AI took investors on a date in 2025. In 2026, analysts say it’s time to foot the bill.

January 5, 2026

In 2025, AI took investors on a date. In 2026, the nascent technology may need to start footing the bill.

This maturation means investing will require a hard look at whether the market’s heavy reliance on a few tech giants has created a dangerous single point of failure.

“Given the concentration, you need to diversify the portfolio, and you need to understand what you own and what happens if you’re wrong,” Max Wasserman, Miramar Capital co-founder and senior portfolio manager, told Yahoo Finance.

Wasserman pointed out that AI darling OpenAI (OPAI.PVT), which has been lifted by massive financial investments, has raised concerns about circular financing, where investors essentially fund their own future revenue.

This warning comes as the S&P 500 (^GSPC) wraps up 2025 with a gain of roughly 17%, a performance driven largely by the “Magnificent Seven” tech stocks and a frenzy for artificial intelligence that has pushed market valuations to levels many skeptics find unsustainable.

Read more: Are we in an AI bubble? How to protect your portfolio if your AI investments turn against you.

“If AI goes south on us, tech will go,” Tom Essaye, founder and president of Sevens Report, told Yahoo Finance in an interview.

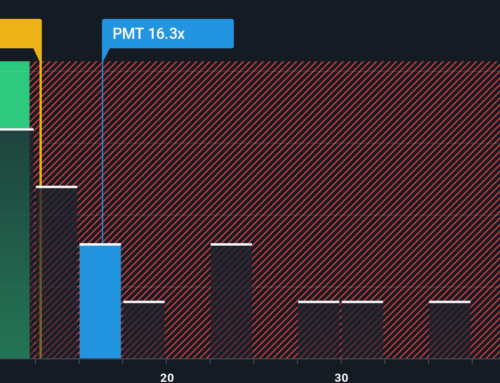

In a new report, “Taking Stock of the Four Pillars of the Rally Ahead of 2026,” Essaye observed that the initial unified enthusiasm for AI has become “fractured.” The industry is moving into a period where the market is aggressively sorting winners and losers. While memory plays like Micron (MU) have surged over 241% year to date, Essaye argued that former darlings like Oracle (ORCL) have faced more scrutiny as investors demand immediate ROI.

For investors seeking chip exposure without the volatility of the OpenAI hype cycle, Broadcom (AVGO) presents a compelling alternative, thanks to its specialized silicon and enterprise software, said Gradient Investments analyst Lisa Schreiber.

Schreiber pointed to Broadcom’s leadership in application-specific integrated circuits (ASICs) and its steady cash flow from VMware, which not only “diversifies the business from solely a chip company” but also creates a higher valuation floor than many hardware-only peers.

Even tech bulls are starting to look for fresh blood outside the standard megacap names. Wedbush analyst Dan Ives, while still favoring Nvidia (NVDA) as a core holding in 2026, suggested investors look to Nebius (NBIS), Iren (IREN), and Palo Alto Networks (PANW) for the next leg of the cycle.

As the AI tide continues to make waves in 2026, a dovish Federal Reserve — and the potential for rate cuts to support a cooling economy — may give the other 493 stocks in the S&P 500 the chance to make a splash, per Wasserman.

He noted that this rotation could shift investor focus toward “boring” but reliable cash generators, bringing into the fold retailers like Home Depot (HD) and McDonald’s (MCD), which stand to benefit from lower short-term rates. Meanwhile, defensive heavyweights like Chevron (CVX), AbbVie (ABBV), and Waste Management (WM) offer a sanctuary of dividends should the AI boom begin to fizzle.

Other sectors, particularly healthcare, could hold major opportunities, as the industry has historically thrived regardless of political rhetoric and legislative upheaval. Essaye argued that the market often overstates the risk of government interference, creating an entry point for a sector that is fundamentally supported by an aging demographic.

Schreiber highlighted Eli Lilly (LLY) as a prime example of this “growth-defensive” hybrid, noting that its GLP-1 drugs — Zepbound and Mounjaro — are essentially the healthcare equivalent of “what AI is for tech,” driving 54% year-over-year revenue growth.

Francisco Velasquez is a Reporter at Yahoo Finance. Follow him on LinkedIn, X, and Instagram. Story tips? Email him at francisco.velasquez@yahooinc.com.

Click here for in-depth analysis of the latest stock market news and events moving stock prices

Read the latest financial and business news from Yahoo Finance

Terms and Privacy Policy

Search

RECENT PRESS RELEASES

Related Post