A Systems Change Framework to Impact Investing (SSIR)

April 21, 2025

(Illustration by iStock/Bahobank)

(Illustration by iStock/Bahobank)

Impact investing arises from a deep desire to use finance to address complex societal challenges such as poverty, climate change, and gender inequality. Yet, despite significant capital mobilization, progress remains limited, as highlighted by the 2024 United Nations Pact for the Future, which emphasized the uneven advancement toward the Sustainable Development Goals. This paradoxical frustration is acutely felt by investors who continuously allocate resources without confidence they are creating lasting positive impact, a sentiment exemplified by the experience of Blink CV, a family office in the Netherlands.

While striving to balance financial returns with societal outcomes, Blink places impact at the forefront. In fact, Blink takes a decidedly unconventional approach—willing to assume significant risk in order to maximize positive impact. Since 2022, their decision making has been guided by a rigorous, data-driven process that combines both quantitative and qualitative assessments of each investment opportunity’s potential for impact. This approach has been more than a framework; it has been a journey of learning, sharing, and continuous innovation. Through the process, Blink’s commitment to creating a more sophisticated impact-driven organization has heightened their sense of responsibility—pushing the family office to critically reflect on whether their investments are truly driving the systemic transformation they set out to achieve.

This pursuit of genuine community-level change, paired with an openness to constant learning, has brought Blink to a pivotal moment: the realization that fulfilling the family office’s impact-first mission requires not only intention but a deeper understanding of how their actions translate into lasting, structural change.

It was clear that many of the societal problems it sought to address were deeply intertwined within complex systems involving multidimensionality, nonlinear interconnectedness, and numerous stakeholders—factors that, if unaccounted for, hinder effective decision-making. This challenge limits the ability to identify, evaluate, and manage investments aligned with a systems change approach.

Are you enjoying this article? Read more like this, plus SSIR’s full archive of content, when you subscribe.

Reflecting on Blink’s journey, which may resonate with many other impact investors, it is evident that better guidelines and strategies are needed to help investors embrace and navigate complexity in their investment decisions. Without this, what serves as a beacon of hope for some could easily devolve into a tide of impact-washing and disillusionment.

Drawing from literature, we propose a five-part monitoring and learning framework that we have applied to Blink’s investment portfolio and refined through continuous engagement with its impact and investment teams. Our hope is this approach will inspire other impact investors to adopt similar strategies for accelerating transformative change through impact investment portfolios.

Three Levels of Impact Investing Demanding a Systemic Lens

Blink CV is an international single-family office of impact and technology professionals with the mission: “Challenging the existing for a brighter future.” With a complex and vast investment portfolio, its reach spans across fund investments, grants, and direct investments across several countries and regions, mostly in Africa, Latin America, Europe, and the United States and is focused on transforming sectors like agriculture and tourism towards a more regenerative approach. Despite the scale of its ambitions and investments, Blink began to reflect how the transformative impact they envisioned was unfolding in the communities they serve. As questions arose, so did the need to explore how capital could be more strategically mobilized while acknowledging the inherent complexity of societal problems.

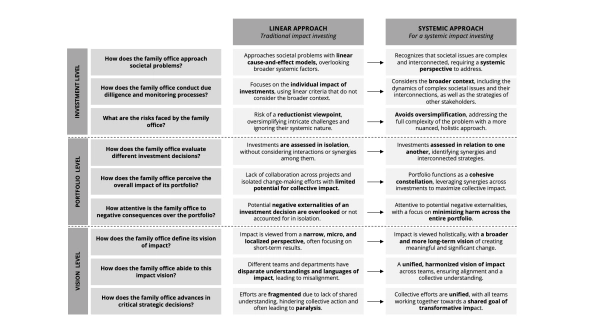

Through our discussions with Blink’s teams, we understood the lack of a systemic investment rationale at three organizational levels: the investment, portfolio, and vision levels. This absence of an integrated systems perspective was identified as a critical barrier, limiting the effectiveness of decision-making and challenging the family office’s ability to evaluate whether deeper outcomes are being achieved. In fact, impact investors are recognizing a competitive advantage in moving from linear approaches toward a more holistic vision of impact at each of these three levels.

Investment-level.

Blink’s investments were traditionally selected based on linear criteria, focusing on individual gains without considering the broader systemic context in which they operate. However, addressing complex societal challenges requires moving beyond traditional due diligence and adopting a systemic perspective that accounts for such complexity to avoid oversimplifying and perpetuating these issues. Considering an investment project focused on digitizing primary health facilities in Kenya, for example, impact investors must ensure that their approach aligns with the broader systemic complexities of the local health care landscape by posing questions like:

- What is the broader health care ecosystem of the project?

- Who are the key stakeholders, and how can they be integrated into the investment process?

- What past solutions were tried, and what lessons were learned?

Portfolio-level. Investments are often assessed in isolation, missing opportunities for synergy, which leads to fragmented efforts and weakens long-term resilience. A systemic approach can enhance effectiveness by aligning investments, unlocking synergies, and mitigating negative externalities. For example, if the Kenyan project coexists with another project focused on establishing independent retail pharmacy chains in East Africa, the investor could spot potential opportunities for cross-project learning and impact by asking questions like:

- What factors shape the health care landscape in Kenya and beyond?

