Top 3 Price Prediction: Bitcoin, Ethereum, Ripple – BTC, ETH and XRP deepen sell-off as be

January 29, 2026

Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP) continued their corrections on Friday, posting weekly losses of nearly 6%, 3%, and 5%, respectively. BTC is nearing the November lows at $80,000, while ETH slips below $2,800 amid increasing downside pressure. Meanwhile, XRP has fallen to its lowest level since mid-October, highlighting broader weakness across the cryptocurrency market.

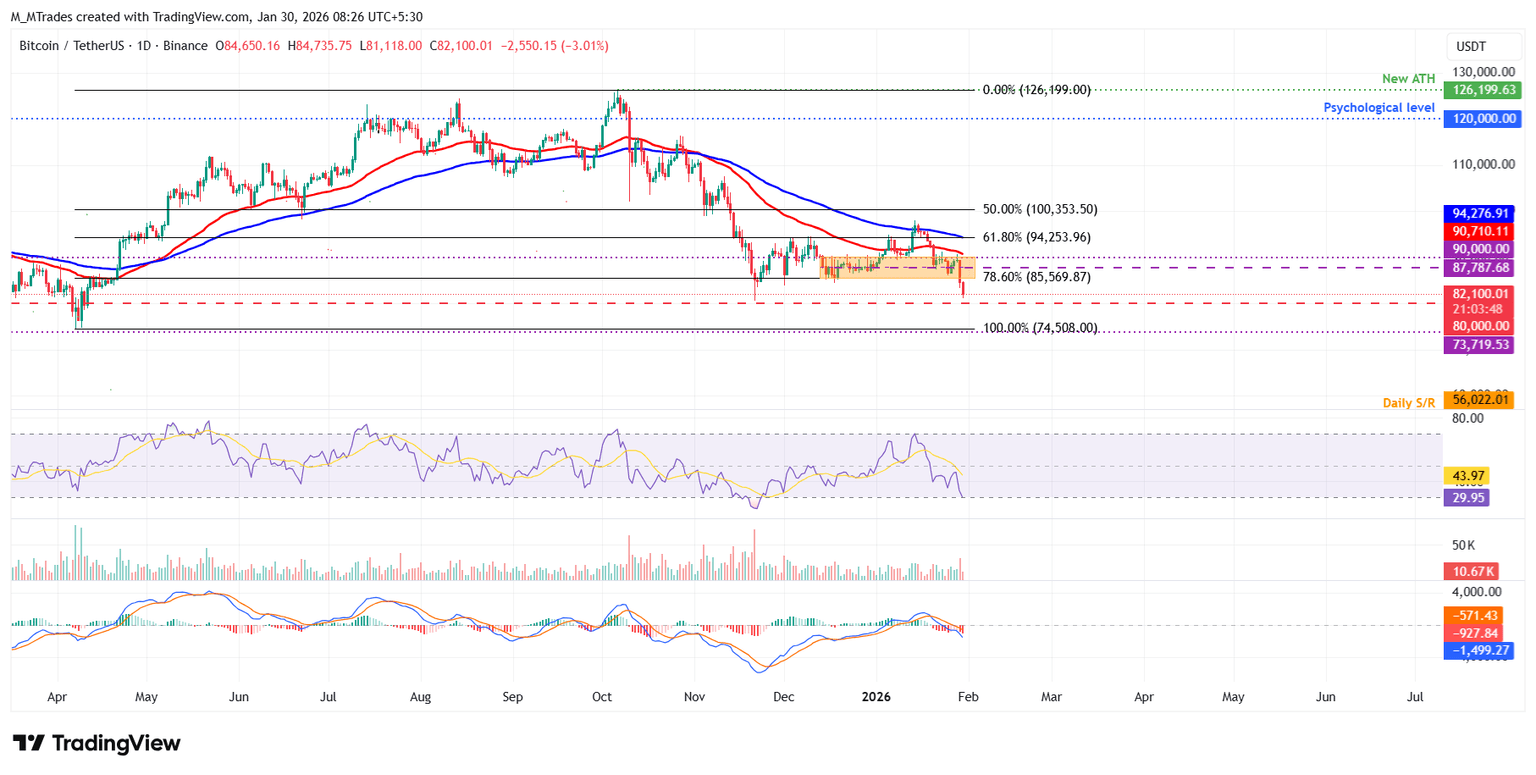

Bitcoin started the week on a positive note. However, on Wednesday, BTC failed to close above the upper boundary of a horizontal pattern at $90,000 and corrected 5.23% the next day, closing below the lower consolidation boundary at $85,569. As of Friday, BTC is continuing its correction, trading near $82,000.

If BTC continues its downward trend, it could extend the decline toward the November lows of $80,600. A decisive close below this level could extend the fall toward the April 7 low (2025 yearly lows) at $74,508.

The Relative Strength Index (RSI) on the daily chart reads 29, slipping below the oversold level of 30, indicating strong bearish momentum. Moreover, the Moving Average Convergence Divergence (MACD) indicator showed a bearish crossover on January 20, which remains intact with rising red histogram bars below the neutral level, further supporting the negative outlook.

On the other hand, if BTC recovers, it could extend the advance toward the previously broken lower consolidation boundary at $85,569, which coincides with the 78.6% Fibonacci retracement (drawn from the April 7 low of $74,508 to the October 6 all-time high of $126,199).

