Alibaba investors beware: History not on your side

September 16, 2014

By PAUL WISEMAN and MARCY GORDON1 hour ago

WASHINGTON (AP) — Chinese e-commerce giant Alibaba is about to launch what may prove the biggest initial public stock offering ever. Yet anyone who expects to get rich from buying into China’s high-growth story will be betting against history.

China’s explosive economic rise has delivered virtually nothing to most stock investors. When Chinese companies have listed stocks on American markets, their shares have lost an average 1 percent a year for the next three years, compared with an average 7 percent annual gain for other U.S. IPOs, according to research by Jay Ritter, a finance professor at the University of Florida.

Most Chinese stocks trade in China, of course. And those stocks have burned investors, too. From 1993 to 2013, when China’s economy grew nearly seven-fold from No. 9 to No. 2 in the world, stocks on Chinese markets returned a cumulative total of just 7.9 percent — even if shareholders had reinvested dividends. Over the same time, U.S. stocks jumped 555 percent, German stocks 458 percent and Spanish stocks more than 1,000 percent, according to Credit Suisse.

“It’s probably one of the biggest disconnects in the history of stock markets,” says Nicholas Lardy, senior fellow at the Peterson Institute for International Economics.

Chinese stock gains didn’t even keep up with inflation, says Elroy Dimson, emeritus professor of finance at the London Business School, who helped compile the Credit Suisse numbers. Adjusted for inflation, Chinese stocks lost 3.8 percent a year from 1993 to 2013.

It’s entirely possible, of course, that Alibaba will produce outsize investment returns over time. The company has become a hugely popular shopping magnet on the strength of China’s surging growth. Its regulatory filing indicates that Alibaba draws 188 million monthly visitors on mobile devices — a tantalizing target for advertisers.

The company’s financial results have been stellar: Alibaba said its revenue jumped 46 percent to $2.54 billion in the three months that ended June 30 and that it earned $1.2 billion excluding a one-time gain.

Potential investors have swarmed to Alibaba’s presentations in advance of the initial offering. Demand has grown so feverish that Alibaba on Monday said it planned to raise the offering price from the $60 to $66 a share it had earlier set to $66 to $68.

Yet the track record for Chinese stocks in general doesn’t inspire confidence. Investment returns have been depressed by a range of factors — from allegations of corporate fraud to questionable accounting to maddeningly cumbersome government rules.

“China has the most stable economy but the riskiest stock markets,” Guoping Li of Beijing’s Central University of Finance and Economics wrote last year. Li says Chinese stocks have become known as “the butchers of small shareholders’ wealth.”

And Ritter’s figures for Chinese stocks in America don’t include the riskiest ones — those that have made a back-door entry onto U.S. exchanges by merging with U.S. shell companies and thereby eluding much of the regulatory scrutiny that usually comes from selling shares publicly for the first time.

More than 100 of these companies were suspended or kicked off U.S. exchanges in 2011 and 2012. The Securities and Exchange Commission has charged about two dozen with civil accounting violations and fraud. In one 2012 case, the SEC accused two executives of Puda Coal Inc. of transferring its most valuable assets to themselves and leaving investors with a worthless shell company.

“China is to stock fraud what Silicon Valley is to technology,” says Carson Block, who runs the investment firm Muddy Waters Research and has profited by betting against Chinese companies.

Even after the purge of some of the worst stocks, Chinese companies on American and Canadian stock exchanges score below average for accounting and corporate governance, according to rankings by MSCI ESG Research.

Yet the allure of China has proved irresistible to many.

“People felt it was very cool,” says Alberto Forchielli, an investor who’s worked for decades in China. Forchielli has passed up opportunities to invest in Chinese companies on U.S. exchanges because “it didn’t smell right.”

Hugh Culverhouse Jr., a real estate investor and former owner of the NFL’s Tampa Bay Buccaneers, lost money when shares of the Chinese lumber company Sino-Forest plunged in 2011 amid allegations of accounting fraud.

