Ethereum leads $197M crypto liquidation wave as DC regulatory fog spooks traders

January 22, 2026

ETH breaks key support, Bitcoin signals cool, and altcoins stay muted despite isolated bright spots.

- Ethereum fell toward $2,900, confirming a technical breakdown after losing support at $3,170–$3,200. The asset is now down more than 10.9% in the last seven days.

- On-chain analysts said that Bitcoin’s market-cap dominance cycle might be losing strength. They pointed out that the gap in value between Bitcoin and the rest of the crypto market has gotten smaller since it peaked in 2025.

- Dogecoin was trading around $0.12, down 2.1% in the last 24 hours. Liquidations totaled over $1.64 million, with about 84.15% of that coming from long positions, as 21Shares’ DOGE ETF readies for its debut today.

Ethereum (ETH) was at the forefront of crypto liquidations on early Friday, as the broader market sentiment remained downbeat on regulatory uncertainty and conflicting on-chain signals. Total liquidations across the market totaled approximately $197.4 million over the past 24 hours, according to CoinGlass data.

Ethereum, the second-largest crypto by market cap, was trading at $2,955.58, down 2.2% over the last 24 hours. With total liquidations at $61 million, nearly $48.30 million in longs, and $11.38 million in shorts in the last 24 hours. On Stocktwits, retail sentiment around Ethereum remained in ‘bearish’ territory, accompanied by ‘normal’ chatter levels over the past day.

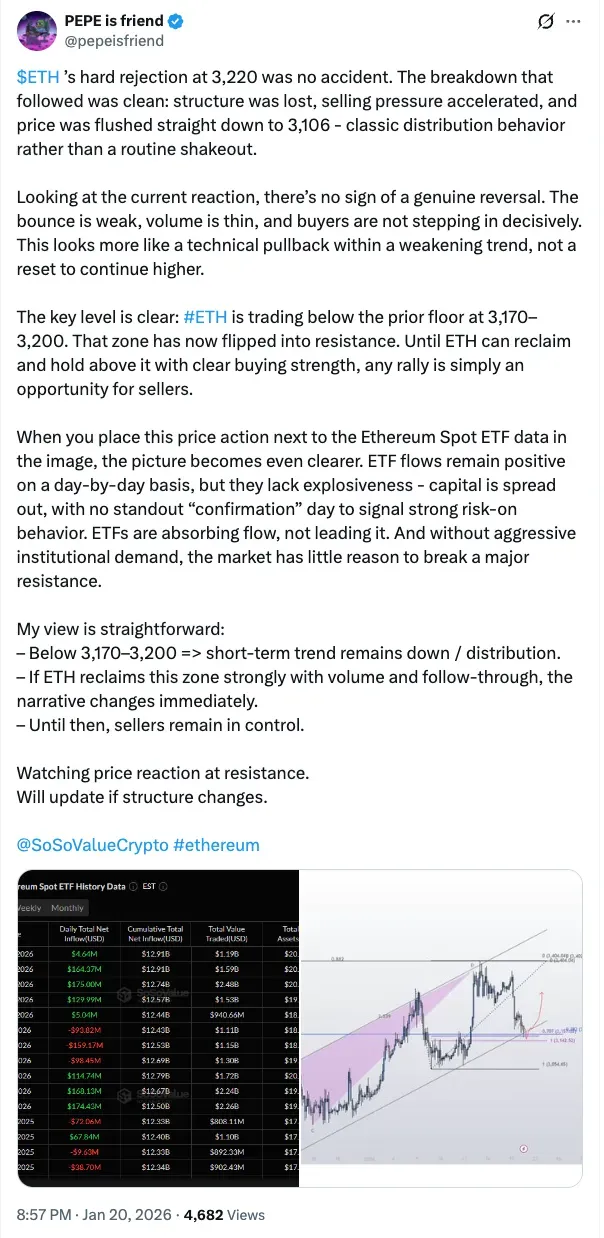

Ethereum’s drop near $2,900 appears to be a breakdown with its new support band at $3,170–$3,200. Ethereum has been down over 10.9% in the last seven days. A trader named Pepe Is Friend, a crypto key opinion leader (KOL), commented on X, saying that sellers win as long as Ethereum stays below $3,200. In the absence of clear volume, he expects most bounces to be used as opportunities to sell, not trend turnarounds.

This comes amid macro and regulatory crosscurrents that are increasingly putting pressure on the crypto market. Late Thursday, Senator Cynthia Lummis said that the CLARITY Act needs to move forward to protect the digital asset industry. However, journalist Eleanor Terrett said that lawmakers still hadn’t reached an agreement on crypto market structure legislation, meaning policy uncertainty will likely continue to impact trader sentiment.

On-chain analysts have also flagged cautionary signals, saying the Bitcoin (BTC) market-cap-dominant cycle may be gradually eroding, given that the gap between Bitcoin and the rest of the market has narrowed from its 2025 peak. CryptoQuant CEO Ki Young Ju said “Bitcoin tourists are cutting losses”, implying that short-term investors are leaving their positions.

Bitcoin was trading at $89,895.14, up 1% in the last 24 hours. The total liquidations across Bitcoin positions were $41.74 million, with $34.3 million in longs and $7.38 million in short positions over the past day. On Stocktwits, retail sentiment around Bitcoin remained ‘bearish’, with chatter dropping from ‘high’ to ‘normal’ levels over the past day.

The altcoin markets also stayed relatively muted on early Friday. Solana (SOL) traded near one $128, down 1.4% in the last 24 hours, with total liquidation standing at $6.51 million, as open interest fell by 0.63%. On Stocktwits, retail sentiment around Solana remained in ‘extremely bearish’ territory, while chatter dropped from ‘normal’ to ‘low’ levels over the past day.

Ripple’s XRP (XRP) traded around $1.91, down 1.8%, with roughly $2.49 million liquidated in the last 24 hours. On Stocktwits, retail sentiment around XRP remained in the ‘bearish’ territory, as chatter levels remained at ‘low’ over the past day.

Dogecoin (DOGE) traded at $0.12, down 2.1% in the last 24 hours, with liquidation exceeding $1.64 million, 84.15% of which was on the long side. The 21Shares Dogecoin (DOGE) spot ETF will launch trading on Nasdaq today, as markets anticipate an uptick in Dogecoin’s price. However, the sentiment failed to reflect on Stocktwits, as the memecoin remained in ‘bearish’ territory, with chatter levels standing at ‘low’ over the past day.

Binance Coin (BNB) was trading at about $889, down 0.3% over the past 24 hours, with comparatively lower liquidations of around $725,000, suggesting mild forced deleveraging during the session. On Stocktwits, retail sentiment around BNB remained in ‘extremely bearish’ territory, while chatter dropped from ‘normal’ to ‘low’ levels over the past day.

Cardano (ADA) was trading at about $0.359, down 2.0% for the day, and there were about $600,000 in liquidations, indicating some light long pressure in a weak market overall. On Stocktwits, retail sentiment around Ethereum remained in ‘bearish’ territory, accompanied by ‘normal’ chatter levels over the past day.

TRON (TRX) was one of the few big losers on Monday. It traded near $0.3076, up 2.5% in the past 24 hours. Liquidations were evenly split between longs at $54,660 and shorts at $54,260, showing that traders were not strongly convinced in one direction. Among all the altcoins, retail sentiment is around ‘neutral’ territory, with chatter remaining ‘high’ over the past day.

Read also: Tokenized Trading Is Coming To NYSE And Chainlink’s Role May Take Time To Surface, Analyst Says

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Search

RECENT PRESS RELEASES

Related Post