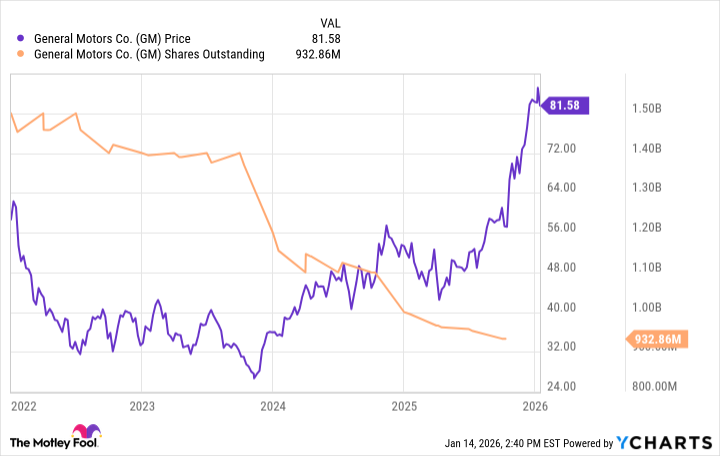

Savvy investors who have been keeping an eye on General Motors know this isn’t just one big share repurchase; it’s been a recent trend for the automaker that has been plagued with what many consider an undervalued stock price. In fact, since 2023, General Motors has announced $16 billion in share buyback programs, and its share price has responded with a significant move higher — as shares outstanding decline and generally as the share price rises, it forms an “X” on the chart.

Advertisement

Data by YCharts.

Why is GM stock overlooked?

Though GM and Ford are fierce rivals and often embark on similar strategies, the former returns value through share buybacks while the latter focuses on its dividend. Investors often default to looking for stocks offering a high dividend yield, similar to Ford’s yield that tops 4%, and overlook a stock such as General Motors, which has a dividend yield of less than 1%.

General Motors

Today’s Change

(-0.11%) $-0.09

Current Price

$80.82

However, when investors look at General Motors’ total yield, which includes the value of its trailing dividend as well as share buybacks, it reaches 11.3%. That compares far favorably to Ford’s total yield of 5.6%, according to Morningstar, as the latter doesn’t have a significant share repurchase program. General Motors has repurchased a significant chunk of its outstanding shares in recent years and improved the value of the remaining shares. Most investors overlook GM, but don’t make that mistake.

Search

RECENT PRESS RELEASES

Related Post