- Is Kenya’s health care digitization project linked to broader East African initiatives?

- What concrete opportunities exist to create synergies such as shared resources, aligned objectives, or collaborative partnerships across these projects? Additionally, what potential negative externalities could arise from not interacting, whether social (e.g. unequal access to benefits or community conflict or fatigue), environmental (overexploitation of natural resources), or financial (redundancy and inefficiency, market distortion overlapping financial support), and how can they be proactively identified and mitigated?

Vision-level. Despite an “impact-first” culture, different teams within Blink had varying views on impact, with operational teams focusing on micro, local effects and transversal departments aiming for broader goals. Aligning these perspectives across the organization would ensure unified efforts and more efficient resource distribution, leading to greater and more meaningful long-term outcomes:

- What transformations do we want to achieve with our investments?

- How can we balance impact across many geographical areas with depth of impact?

- How do we create an impact vision that aligns everyone in the organization?

Monitoring and Learning Framework

As the authors of another recent SSIR article, Jess Daggers, Alex Hannant, and Jason Jay, put it: “Systemic investing, as we see it, requires mindsets, principles, practices, and infrastructures that are distinct from status quo funding and financing.”

Over recent decades, impact measurement and management tools have emerged to guide impact investors in identifying where to direct efforts toward positive outcomes. These include the Impact Management Project (IMP), Impact Reporting and Investment Standards (IRIS+), B Impact Assessment (BIA), and methodologies like Social Return on Investment (SROI). However, this more ambitious model of impact investing—centered on systems change—is gaining momentum, emphasizing the need for more holistic tools to select, monitor, and manage investments.

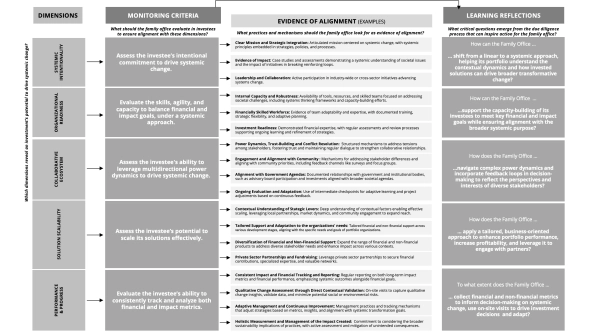

Through collaboration with Blink CV, it became clear that, while the concept of systems change is recognized and relevant, there is a lack of consistent language and actionable steps. This led to the development of the following monitoring and learning framework to help impact investors understand the systemic stance of their portfolios and make informed, transformative investment decisions through the continuous assessment of five dimensions across their portfolio. The framework enables impact investors to evaluate the alignment of investments against five systemic dimensions (monitoring). This process then generates a feedback loop that encourages investors to incorporate lessons that enhance future investment selection and portfolio design, translating monitoring into a continuous learning process towards more systemic impact investments (learning).

Intentionality to implement a systemic approach. Investors should first assess whether the investee demonstrates a clear commitment to drive systemic impact. The investor should check alignment of impact missions of the investor and the investee—crucial for effective communication and resource coordination—as well as concrete actions such as building internal capacity for systems change and embedding systemic thinking into strategies. A strong understanding of complex societal challenges and the ability to identify key leverage points are essential. Ultimately, investees should provide evidence of disrupting harmful feedback loops, ensuring their approach leads to meaningful and lasting impact.

Organizational readiness. Investees should have the necessary skills, agility, and capacity to drive systemic impact while balancing financial and impact goals. This must be supported by internal capacity, tools, and expertise to address societal challenges through a systemic lens. Additionally, investees need robust teams with strong management processes and a solid understanding of financial language to meet mainstream due diligence requirements and ensure readiness for investment.

Collaborative ecosystem.

Evaluate whether investees leverage the multidirectional power dynamics among stakeholders, as highlighted in FSG’s “The Water of Systems Change.” Meaningfully involving local communities in decision-making and aligning with government agendas is fundamental to co-creating solutions that sustainably serve community needs and align with public priorities, practices, resources, and in-field knowledge, leading to stronger and more collaborative interventions. The investor should also evaluate the investees’ capacity to build trust and establish intermediate checkpoints for continuous learning.

Solution scalability. Does the investee follow a business-oriented approach that improves the financial and non-financial performance of projects? This can be seen in the capacity of the investee to identify and capitalize on local partnerships, market dynamics, and community engagement, particularly with the private sector, to expand and deepen their reach in the served communities. It is also relevant to assess the provision of non-financial support—technical assistance, mentorship, and networking opportunities—that strengthens scalability.

Transformative performance and progress. Investees should integrate both financial and impact metrics to track systemic transformation effectively. This requires a dual-management approach that balances rigorous financial reporting with continuous impact assessment. Is decision-making guided by regular data collection and analysis? On-site visits can complement quantitative metrics by providing experiential insights into local dynamics and emerging challenges, fostering continuous learning and strategic adaptation. Additionally, investors should evaluate the broader repercussions of their investments, ensuring they do not sustain systemic issues or conflict with other projects in their portfolio.