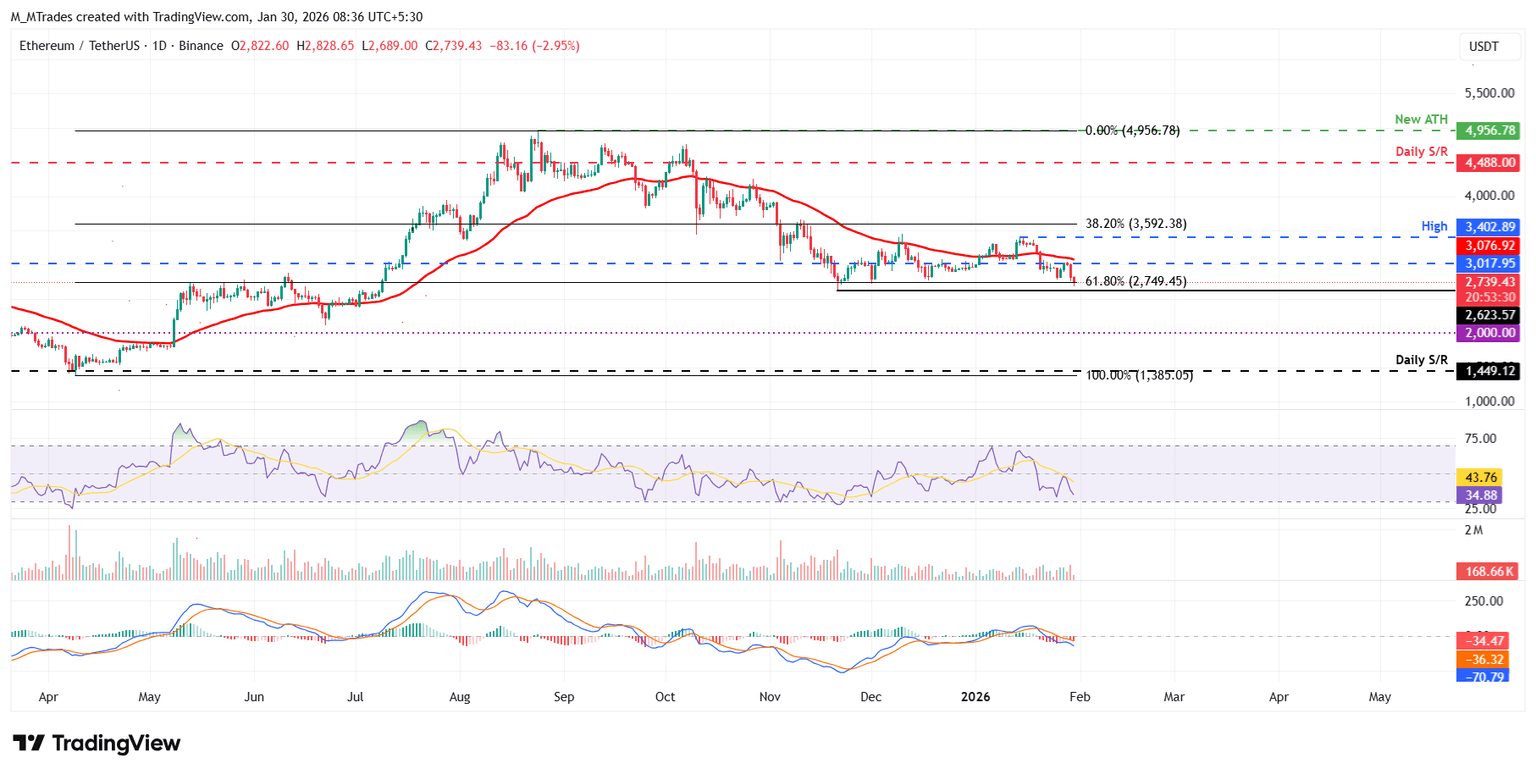

Ethereum price started the week on a positive note, recovering 7.62% by Tuesday after a massive 14.22% correction the previous week. However, on Wednesday, ETH failed to breach the daily resistance at $3,017 and declined 6.25% the next day. At the time of writing on Friday, ETH is slipping below the key support at $2,749.

If ETH closes below the 61.8% Fibonacci retracement level at $2,749 on a daily basis, it could extend its fall toward the November 21 low of $2,623. A close below this level could extend further losses toward the key psychological level at $2,000.

Like Bitcoin, Ethereum RSI and MACD indicators on the daily chart are showing strong bearish strength.

However, if ETH recovers, it could extend the advance toward the daily resistance at $3,017.

