Amazon Seller Registrations Hit Decade Low in 2025

January 15, 2026

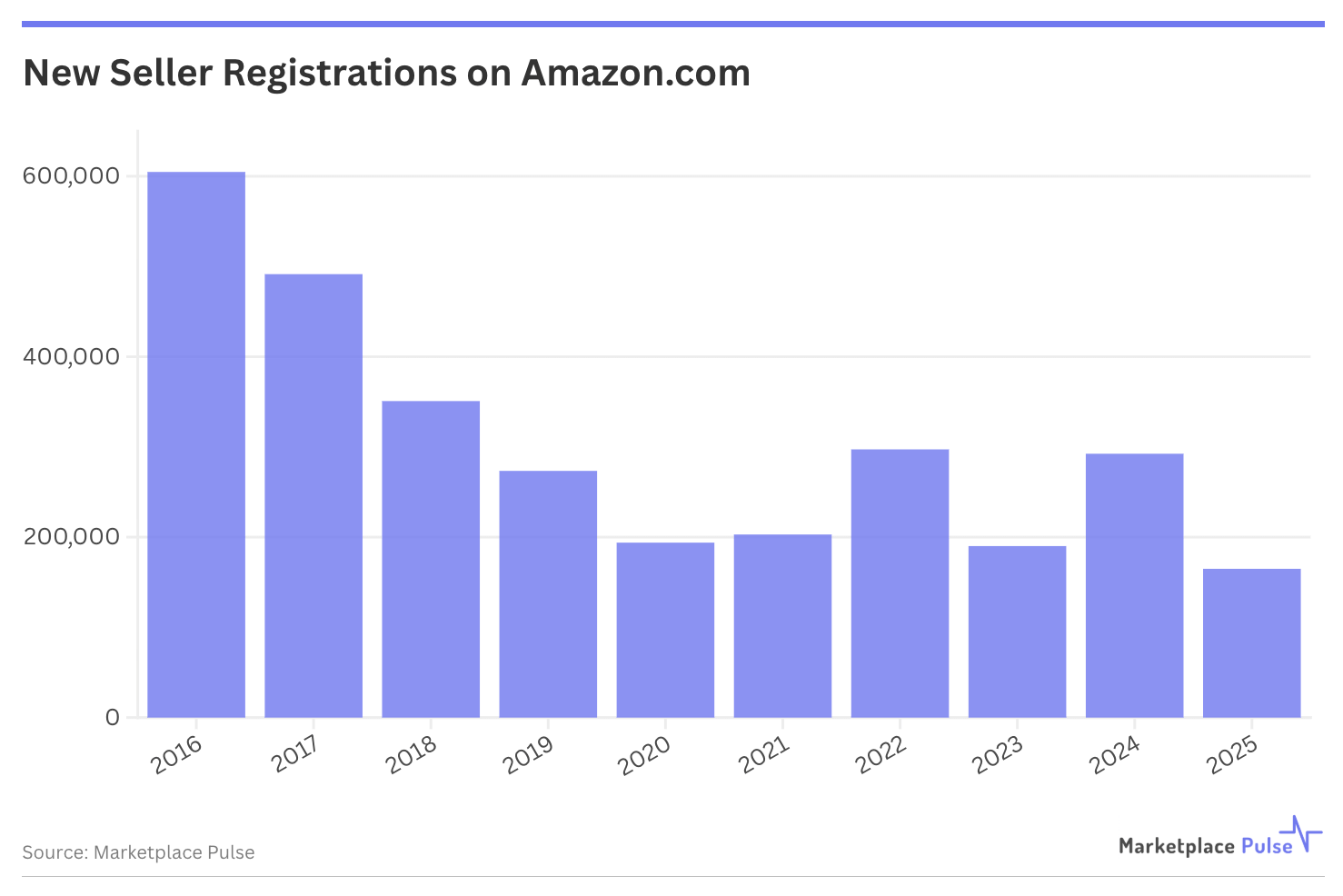

Amazon.com registered just 165,000 new sellers in 2025, the lowest annual total since Marketplace Pulse began collecting data in 2015 and down 44% from 2024. The decline signals Amazon’s transformation from an accessible entry point for entrepreneurial experimentation into infrastructure for established, well-capitalized operators.

The registration decline extended across Amazon’s global marketplaces during what Marketplace Pulse’s 2025 Year in Review called the Great Compression, when multiple forces simultaneously squeezed margins. Tariffs compressed domestic sellers while foreign competitors exploited enforcement gaps. AI raised competitive baselines while benefiting overseas sellers asymmetrically. Advertising accelerated its evolution from optional to unavoidable. Platform fees extracted maximum value as Amazon became 60% services, and just 40% retail. Chinese sellers crossed 50% of Amazon’s global active seller base. The resulting uncertainty caused prospective sellers to pull back from registration at a significant rate.

2025’s registration decline further illustrates what the Amazon Marketplace Trends Report calls a competition paradox. Despite fewer new sellers joining and active sellers dropping from 2.4 million in 2021 to 1.65 million by the end of 2025, opportunity per seller has expanded. Amazon’s third-party GMV reached an estimated $305 billion in the U.S. and $575 billion globally, continuing growth even as seller counts contracted. Traffic per active seller increased 31% since 2021, while over 100,000 sellers now generate $1 million or more annually – up from roughly 60,000 in 2021 – and 235 sellers generate $100 million or more, up from just 50. Revenue is concentrating among survivors who can navigate Amazon’s increasingly complex environment.

The bar for execution has never been higher, but for those who clear it, numerical competition has never been lower. More than 60% of the top 10,000 sellers registered before 2019, demonstrating that longevity remains the strongest predictor of success.

The marketplace is increasingly challenging for casual, side-income sellers, yet disproportionately rewards sophisticated businesses with capital reserves to absorb fee increases, tariff volatility, and margin compression. The consolidation extends to the broader ecosystem, naturally shifting software and service providers toward enterprise sellers where contract values justify the operational complexity.

The composition of new sellers also shifted. Chinese sellers represented 59.9% of new registrations, down from 62.3% in 2024. The 2.4 percentage-point decline marked the first drop in four years, potentially reflecting increased tax reporting requirements from Beijing. Yet Chinese sellers still dominate new registrations, and their structural advantages remain largely intact. American sellers accounted for just 16.3% of new registrations, down from a previous low of 26.8% in 2024, continuing their long-term decline from 70.8% in 2016.

The registration data provides the clearest leading indicator yet of Amazon’s completed transformation. When the platform attracts its fewest new sellers in a decade while simultaneously supporting record GMV and the highest concentration of million-dollar sellers in its history, the message is unambiguous. Amazon has evolved from a marketplace where anyone could experiment with a side business to one that demands sophisticated operation from the outset for anyone seeking to build sustainable revenue.

The 165,000 sellers who registered in 2025 enter a fundamentally different marketplace than those who joined ten, five, or even three years ago, one where the middle ground of moderate-scale, profitable operation has become substantially more difficult. Fewer sellers are attempting entry because the demands of profitable marketplace operation have become impossible to ignore.

Search

RECENT PRESS RELEASES

Related Post