Amazon.Com’s Quarterly Earnings Preview: What You Need to Know

January 12, 2026

/Amazon_com%20Inc_%20%20logo%20on%20building%20by-%20HJBC%20via%20iStock.jpg)

Amazon_com Inc_ logo on building by- HJBC via iStock

Valued at a market cap of $2.6 trillion, Amazon.com, Inc. (AMZN) is a technology and consumer services company based in Seattle, Washington. It is best known for its dominant e-commerce platform, where it sells a vast range of products directly and through third-party sellers. The company is ready to announce its fiscal Q4 earnings for 2025 in the near future.

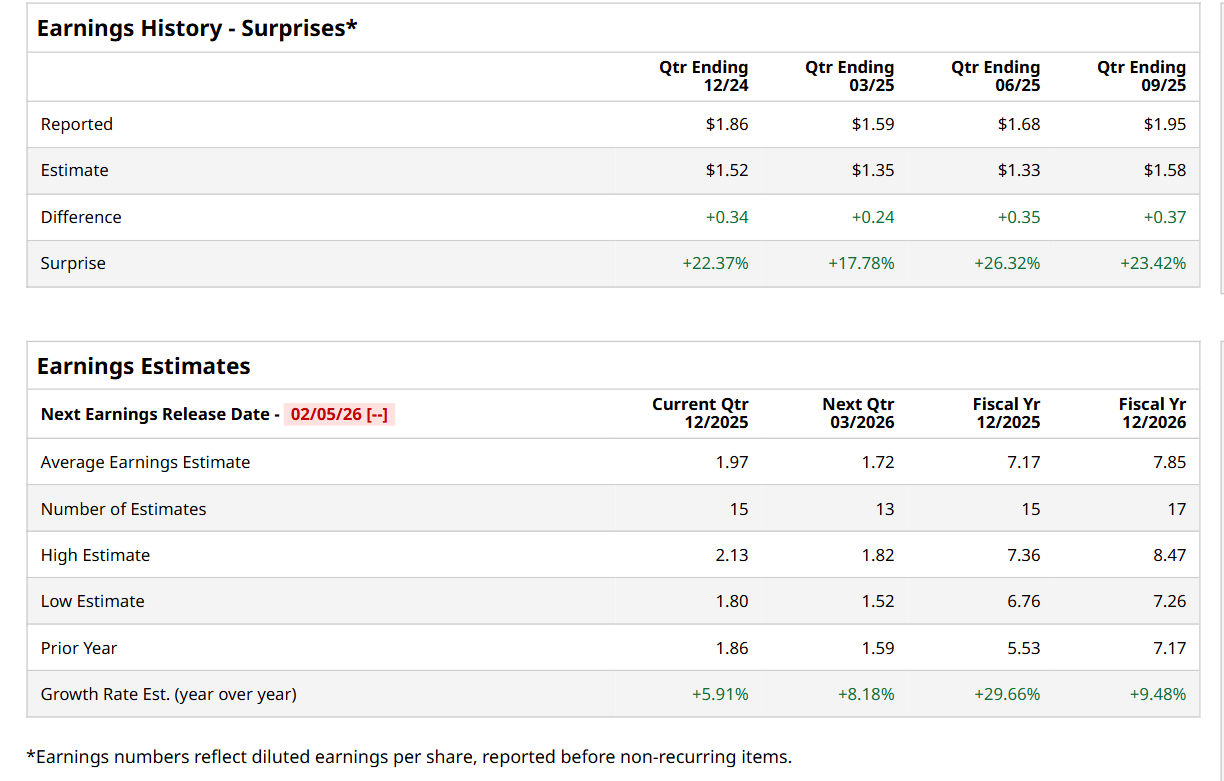

Before this event, analysts expect this e-commerce giant to report a profit of $1.97 per share, up 5.9% from $1.86 per share in the year-ago quarter. The company has topped Wall Street’s bottom-line estimates in each of the last four quarters. In Q3, its EPS of $1.95 exceeded the consensus estimates by a notable margin of 23.4%.

For the current fiscal year, ending in December, analysts expect AMZN to report a profit of $7.17 per share, up 29.7% from $5.53 per share in fiscal 2024. Furthermore, its EPS is expected to grow 9.5% year-over-year to $7.85 in fiscal 2026.