Applying the Framework to Blink’s Portfolio

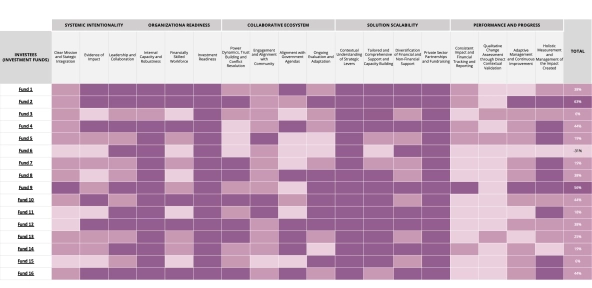

Blink CV’s ambition to transition from a linear to a systemic approach enabled a comprehensive evaluation of its portfolio in line with the five-dimensions of the framework. Scores were assigned to assess the alignment of investments with the identified systemic dimensions. This analysis provided strategic insights for capital allocation, stakeholder management, and continuous framework refinement. A key outcome was the development of a visual scorecard tool with a color-coded system, which highlighted alignment gaps and served as a call to action for improving systemic integration. The tool facilitated multi-level analysis—at the investment, portfolio, and vision levels—allowing Blink to assess both individual investments and the broader portfolio’s systemic potential as well as establish a common language on the impact the family office aimed to achieve.

The darkest shade represents a match. The lightest shade represents a gap. The shade between the two represents an intermediate result or assessment.

The darkest shade represents a match. The lightest shade represents a gap. The shade between the two represents an intermediate result or assessment.

The findings revealed a strong performance of the investment portfolio in solution scalability, which aligns with traditional investment logic, while gaps emerged in organizational readiness, collaborative ecosystem, and performance and progress. These gaps reflected challenges in systemic understanding, stakeholder engagement, and long-term impact reporting, particularly the need for deeper involvement with local institutional actors and qualitative impact storytelling. The scorecard tool encouraged Blink to adopt a more systemic perspective within investments but also to start identifying synergies across the portfolio. This shift helps to position the family office as a catalyst for systemic change, asking critical questions about the potential of its portfolio to become a network of interrelated investments rather than a collection of standalone projects.

Future Reflections for Impact Investors

While the monitoring and learning framework holds strong potential to deepen systemic impact through more strategic investment decisions, we recognize that it is not without limitations. One such concern is whether certain types of investments might be excluded if they are fundamentally misaligned with a systemic change perspective. From our point of view, however, the framework is not intended as a set of exclusion criteria, but rather as an evolving journey toward impact. Although early-stage ventures may score lower on dimensions such as “organizational readiness” and “performance and progress,” the framework is designed to outline a potential pathway for systemic contribution over time.

Additional concerns include the risk of increased bureaucratic burden in reporting, particularly when applying the framework across larger portfolios, given that it is built around a project-level perspective. Nevertheless, it is important to view the framework as part of an evolving process. Investments typically unfold over several years, and the goal is to engage with different dimensions progressively, based on emerging opportunities and available resources. This might involve identifying missing systemic dimensions across the portfolio (the framework’s vertical view) or prioritizing key areas within each individual investment (the horizontal view). In doing so, we help ensure that today’s investments lay the groundwork for long-term systemic value, so impact investors don’t find themselves reinvesting later to address unresolved gaps. Moreover, while the methodology may require more effort at the outset, embedding its principles into the overall investment strategy and reporting approach helps normalize and streamline the process over time.

Finally, no framework can fully capture the evolving, complex, and non-linear nature of systems change. As widely acknowledged in the literature, all frameworks represent the best available knowledge at a given point in time and must remain open to iteration and refinement. While the Monitoring and Learning Framework is well-suited to current needs, it has been intentionally designed with the flexibility to adapt as new theoretical insights emerge. As the field of systemic impact investing continues to mature, we both expect and encourage the framework to evolve—whether through expanding its dimensions, refining its indicators, or even replacing certain components—to remain aligned with emerging evidence and a deeper understanding of systems change.

All in all, the framework provides a valuable foundation for systems change, by embedding systemic thinking into how investments are selected, supported, and assessed. Applying the framework to Blink’s portfolio—with focus on learning and the potential for transformation—demonstrated its relevance and innovative potential, sparking broader discussions within the impact investing community about the successes and challenges of scaling impact systemically. By integrating systemic dimensions into investment selection and monitoring, investors can better align their portfolios with long-term, regenerative outcomes, while also supporting investees in evolving more systemically. Furthermore, we believe the framework’s potential extends well beyond what has been explored so far. Looking ahead, treating the portfolio itself as a dynamic system, subject to intentional design and continuous learning, opens up new possibilities for catalyzing systems-level impact. We see this as a promising next frontier for both practice and research.

Support SSIR’s coverage of cross-sector solutions to global challenges.

Help us further the reach of innovative ideas. Donate today.

Read more stories by , , & .

Search

RECENT PRESS RELEASES

Related Post