A Look At Amazon (AMZN) Valuation After Recent Share Price Weakness

February 8, 2026

Advertisement

Recent performance context for Amazon.com (AMZN)

Amazon.com (AMZN) has been under pressure recently, with the share price showing negative returns over the past week, month, past 3 months, year to date, and past year, prompting closer attention from investors.

See our latest analysis for Amazon.com.

With the share price at US$210.32 and a 30 day share price return of a 14.98% decline, recent momentum has clearly faded, even though the 3 year total shareholder return of 115.47% still reflects a very strong longer term outcome.

If you are reassessing big tech exposure after this move, it could be a good time to scan our list of 56 profitable AI stocks that aren’t just burning cash as potential alternatives to research next.

So with the share price weaker even as analysts see roughly a 35% gap to their average target and one valuation model implies a near 39% discount, is this a reset that offers upside, or is future growth already priced in?

Most Popular Narrative: 53.3% Undervalued

At a last close of $210.32 against a narrative fair value of $450, Amazon.com is framed as materially undervalued, with that gap tied directly to how its AI and infrastructure spend is expected to reshape long term earnings power.

Amazon (AMZN) enters 2026 materially misunderstood by the market. My valuation of $450 per share implies the stock is approximately 48% undervalued, not because Amazon is executing poorly, but because the market is mispricing intentional margin compression driven by some of the most strategically sound investments in the company’s history.

Want to see what is behind that $450 figure? The narrative focuses on how earnings compound, how margins evolve, and what kind of profit multiple that could support. Curious which assumptions really move the valuation math and how they treat AWS, advertising, and retail together? Read on to see the full playbook behind this fair value.

Result: Fair Value of $450 (UNDERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, this bullish setup could unravel if AI and infrastructure spending fail to generate attractive returns, or if competition in cloud and advertising pressures margins for longer.

Find out about the key risks to this Amazon.com narrative.

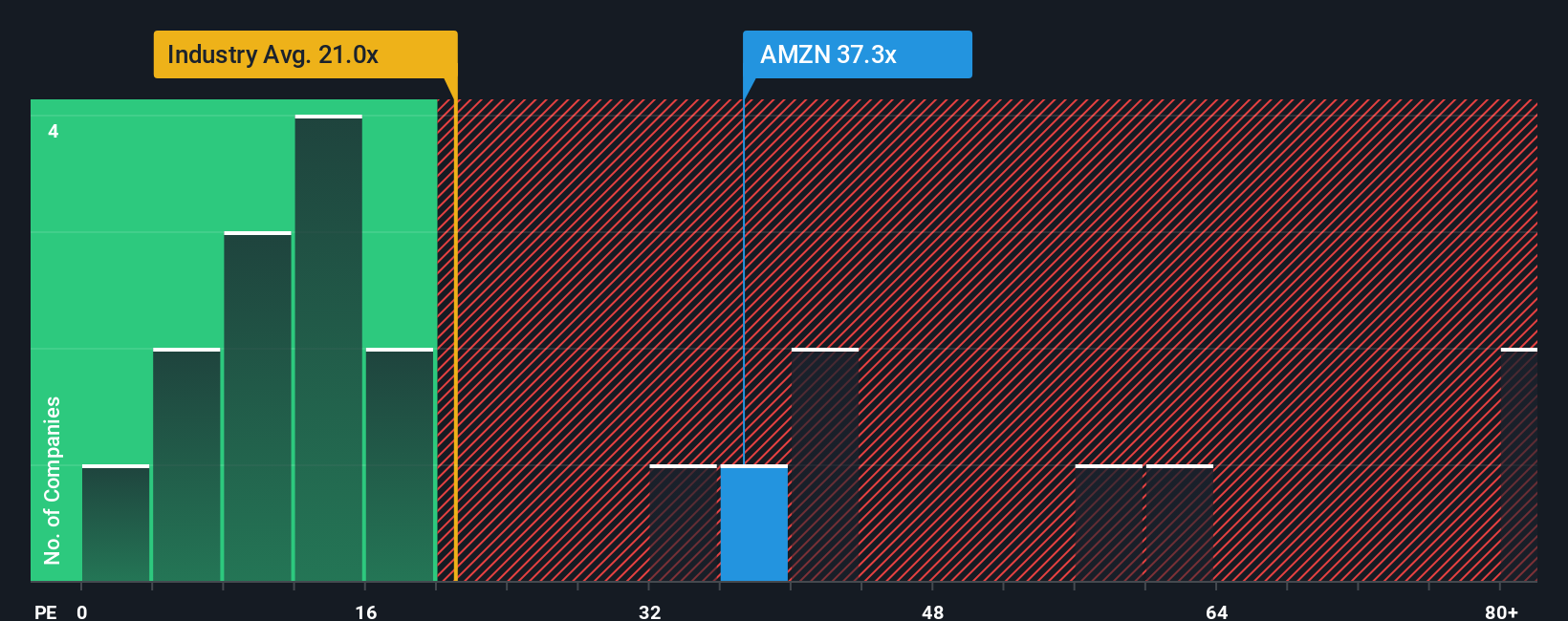

Another angle on valuation: what the P/E is saying

The $210.32 price and $450 narrative fair value lean heavily on long term earnings power, but the current 29.1x P/E paints a more mixed picture. It is richer than the North American Multiline Retail average at 18.4x, slightly cheaper than peers at 30.9x, and still below a fair ratio of 42.1x that the market could move toward over time. To you as an investor, that mix suggests both room for optimism and clear valuation risk if expectations cool. The key question is which side of that trade off feels more convincing.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Amazon.com Narrative

If this version of the story does not quite fit how you see Amazon.com, you can stress test the numbers yourself and build a custom view in under three minutes, then Do it your way

A great starting point for your Amazon.com research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Amazon.com is on your radar, do not stop there. The best portfolios are built by regularly hunting for fresh, high quality ideas across sectors and styles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Search

RECENT PRESS RELEASES

Related Post