A Look At United Parcel Service (UPS) Valuation As It Resets Amazon Volumes And Cuts Jobs

January 31, 2026

United Parcel Service (UPS) stock is in focus after the company moved to sharply cut lower margin deliveries for Amazon, pairing that reset with job reductions and cost savings across its global network.

See our latest analysis for United Parcel Service.

Those Amazon cuts and cost actions sit against a mixed share price story, with a 30 day share price return of 7.09% and 90 day share price return of 10.16%, but a 1 year total shareholder return of 0.62% decline. This suggests recent momentum contrasts with weaker longer term results as investors reassess both growth prospects and risk around the turnaround.

If UPS’s reset has you rethinking logistics and transportation exposure, it could be a good moment to widen your search to auto supply chains through auto manufacturers.

With UPS trading at $106.22, sitting on an estimated 31.75% intrinsic discount and only a 6.55% gap to the average analyst target, you have to ask: is there real mispricing here, or is the turnaround already reflected in the price?

Advertisement

Most Popular Narrative: 11.6% Overvalued

According to the most followed narrative, United Parcel Service’s fair value of $95.21 sits below the latest $106.22 close, setting up a tight valuation debate.

UPS issued over $5 billion in long-term, senior unsecured debt in May 2025. This is described as a bullish strategy from management that suggests they believe external financing to manage short-term obligations and initiatives will pay dividends for the company’s long-term growth as they seek to optimize current operations.

Prioritizing short term liquidity to promote efficiency and innovation will increase interest expenses in the long term, which will weigh on net income in future earning cycles. This highlights a constraint on their financial flexibility going forward unless profit margins and/or revenues increase.

Curious how a modest growth outlook, firmer margins and a higher future earnings multiple all connect to that $95.21 fair value? The full narrative spells out the revenue runway, the margin reset and the earnings profile that need to line up before this price view makes sense.

Result: Fair Value of $95.21 (OVERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, shareholder pressure around governance and ongoing union disputes could quickly change sentiment if they limit cost cuts or slow the “Efficiency Reimagined” overhaul.

Find out about the key risks to this United Parcel Service narrative.

Another View on UPS Valuation

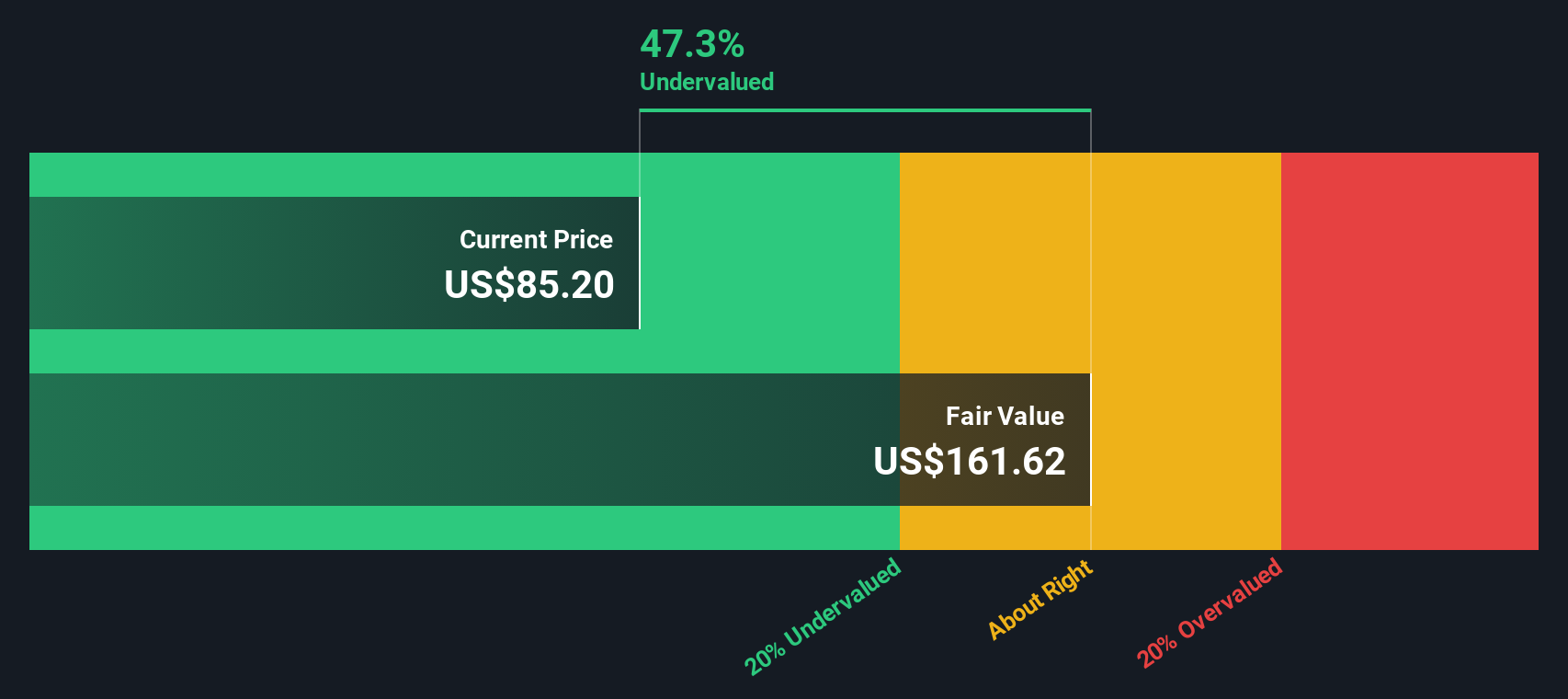

That $95.21 fair value comes from a narrative built around earnings and multiples, but our DCF model points in a different direction. On those cash flow assumptions, UPS at $106.22 sits around 31.7% below an estimated value of $155.63, which frames the stock as undervalued instead. Which story do you think fits the risk and cash flow profile better?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own United Parcel Service Narrative

If you are not fully on board with this view, or you prefer to test the numbers yourself, you can build a fresh narrative in just a few minutes. To get started, use Do it your way.

A great starting point for your United Parcel Service research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

UPS might be your starting point, but the real edge often comes from lining up a few strong ideas across different themes so you are not relying on a single story.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Search

RECENT PRESS RELEASES

Related Post