AI-Powered Application Modernization Platform Might Change The Case For Investing In Mongo

September 21, 2025

- Earlier this month, MongoDB unveiled its AI-powered Application Modernization Platform (AMP), designed to accelerate the transformation of legacy enterprise applications using AI-driven code transformation and a specialized delivery framework.

- With AMP and new AI search features now available across its database offerings, MongoDB is addressing enterprise technical debt and streamlining the adoption of modern, scalable AI solutions.

- We’ll explore how the launch of MongoDB AMP, which enables faster application modernization through AI, impacts its broader investment narrative.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump’s tariffs. Discover why before your portfolio feels the trade war pinch.

Advertisement

MongoDB Investment Narrative Recap

For shareholders, the core investment thesis for MongoDB rests on the company’s ability to drive long-term growth through accelerating enterprise application modernization and capitalizing on AI-driven demand for flexible data platforms. The recent launch of MongoDB AMP is a positive catalyst for near-term adoption among large enterprises dealing with technical debt, though it may not fully address the ongoing risk of margin pressure from powerful, lower-cost competitors in the cloud database space.

The announcement expanding MongoDB’s search and vector capabilities to its Community Edition and Enterprise Server is directly relevant, signaling the company’s push to bring advanced AI features to both cloud and on-premises customers. This extension could make MongoDB more attractive across a broader market, supporting further growth and potentially reinforcing the AMP platform’s impact.

However, investors should also be aware that unlike the promise of acceleration, MongoDB’s margins could still come under pressure…

Read the full narrative on MongoDB (it’s free!)

MongoDB’s narrative projects $3.5 billion revenue and $5.0 million earnings by 2028. This requires 16.8% yearly revenue growth and a $83.6 million earnings increase from -$78.6 million today.

Uncover how MongoDB’s forecasts yield a $317.10 fair value, in line with its current price.

Exploring Other Perspectives

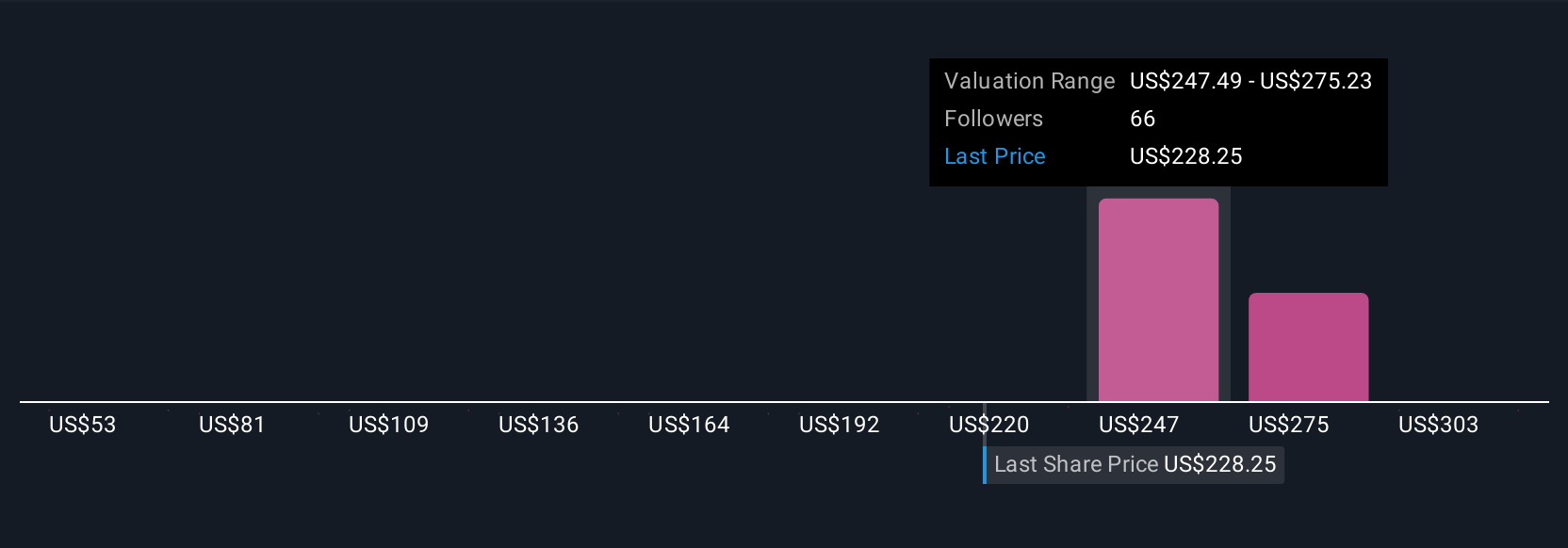

Eleven members of the Simply Wall St Community estimate MongoDB’s fair value between US$130.20 and US$389.41 per share. While expectations for strong AI-fueled revenue growth are common, some point to stiff competition from cloud-native alternatives as a brake on future margins and profitability, so explore several viewpoints before forming your own opinion.

Explore 11 other fair value estimates on MongoDB – why the stock might be worth as much as 20% more than the current price!

Build Your Own MongoDB Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

- A great starting point for your MongoDB research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free MongoDB research report provides a comprehensive fundamental analysis summarized in a single visual – the Snowflake – making it easy to evaluate MongoDB’s overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won’t stay hidden for long. Get the list while it matters:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Search

RECENT PRESS RELEASES

Related Post