In some ways, Block says, China’s market troubles shouldn’t be surprising. Emerging markets can be lawless. In the 19th century, the United States itself was an emerging market, and U.S. investors were preyed upon by manipulators such as Jay Gould and Jim Fisk.

Not all Chinese stocks fare poorly, of course. The Internet search firm Baidu, for example, has surged since it listed on Nasdaq in 2005; its shares are up 48 percent in the past 12 months.

But the reputation for questionable accounting and dodgy business practices can tarnish even the soundest Chinese companies.

“These stocks are carrying a lot of heavy baggage on them, and that’s reflected in their prices,” says Paul Gillis, accounting professor at Peking University in Beijing.

Li at Beijing’s Central University of Finance blames government meddling for the poor performance of Chinese stocks. Authorities control which companies can sell stock to the public. They tend to green-light mainly those connected to government or Communist Party figures. And these companies, Li finds, are more likely to commit fraud and get away with it.

“There is no repercussion to getting caught,” says Dan David of GeoInvesting LLC, who bets against stocks and who helped expose the problems at Puda Coal.

U.S. investors essentially have to take Chinese companies’ financial statements on faith. The U.S. Public Company Accounting Oversight Board is supposed to review audits done of companies that trade on U.S. exchanges. But Beijing refuses to let the board or the SEC review audits done by accounting firms based in China.

Investors in U.S.-listed Chinese stocks must often rely on audits that don’t comply with U.S. law. And they must bear the risk that the companies might be delisted from American stock exchanges.

Another risk comes from the contortions Chinese companies go through to get around their government’s rules. Beijing, for example, restricts foreign investment in Internet companies. To dodge that obstacle, Alibaba and others deploy an odd structure that gives foreign investors a stake in profits but keeps management control in China.

The arrangement magnifies the risks for investors. Chinese executives can confiscate corporate assets without compensating shareholders. And investors might have no grounds to sue.

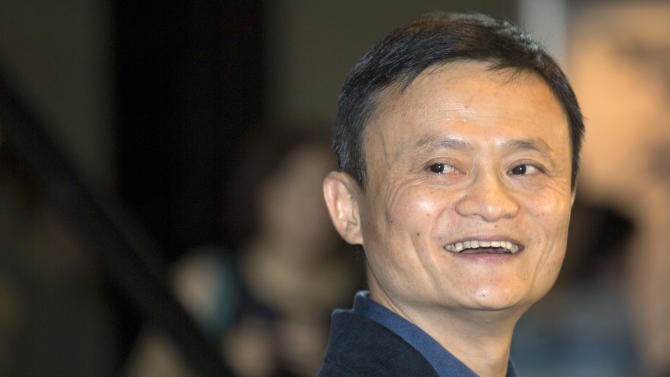

In SEC filings, Alibaba warns that there’s no guarantee CEO Jack Ma or other Alibaba executives “will not breach the existing contractual arrangements.” If investors sued, there would be “substantial uncertainty as to the outcome.”

The risks aren’t theoretical. In 2011, Ma spun off Alibaba’s payment service, Alipay, into a company he controlled. He said this was necessary to comply with Chinese regulations. Yahoo, which owns a 22 percent stake in Alibaba, didn’t learn about the spinoff until it reviewed a regulatory filing.

Alibaba plans to raise up to $25.03 billion — a record for a first-time offering — by selling 368.1 million shares. The $66-to-$68 price range would give the company a market value exceeding $170 billion.

Alibaba originally considered listing its stock in Hong Kong. But it didn’t comply with Hong Kong rules intended to treat all shareholders equally. Like U.S. tech giants Facebook, Google and LinkedIn, Alibaba has a partnership structure that gives Ma and a few insiders outsize power to nominate a majority of company directors.

“It’s the biggest jeopardy,” investor Dan David says, “to put all that control in one man’s hands.”

Search

RECENT PRESS RELEASES

Related Post