ETHUSD Outlook: Ethereum Balances Macro Forces and Key Technical Levels

January 23, 2026

Ethereum Fundamentals and Macro Drivers

Ethereum is the second largest cryptocurrency by market capitalization and serves as the foundational infrastructure for decentralized applications, smart contracts, decentralized finance, and non-fungible tokens. Unlike Bitcoin, which primarily functions as a store of value and settlement layer, Ethereum operates as a programmable blockchain that allows developers to build and deploy applications without centralized intermediaries. This utility driven design makes Ethereum both a technology platform and a financial asset, which often causes its price behavior to reflect a blend of macro risk sentiment and internal network developments.

From a macro perspective, Ethereum remains sensitive to global liquidity conditions, real interest rates, and overall risk appetite. Periods of easing financial conditions and expanding liquidity tend to support higher valuations across crypto assets, while tightening cycles often pressure speculative positioning. Recent sentiment has been mixed as markets balance expectations around central bank policy, regulatory clarity in the United States, and ongoing discussions around Ethereum scaling upgrades and network efficiency. Headlines related to spot ETF flows, regulatory enforcement actions, or significant protocol upgrades can quickly shift sentiment and short-term positioning.

Ethereum maintains a strong correlation to Bitcoin, particularly during broad risk on and risk off phases. Bitcoin often leads directional moves, with Ethereum following at a higher beta. However, Ethereum can outperform during periods when attention shifts toward smart contract platforms and decentralized finance growth. Relative to other large cap altcoins such as Solana and XRP, Ethereum is viewed as more institutionally established, though it can lag faster moving narratives tied to transaction speed or payments focused use cases.

What the Market Has Done

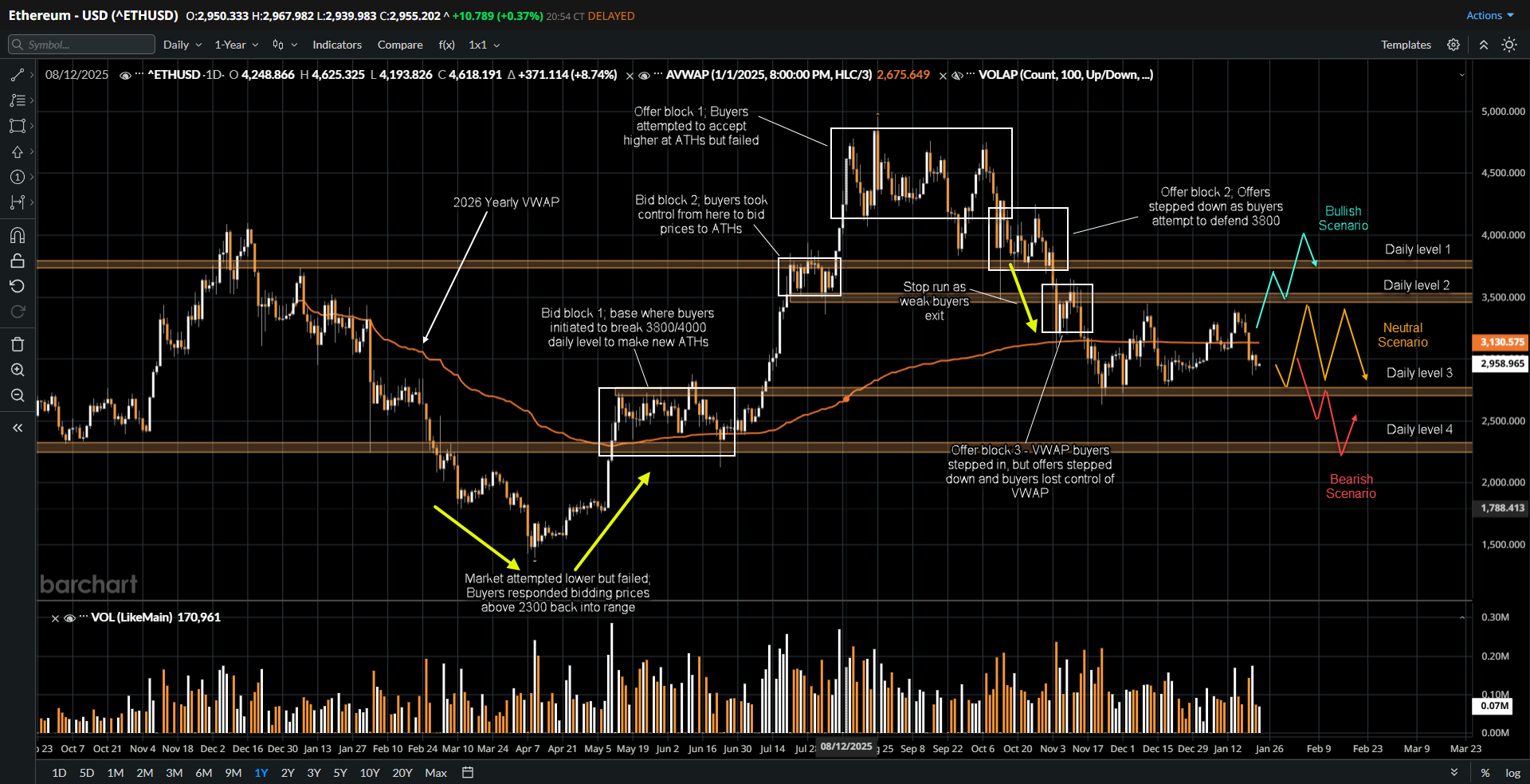

• Market has been in a large multi-year sideways range between the 4000 and 2300 area since December 2024.