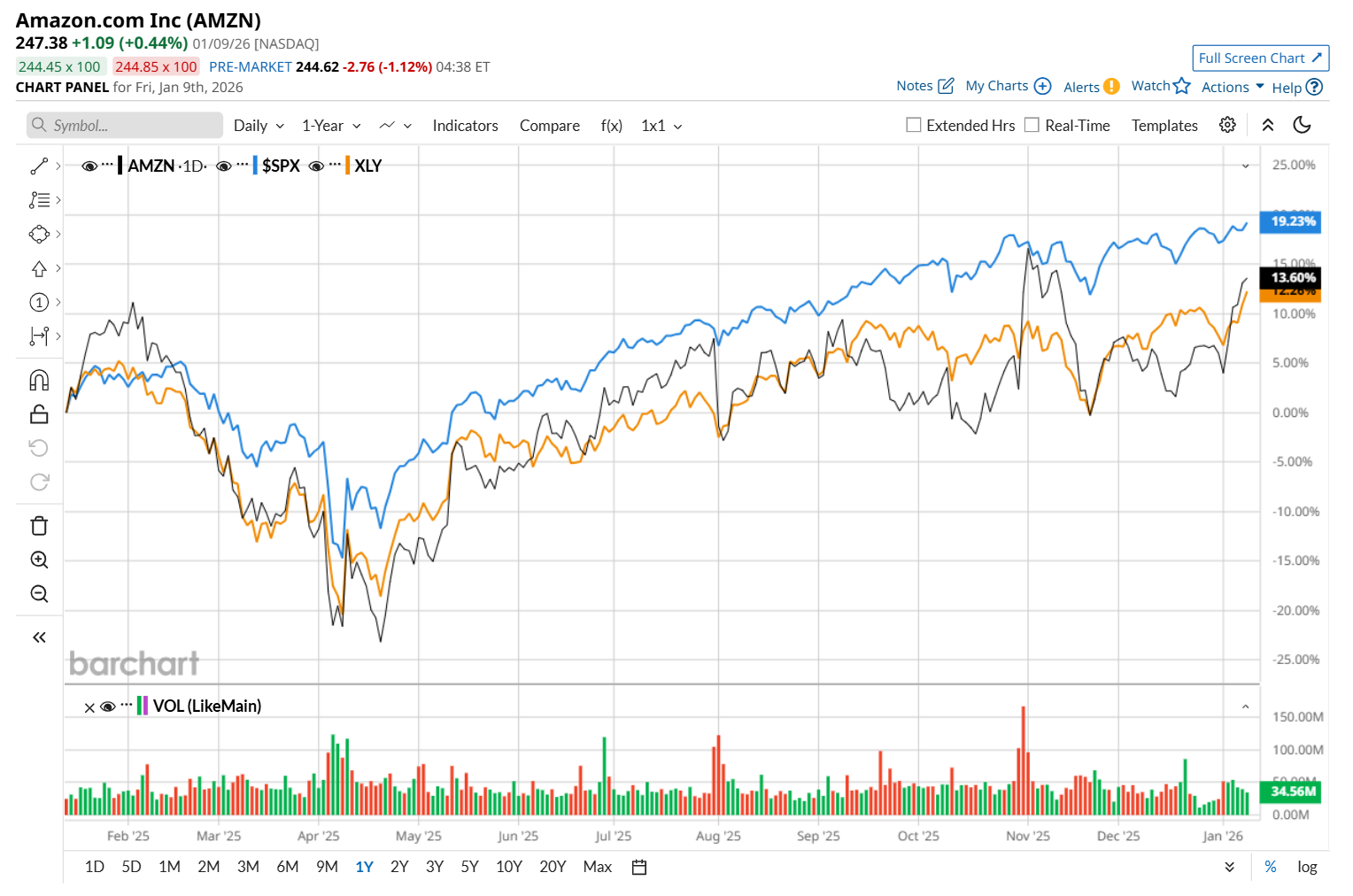

Shares of AMZN have gained 11.4% over the past 52 weeks, underperforming both the S&P 500 Index’s ($SPX) 17.7% return and the State Street Consumer Discretionary Select Sector SPDR ETF’s (XLY) 11.6% uptick over the same time period.

AMZN’s underperformance over the past year has been driven by rising capital expenditure on artificial intelligence (AI), which is currently pressuring free cash flows and is expected to weigh on future earnings through higher depreciation costs. At the same time, competition is intensifying across both its e-commerce and cloud computing businesses, adding to growth concerns. Additionally, the emergence of third-party AI agents is seen as a potential headwind for Amazon’s high-margin digital advertising segment, further impacting investor sentiment.

Wall Street analysts are highly optimistic about AMZN’s stock, with an overall “Strong Buy” rating. Among 57 analysts covering the stock, 49 recommend “Strong Buy,” five indicate “Moderate Buy,” and three suggest “Hold.” The mean price target for AMZN is $293.96, indicating an 18.8% potential upside from the current levels.

On the date of publication,

Neharika Jain

did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes.

For more information please view the Barchart Disclosure Policy

here.

Search

RECENT PRESS RELEASES

Ethereum to $40,000? Why one analyst expects the second-biggest crypto to outperform Bitco

SWI Editorial Staff2026-01-12T09:18:02-08:00January 12, 2026|

Bank of Italy: what if TradFi adopts Ethereum but ETH collapses? – Ledger Insights

SWI Editorial Staff2026-01-12T09:17:35-08:00January 12, 2026|

MARA publishes framework to support delivery of offshore renewable energy

SWI Editorial Staff2026-01-12T08:19:00-08:00January 12, 2026|

Nextpower Arabia launches to fast-track utility-scale solar rollout

SWI Editorial Staff2026-01-12T08:18:32-08:00January 12, 2026|

India grants extra time for solar projects hit by bird conservation

SWI Editorial Staff2026-01-12T08:17:57-08:00January 12, 2026|

2026 Outlook: Clean Energy, Nature, And Water Drive Global Resilience

SWI Editorial Staff2026-01-12T08:17:26-08:00January 12, 2026|

Related Post