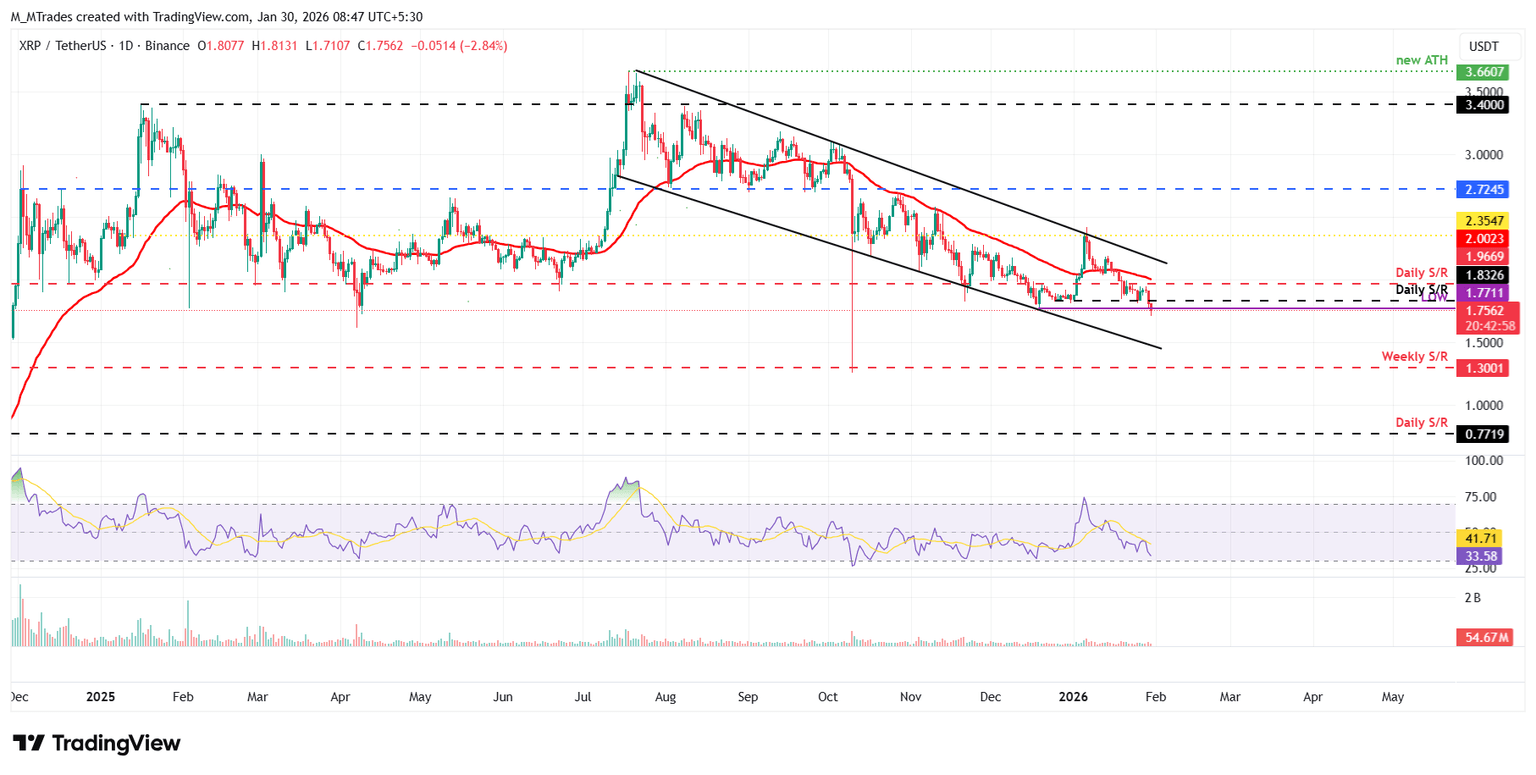

XRP price failed to close above the daily resistance at $1.96 on Wednesday and declined 5.42% the next day, closing below the daily support at $1.83. As of Friday, XRP is trading down to $1.75, its lowest level since mid-October.

If XRP continues its decline, it could extend it toward the lower trendline of the falling wedge pattern around $1.50.

Like Bitcoin and Ethereum, XRP’s momentum indicators (RSI and MACD) are also projecting a bearish outlook.

On the other hand, if XRP recovers, it could extend the advance toward the daily level at $1.83.

The developer or creator of each cryptocurrency decides on the total number of tokens that can be minted or issued. Only a certain number of these assets can be minted by mining, staking or other mechanisms. This is defined by the algorithm of the underlying blockchain technology. On the other hand, circulating supply can also be decreased via actions such as burning tokens, or mistakenly sending assets to addresses of other incompatible blockchains.

Market capitalization is the result of multiplying the circulating supply of a certain asset by the asset’s current market value.

Trading volume refers to the total number of tokens for a specific asset that has been transacted or exchanged between buyers and sellers within set trading hours, for example, 24 hours. It is used to gauge market sentiment, this metric combines all volumes on centralized exchanges and decentralized exchanges. Increasing trading volume often denotes the demand for a certain asset as more people are buying and selling the cryptocurrency.

Funding rates are a concept designed to encourage traders to take positions and ensure perpetual contract prices match spot markets. It defines a mechanism by exchanges to ensure that future prices and index prices periodic payments regularly converge. When the funding rate is positive, the price of the perpetual contract is higher than the mark price. This means traders who are bullish and have opened long positions pay traders who are in short positions. On the other hand, a negative funding rate means perpetual prices are below the mark price, and hence traders with short positions pay traders who have opened long positions.

Search

RECENT PRESS RELEASES

Related Post