Apple Shares Surge on Stellar Quarterly Performance and Dividend Announcement

February 9, 2026

09.02.2026 – 08:48:05

Apple Inc. has declared an ex-dividend date, with a payment of $0.26 per share scheduled for February 12. This shareholder return follows the disclosure of record-breaking financial results for its first fiscal quarter, sending the company’s stock to approximately $278.

The tech giant reported financial figures for Q1 2026, which concluded on December 27, 2025, that significantly outpaced its own guidance. Revenue climbed 16% year-over-year to reach $143.8 billion, surpassing the projected growth range of 10% to 12%.

Earnings per share (EPS) saw an even more pronounced increase, jumping 19% to a new high of $2.84. This result comfortably exceeded the average analyst estimate of $2.66 by nearly 7%.

Key Financial Highlights:

* Revenue: $143.8 billion (16% year-over-year growth)

* Earnings Per Share (EPS): $2.84 (19% year-over-year growth)

* Operating Cash Flow: $54 billion

* Installed Base: Over 2.5 billion active devices globally

iPhone Demand Drives Record Results

During an earnings call, CEO Tim Cook described iPhone demand as “overwhelming,” with the segment’s revenue expanding by 23%. The strong performance is attributed to a robust upgrade cycle fueled by the iPhone 17, contributing to all-time high sales across every geographic region.

Should investors sell immediately? Or is it worth buying Apple?

The Services division also achieved a new revenue record, growing by 14%. Apple’s expansive installed base of more than 2.5 billion active devices worldwide provides a substantial foundation for further monetization through subscriptions and digital offerings.

CFO Kevan Parekh highlighted that the robust operating cash flow of nearly $54 billion enabled the company to return close to $32 billion to shareholders through dividends and buybacks.

Forward Guidance and Key Dates

Looking ahead to the current quarter, Apple’s management provided a revenue growth forecast of between 13% and 16%. The company is expected to release its next quarterly report around April 30, 2026.

The Annual General Meeting will be conducted virtually on February 24. Investors will be watching closely to see if the iPhone’s impressive momentum can be sustained through the spring quarter.

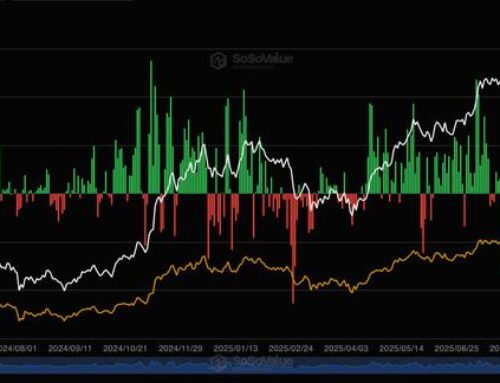

Apple’s stock has traded within a 52-week range of $169.21 to $288.62 and currently carries a price-to-earnings (P/E) ratio of approximately 35. While the technology sector has recently experienced volatility, particularly around AI-related valuations, Apple is often viewed as a comparatively stable anchor among mega-cap stocks.

Ad

Apple Stock: Buy or Sell?! New Apple Analysis from February 9 delivers the answer:

The latest Apple figures speak for themselves: Urgent action needed for Apple investors.

Is it worth buying or should you sell? Find out what to do now in the current free analysis from February 9.

Apple: Buy or sell?

Read more here…

Search

RECENT PRESS RELEASES

Related Post