Alphabet (GOOGL) Valuation: How Meta Deal, AI Advances, and Q2 Earnings Are Shaping the Bu

August 24, 2025

Alphabet (GOOGL) has been making headlines after a series of major events sent its stock climbing higher. In the past few weeks, the tech giant beat Wall Street’s Q2 earnings expectations, clinched a multi-year $10 billion cloud partnership with Meta, and rolled out the new AI-powered Pixel 10 lineup with broad carrier support. At the same time, rumors have Apple considering Google’s Gemini AI for Siri. This move could potentially unlock new sources of high-margin licensing revenue. These rapid developments are fueling investor enthusiasm and sparking new debates over the company’s true value.

All this momentum is showing up in the stock price. Shares of Alphabet have surged 22% over the past three months and are now up 25% over the last year, following a period of relatively modest gains earlier. The narrative has shifted from Alphabet being a back-and-forth performer to a market leader again. This shift is being driven by both strong operational results and excitement about its position in the AI ecosystem. Notably, the company’s annual revenue and net income growth rates remain in double digits, reinforcing confidence in its fundamental engine.

With the market piling back into Alphabet, is there still room for upside, or is the market already pricing in all of this future growth? Let’s dig into the valuation picture.

Advertisement

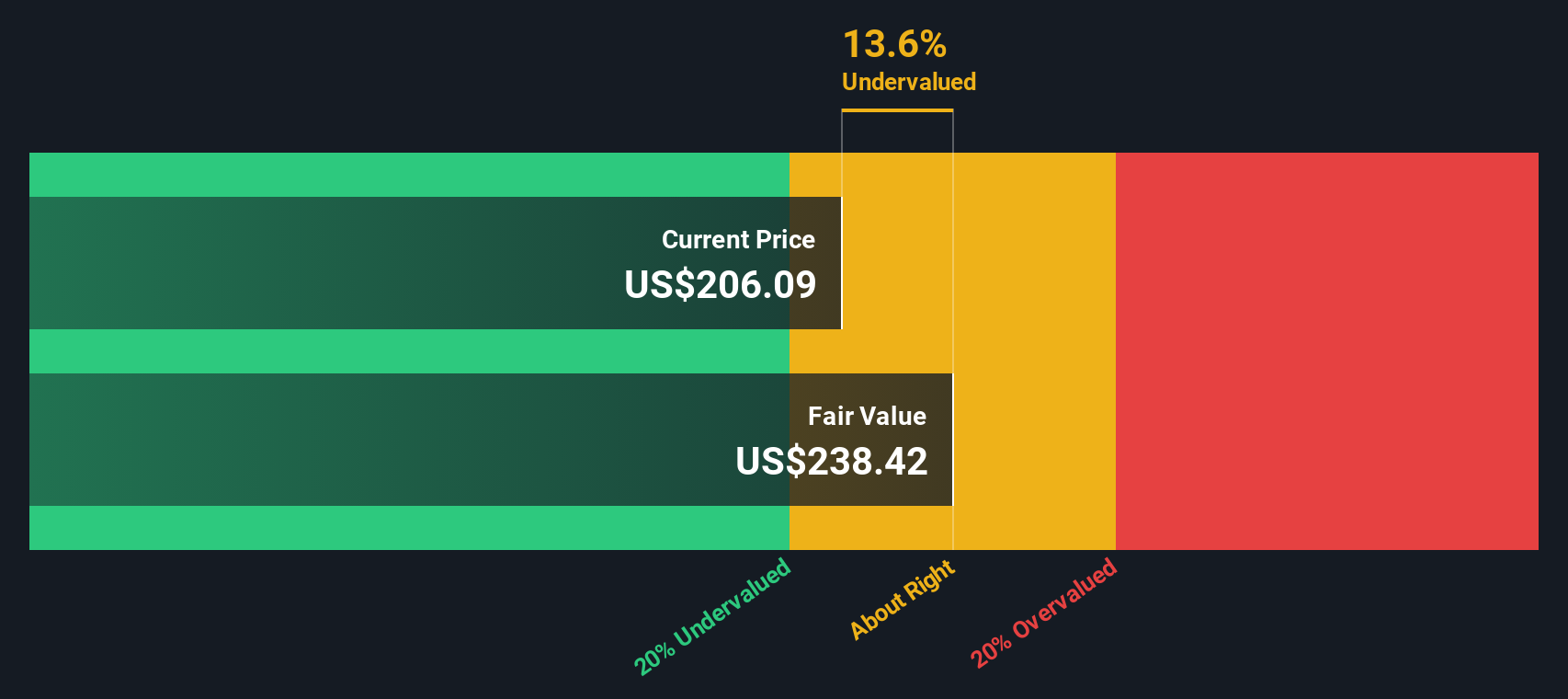

Most Popular Narrative: 13.2% Undervalued

According to the narrative by Investingwilly, Alphabet is currently trading at a notable discount to its estimated fair value. This suggests an attractive entry point for long-term investors who believe in the company’s growth story.

Alphabet Inc., the parent company of Google, is considered a cornerstone of the tech world, leading in search, digital advertising, AI, and cloud computing. Despite its dominance and innovation, Alphabet is currently the cheapest stock among the “Magnificent 7” — a group of the seven largest U.S. tech companies by market capitalization. This relative undervaluation, combined with its robust fundamentals and forward-thinking strategy, makes Alphabet a highly attractive opportunity for long-term investors.

Alphabet’s valuation is anything but ordinary. Curious about what could be driving this price gap? There is a bold set of projections and high expectations for future profitability behind this narrative. Want to know which market assumptions are fueling that estimate of fair value? Get ready to dig deeper and discover the surprising factors that make this tech giant’s stock look so appealing.

Result: Fair Value of $237.43 (UNDERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, persistent regulatory scrutiny or a sharp downturn in digital ad spending could quickly reshape the bullish outlook for Alphabet’s shares.

Find out about the key risks to this Alphabet narrative.

Another View: Looking Through a Different Lens

However, our DCF model takes a different approach by focusing on Alphabet’s expected future cash flows instead of relying on market multiples. This second method also points to undervaluation, but how reliable is it?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Alphabet for example). We show the entire calculation in full. You can track the result in yourwatchlistorportfolioand be alerted when this changes, or use our stock screener to discoverundervalued stocks based on their cash flows. If yousave a screenerwe even alert you when new companies match – so you never miss a potential opportunity.

Build Your Own Alphabet Narrative

If you have your own perspective or want to dive deeper into Alphabet’s story, you can easily build your own view in just a few minutes. do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Alphabet.

Looking for More Winning Ideas?

If you want your next move to count, don’t stop at Alphabet. New opportunities are waiting for investors who act ahead of the crowd. Put your research to work with these expertly curated handpicked sets of stocks, each one targeting a unique advantage for your portfolio.

- Secure steady income and shield your investments from market swings by targeting companies with high payout potential right here: dividend stocks with yields > 3%.

- Ride the AI-driven transformation in healthcare by analyzing cutting-edge companies at the forefront of this medical revolution via healthcare AI stocks.

- Get ahead of tomorrow’s trends and capitalize on breakthroughs in cryptocurrencies and blockchain technology with this tailored stock shortlist: cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Search

RECENT PRESS RELEASES

Related Post