Amazon.Com’s Quarterly Earnings Preview: What You Need to Know

January 12, 2026

/Amazon_com%20Inc_%20%20logo%20on%20building%20by-%20HJBC%20via%20iStock.jpg)

Amazon_com Inc_ logo on building by- HJBC via iStock

Valued at a market cap of $2.6 trillion, Amazon.com, Inc. (AMZN) is a technology and consumer services company based in Seattle, Washington. It is best known for its dominant e-commerce platform, where it sells a vast range of products directly and through third-party sellers. The company is ready to announce its fiscal Q4 earnings for 2025 in the near future.

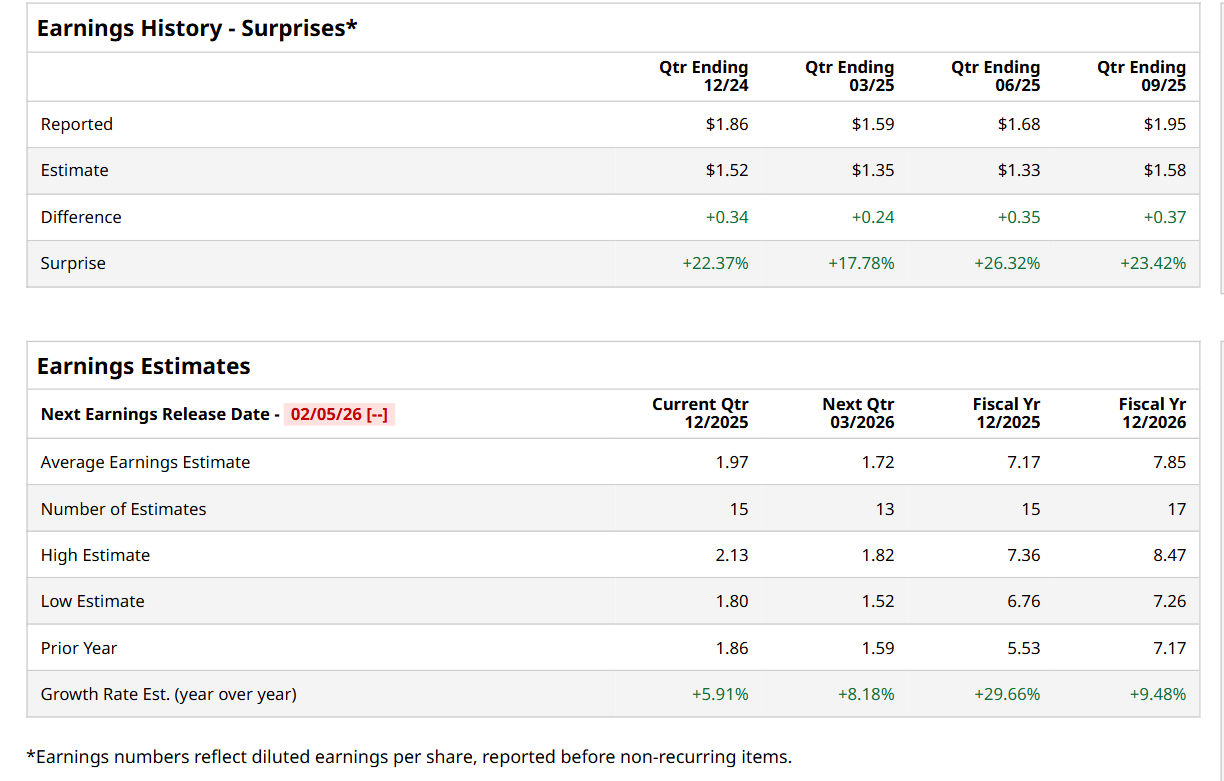

Before this event, analysts expect this e-commerce giant to report a profit of $1.97 per share, up 5.9% from $1.86 per share in the year-ago quarter. The company has topped Wall Street’s bottom-line estimates in each of the last four quarters. In Q3, its EPS of $1.95 exceeded the consensus estimates by a notable margin of 23.4%.

For the current fiscal year, ending in December, analysts expect AMZN to report a profit of $7.17 per share, up 29.7% from $5.53 per share in fiscal 2024. Furthermore, its EPS is expected to grow 9.5% year-over-year to $7.85 in fiscal 2026.