• In August 2025, the market was able to bid above daily level 1, which also marked the top of this range near 4000, and printed new all-time highs (ATHs).

• However, the market was unable to accept above the 4000 level and subsequently, rotated back toward the 3800 to 4000 zone where buyers and sellers engaged in a prolonged battle between 3750 (bid block 1 high) and 4250 (offer block 1 low), forming offer block 2 in October 2025

• Buyers attempted to defend this region while sellers stepped down offers, eventually forcing long liquidation as price auctioned lower.

• In November 2025, buyers responded at the yearly VWAP, but sellers continued to apply pressure and prices rotated further down toward bid block 1, where buyers once again stepped in.

• Since November 2025, the market has balanced in a two-way auction between 3500 (daily level 2), and 2700 (daily level 3), with sellers defending at offer block 2 and buyers defending at bid block 1.

• Since the start of 2026, price has tested lower, crossed above the yearly VWAP to print new highs, and has since rotated back to chop around VWAP. The flatness of VWAP suggests indecision and ongoing balance.

What to Expect in the Coming Weeks

Key levels to watch remain the top and bottom of the current balance range at 3500 and 2750, corresponding to daily levels 2 and 3.

Neutral Scenario

• Without volume and velocity at the edges of 3500 and 2750, expect continued two-way balanced auction within the range.

• Price is likely to rotate around range mid and VWAP as both buyers and sellers remain responsive rather than initiative.

• Flat VWAP would continue to signal market indecision and acceptance of current value.

Bullish Scenario

• Early clues may include buyers holding above range mid and VWAP, indicating stronger initiative demand.

• A test of 3500 accompanied by increasing volume and pace would increase the probability of a breakout attempt.

• Acceptance above 3500 could open a move toward 3800 and potentially extend to the 4100 area.

• Responsive sellers are expected at offer block 2, which may slow or cap upside momentum.

Bearish Scenario

• If sellers begin holding below range mid and VWAP, it would suggest that downside control is developing.

• An approach toward 2750 with expanding volume and speed on the tape would increase the likelihood of a breakdown.

• A failure at daily level 3 could result in price auctioning lower toward the 2250 area (daily level 4).

• Buyers are expected to respond at bid block 1, potentially leading to another period of balance.

Conclusion

Ethereum remains technically balanced while macro forces continue to dictate broader risk sentiment. Flat VWAP and sustained two-way trade suggest the market is waiting for a catalyst, whether from liquidity conditions, regulatory clarity, or renewed institutional flows. A decisive move beyond the current range will likely require both technical acceptance and supportive macro alignment, making patience and level awareness critical in the weeks ahead.

For traders actively participating in crypto markets such as ETHUSD, trading regulated cryptocurrency futures offers key advantages over spot venues and offshore derivatives. Futures provide transparent pricing, centralized liquidity, and the ability to manage risk through standardized contracts and professional grade execution. “Edge Clear LLC” offers access to regulated crypto futures markets with reliable infrastructure, risk management tools, and trader focused platforms designed for participants who want institutional level execution in a rapidly evolving digital asset landscape. Traders looking to elevate their trading can learn more by visiting edgeclear.com.

Disclaimer:

This article is provided for informational and educational purposes only and does not constitute financial, investment, or trading advice. The analysis presented reflects the author’s market observations and opinions at the time of writing and is not a recommendation to buy or sell any futures contract, security, or financial instrument. Futures trading involves significant risk and is not suitable for all market participants. Losses may exceed initial margin deposits, and market conditions can change rapidly.

Any scenarios, levels, or market expectations discussed are hypothetical in nature and are intended solely to illustrate potential market behavior. They do not represent actual trading results and should not be interpreted as guarantees of future performance. Past performance, market behavior, or historical price action are not indicative of future outcomes.

Readers are solely responsible for their own trading decisions and risk management. Always conduct independent research, consider your financial situation and risk tolerance, and consult with a qualified financial professional if necessary before engaging in futures or derivatives trading.

This article contains syndicated content. We have not reviewed, approved, or endorsed the content, and may receive compensation for placement of the content on this site. For more information please view the Barchart Disclosure Policy here.

Search

RECENT PRESS RELEASES

Related Post