Amazon Analysts See Renewed Growth Potential Into 2026

December 31, 2025

This article first appeared on GuruFocus.

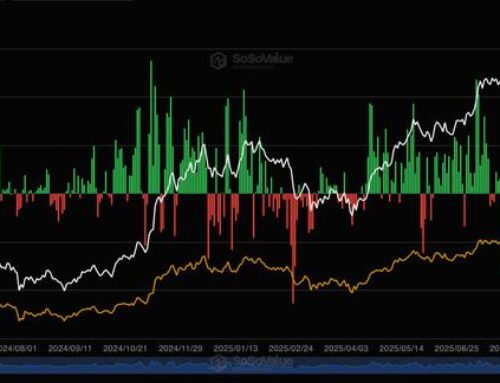

Amazon (AMZN, Financials) is entering 2026 with renewed optimism from Wall Street, as top analysts project a rebound in its cloud and artificial intelligence businesses after a year of underperformance. Shares gained just 6% in 2025, trailing the S&P 500’s 18% advance, amid slower AWS growth and delayed AI monetization.

Mark Mahaney of Evercore ISI said that Amazon was his “top pick” for 2026 because he thinks that Amazon Web Services will rise again, AI chip sales would go up, and advertising will work. He thinks that AWS income would rise by more than 20% a year as Trainium processors and AI workload capacity expand.

As AI use grows, Goldman Sachs analyst Eric Sheridan maintained his Buy rating and $290 target, saying that demand for cloud services will rise. Doug Anmuth of JPMorgan said that a $38 billion cloud agreement with OpenAI may go up by 31%.

Justin Post of Bank of America kept his Buy rating and $303 price target. He also said that Amazon’s $10 billion investment in OpenAI might make AWS more competitive and encourage more people to adopt its own AI infrastructure. Experts say that Amazon’s foundations remain robust, even if the company cut off workers in late 2025. The company builds AI infrastructure while also expanding advertising and retail automation.

Search

RECENT PRESS RELEASES

Related Post