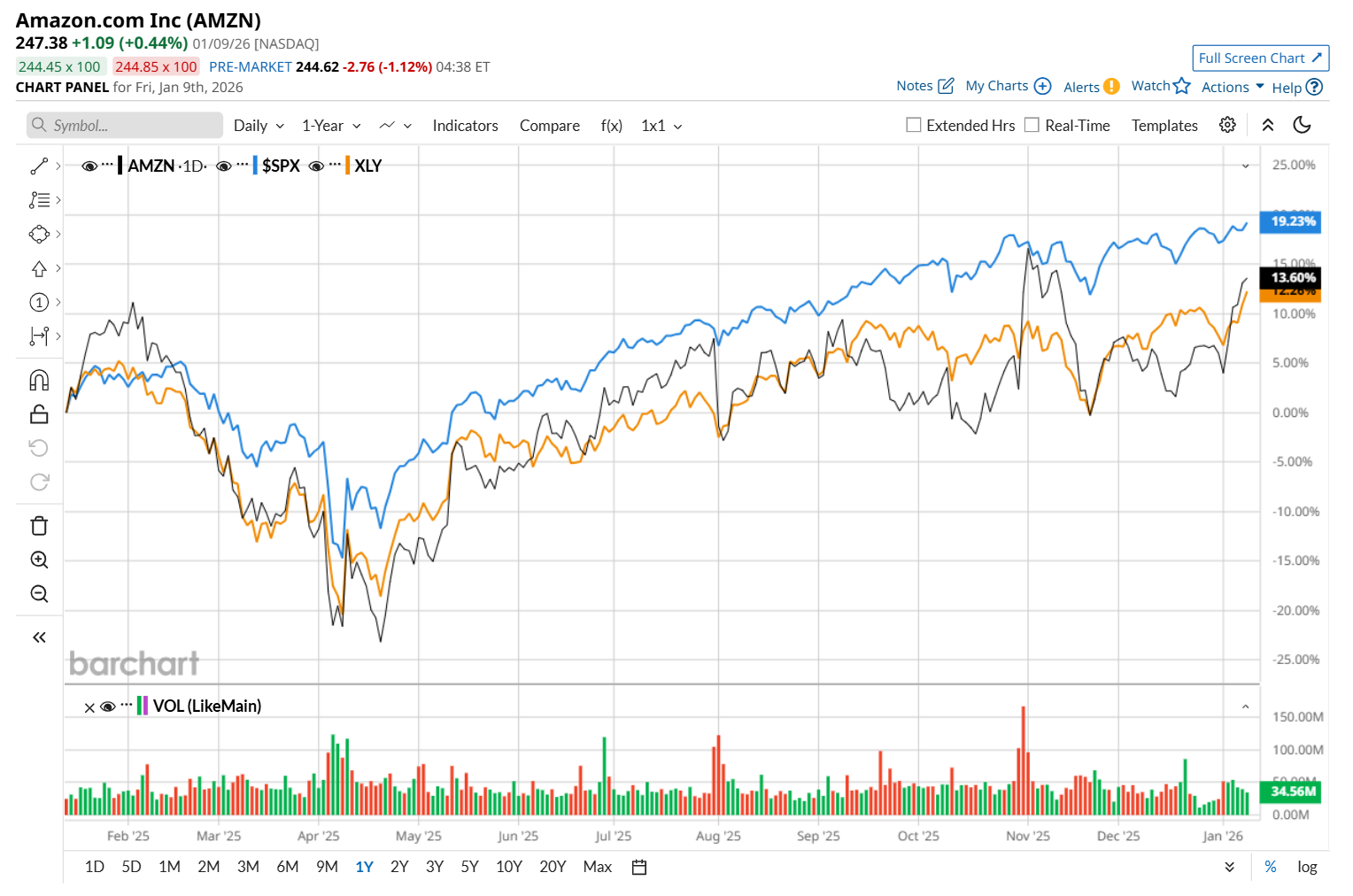

Shares of AMZN have gained 11.4% over the past 52 weeks, underperforming both the S&P 500 Index’s ($SPX) 17.7% return and the State Street Consumer Discretionary Select Sector SPDR ETF’s (XLY) 11.6% uptick over the same time period.

AMZN’s underperformance over the past year has been driven by rising capital expenditure on artificial intelligence (AI), which is currently pressuring free cash flows and is expected to weigh on future earnings through higher depreciation costs. At the same time, competition is intensifying across both its e-commerce and cloud computing businesses, adding to growth concerns. Additionally, the emergence of third-party AI agents is seen as a potential headwind for Amazon’s high-margin digital advertising segment, further impacting investor sentiment.

Wall Street analysts are highly optimistic about AMZN’s stock, with an overall “Strong Buy” rating. Among 57 analysts covering the stock, 49 recommend “Strong Buy,” five indicate “Moderate Buy,” and three suggest “Hold.” The mean price target for AMZN is $293.96, indicating an 18.8% potential upside from the current levels.

On the date of publication,

Neharika Jain

did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes.

For more information please view the Barchart Disclosure Policy

here.

Search

RECENT PRESS RELEASES

Bitcoin’s Four-Year Cycle Broken: VanEck

SWI Editorial Staff2026-01-13T10:48:08-08:00January 13, 2026|

Drug kingpin who used Bitcoin to launder millions gets 20 years in prison

SWI Editorial Staff2026-01-13T10:47:41-08:00January 13, 2026|

Crypto Billionaire Michael Saylor Names Nvidia, Bitcoin Among ‘Best Performing Assets’ Of

SWI Editorial Staff2026-01-13T10:47:12-08:00January 13, 2026|

Best US Internet Stocks for 2026: Mizuho’s 4 Top Picks By Investing.com

SWI Editorial Staff2026-01-13T10:46:14-08:00January 13, 2026|

Netflix stock price target lowered to $115 by TD Cowen on content slate By Investing.com

SWI Editorial Staff2026-01-13T10:45:40-08:00January 13, 2026|

Motley Fool Survey Reveals Why AI Investors Aren’t Worried About a Bubble. Here Are 2 AI S

SWI Editorial Staff2026-01-13T10:45:10-08:00January 13, 2026|

Related Post