A Look at Bit Digital (BTBT) Valuation After $150M Ethereum Acquisition and New Crypto Str

October 12, 2025

Bit Digital (BTBT) recently completed a $150 million convertible notes offering and used a portion of the proceeds to acquire a substantial amount of Ethereum. This move places the company among the world’s top institutional Ethereum holders.

See our latest analysis for Bit Digital.

Momentum has picked up for Bit Digital lately, with its 1-month share price return of 26.6% and year-to-date gain of 20.5% outpacing much of the crypto sector. That surge has been powered by the company’s headline-grabbing move into Ethereum, regulatory tailwinds for crypto adoption, and growing optimism around its strategic pivot. Still, the total shareholder return sits at 18.99% for the past year and a staggering 265% over the last three years. This shows that Bit Digital’s bold repositioning is attracting renewed investor attention, but with some volatility along the way.

If Bit Digital’s big bet on Ethereum has you rethinking what’s possible, now’s the perfect moment to discover fast growing stocks with high insider ownership

Yet despite the headlines and outsized returns, Bit Digital still trades at a steep intrinsic discount according to some models. Is the market overlooking its new Ethereum strategy, or is anticipated growth already reflected at these levels?

Advertisement

Most Popular Narrative: 34% Undervalued

With Bit Digital’s last close at $3.76 and the narrative’s fair value set at $5.70, there is a notable disconnect. This price gap is fueling debate about whether the company’s future plans fully justify the upside suggested by the most followed viewpoint.

The company’s structural pivot to become a dedicated Ethereum treasury and staking platform positions it to capitalize on the growing acceptance of Ethereum among institutional investors and asset managers. This is expected to drive future revenue growth through larger scale ETH holdings and increased staking yields.

Curious what is really powering this aggressive target? The narrative leans on assumptions about surging revenue and a profit multiple usually reserved for high-octane tech disruptors. Intrigued which ambitious figures are behind this eye-catching valuation? Find out what is driving the optimism before everyone else.

Result: Fair Value of $5.70 (UNDERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, risks remain if Ethereum’s price falters or regulatory momentum stalls. Either of these factors could sharply pressure Bit Digital’s revenue outlook.

Find out about the key risks to this Bit Digital narrative.

Another View: Multiples-Based Valuation

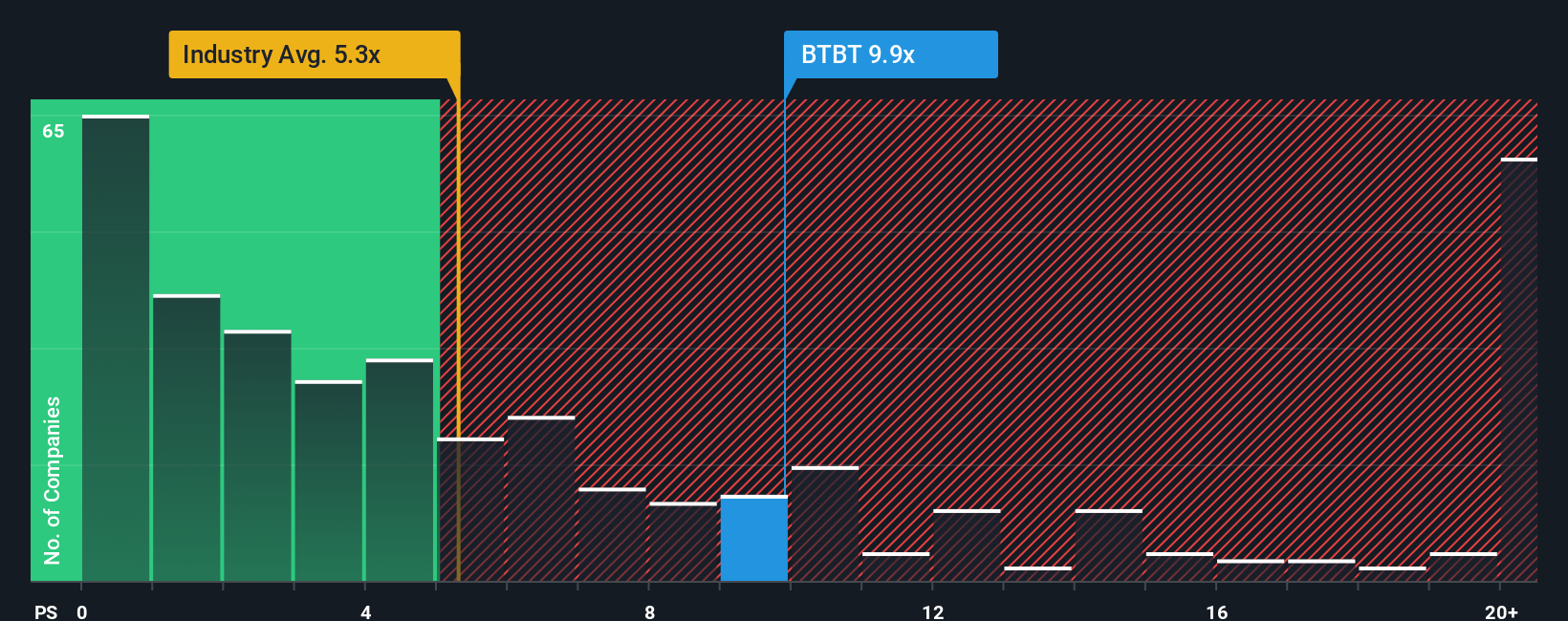

While the leading narrative sees Bit Digital as materially undervalued, another lens tells a different story. Based on its sales ratio of 12.3x, the company looks pricier than both the software industry average of 5x and its fair ratio of 11x. This could signal a premium market is already pricing in much of the optimism, or is something missing from this snapshot?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Bit Digital Narrative

If you see things differently or want to dive into the numbers on your own, you can craft a personal thesis in just a few minutes. Do it your way

A great starting point for your Bit Digital research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Stay ahead of the curve and spot your next big opportunity by targeting companies that fit your personal strategy. Don’t let fresh investment angles pass you by. Seize your edge with these focused lists:

- Tap into potential by reviewing these 892 undervalued stocks based on cash flows built on strong cash flow fundamentals and favorable valuations.

- Ride the artificial intelligence wave by uncovering unique possibilities through these 24 AI penny stocks at the intersection of innovation and rapid market growth.

- Grow your passive income stream by tracking these 19 dividend stocks with yields > 3% featuring robust yields and the consistency investors seek from their portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Bit Digital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Search

RECENT PRESS RELEASES

Related Post