Amazon Is Lifting Cipher Mining Stock. Is There More Upside in Store?

November 3, 2025

/2d%20illustration%20of%20Cloud%20computing%20by%20Blackboard%20via%20Shutterstock.jpg)

2d illustration of Cloud computing by Blackboard via Shutterstock

Cipher Mining (CIFR) shares closed well over 20% higher on Monday after the New York-headquartered firm announced a 15-year hosting agreement worth $5.5 billion with Amazon’s (AMZN) Amazon Web Services (AWS).

In September, the Nasdaq-listed firm signed a similar deal with Google-backed Fluidstack as well, but the AWS transaction marks its most notable pivot into artificial intelligence (AI) infrastructure.

Following today’s rally, CIFR stock is trading at more than 10x its price in the first week of April.

Significance of the AWS Deal for CIFR Shares

The AWS partnership cements Cipher’s transition from crypto mining to AI infrastructure, tapping into hyperscaler demand for high-performance computing (HPC).

It covers 300 megawatts of hosting capacity, with deployment beginning in 2026.

The announced agreement also validates CIFR’s energy-first strategy, leveraging its West Texas footprint and power contracts to attract top-tier clients.

For those invested in CIFR shares, it simply means long-term revenue visibility, operational scale, and relevance in the artificial intelligence arms race.

All in all, the AWS deal confirms that Cipher is no longer a speculative miner only, it’s becoming a serious infrastructure player heading into 2026.

Cantor Fitzgerald Raises Price Target on Cipher Mining Stock

Cipher Mining stock emerged as a millionaire-maker in 2025, but Brett Knoblauch, a senior Cantor Fitzgerald analyst, believes it will push meaningfully higher in the coming year.

According to him, the company’s long-term hosting agreements with Fluidstack and Amazon Web Services will see its share price hit $26 within the next 12 months.

“When combined with CIFR having one of the largest power pipelines, we would not be surprised to see Cipher continue to announce additional deals,” he told clients in a research note today.

Note that Cantor Fitzgerald’s upwardly revised price target on CIFR shares signals potential upside of another 14% from current levels.

CIFR Stock Remains a ‘Buy’ Among Wall Street Firms

Other Wall Street analysts seem to agree with Brett Knoblauch’s positive view on Cipher Mining shares as well.

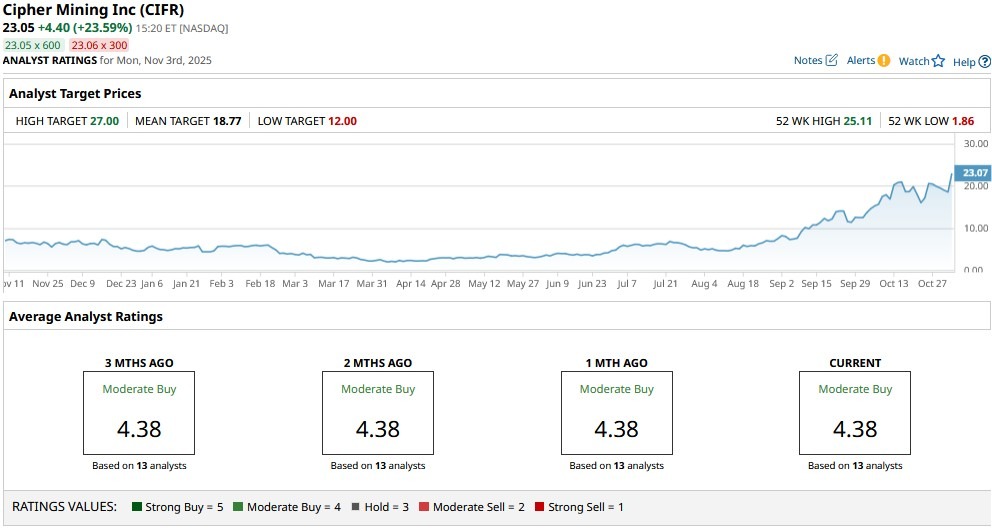

According to Barchart, the consensus rating on CIFR stock currently sits at “Moderate Buy” with price targets going as high as $27, indicating potential upside of nearly 20% from here.

On the date of publication,

Wajeeh Khan

did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes.

For more information please view the Barchart Disclosure Policy

here.

Search

RECENT PRESS RELEASES

Omaha Tribe accuses Nebraska attorney general of retaliation over medical marijuana progra

SWI Editorial Staff2025-11-04T21:36:37-08:00November 4, 2025|

Bellville voters reject marijuana dispensary in the village

SWI Editorial Staff2025-11-04T21:36:17-08:00November 4, 2025|

WhatsApp dominance abuse confirmed, but Indian tribunal overturns 5-year data-sharing ban

SWI Editorial Staff2025-11-04T21:34:53-08:00November 4, 2025|

COP30: Keep people, not profits and power, at heart of negotiations

SWI Editorial Staff2025-11-04T21:13:18-08:00November 4, 2025|

China has a new champ in coal-fired power despite focus on renewable energy

SWI Editorial Staff2025-11-04T21:12:45-08:00November 4, 2025|

Earnings live: Spotify stock turns lower, Palantir and Uber dive while Pfizer, Marriott ri

SWI Editorial Staff2025-11-04T20:10:36-08:00November 4, 2025|

Related Post