Amazon’s Pullback Paves the Way for a Strong Buy

April 6, 2025

Amazon’s stock has taken a decent hit since it reached its all-time high back in early February 2025right before it dropped its FY 2024 annual report. Since then, shares are down more than 15%, but to me, this feels more like a short-term pullback rather than a sign of anything fundamentally broken. The bigger drop came after Trump’s Liberation Day remarks, which rattled the broader market and dragged Amazon down with it. Still, the company beat earnings estimates and showed solid performance overall. The Q4 2024 numbers were decent, but I think the forward guidance came off a bit cautious, and with tensions rising globally, investor sentiment cooled pretty fast. The stock had touched around $245 at one point, before sliding down to about $170that’s roughly a 28% decline from the highs. In my view, though, this correction is more about momentum and headlines than anything serious with the business itself.

This drop has brought the stock into the $160-180 buy zone, making it a great opportunity for both intermediate and long-term buyers. The holiday season really boosted earnings in Amazon’s core e-commerce business, and Cloud performed exceptionally well, with operating income reaching new highs. I believe Amazon Web Services will continue to be a crown jewel for the company, driving overall earnings growth. With high-margin ad revenue, record third-party sales, Prime membership growth, and cost-cutting through logistics and automation, Amazon is well-positioned for the future. In my view, these factors make any pullback a solid buying opportunity, and I’ll break down the key catalysts that could push Amazon’s valuation higher in this article.

I know investors are watching Amazon’s segment growth rates closelyeven if they aren’t as high as they used to be. And honestly, I’m not surprised or worried. It’s tough for a company of Amazon’s size to keep growing at high double-digit rates. Global sales grew by 10.5%, with North America adding about 10% to reach $115.6 billion. Meanwhile, AWS sales jumped 19% YoY to $28.8 billion, and for FY 2024, AWS hit $107.6 billion, showing an 18.5% YoY boost. This year, AWS is estimated to reach $128 billion, which is roughly a 19% gain. Over the last five years since 2019, Amazon more than doubled its revenuedriven by a strong North America segment and a fast-growing, yet maturing, AWS business. However, growth has slowed down a bit recently: the overall revenue CAGR from 2015-2024 was about 22%, while from 2020-2024 it was around 18%. Looking ahead, I expect Amazon’s sales to grow about 10% YoY in a base case, though a more bullish scenario could see 12-15% growth.

I believe AWS is the real engine behind Amazon’s future. Despite some decelerationlikely due to rising competition from Microsoft’s AzureAWS still delivered a strong 18.9% YoY jump to $28.8 billion in Q4. Customers are really pushing to expand their cloud presence, and Jassy (CEO of Amazon) mentioned that some of the growth is held back by supply and power limits, which he expects to ease in the back half of 2025. With AWS’s impressive track record, it’s clear to me that this segment will continue to drive Amazon’s overall growth. In fact, if you look at healthy cloud businesses trading at around 10x forward sales, applying a similar multiple to AWS suggests it could be worth roughly $1.3 trillion on its own.

I’ve been impressed by how Amazon’s margins have improved. Even though its North America and International segments have modest growth, overall operating income margins reached nearly 10.8% in 2024, thanks largely to AWS, which hit an all-time high margin of 37%. This margin boost has also helped push EBITDA margins to 19% and operating cash flow to $115.9 billion. Amazon’s been working hard to reduce shipping costs through better automation and robotics in its warehousessomething that used to hurt margins before the pandemic. Plus, incremental operating income in North America has grown by about $2.8 billion YoY, almost matching the $3.5 billion growth seen in AWS. With recent headcount cuts and ongoing automation, I expect these efficiency gains to continue.

Looking forward, Amazon’s plan to spend $100 billion on CapEx in 2025 is another strong signal. Most of that will go into AI for AWS, representing about a 20% growth rate over 2024 and nearly double the investment compared to 2023. This massive spending backs up my view that Amazon’s growth catalysts remain very strong. Not only does the core e-commerce business have room for margin improvements, but the AI-driven boost in AWS and further automation across the company make me confident that revenue expansion will be more profitable and boost the stock’s valuation in the mid-term.

In short, even though the growth rates have slowed a bit, Amazon’s diverse segments, efficiency improvements, and aggressive CapEx spending on AI and cloud show that the company is well-positioned for future growth.

From both a fundamental and valuation standpoint, I believe Amazon is a very attractive investment right now. The company’s planned CapEx for 2025 shows that management is optimistic about the future, and trends in e-commerce, cloud computing, and AI support this bullish view. For a long time, Amazon traded at high multiples due to its low margins, but that’s changing fast as it delivers strong operating income growth. Today, Amazon is trading at a modest forward P/E, even lower than many of its big tech peers. With an EPS of $8.70, the forward P/E comes in around 17.9x, which is quite cheap for a market-leading company that also owns the largest cloud business globally.

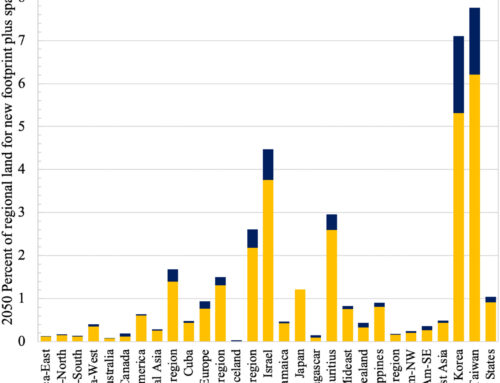

[Author’s Calculations]

Looking ahead, I think Amazon still has a solid growth runway. In a base case, I expect sales to grow around 10% YoY, while a more optimistic scenario could see that number closer to 1215%. As the business gets more efficient and profit margins improve, I believe EPS will follow suit and increase meaningfully. What gets me even more interested is the potential for a double benefitearnings growth and some multiple expansion. If macro conditions and the broader geopolitical environment stabilize a bit, I could easily see Amazon trading at a forward P/E in the 2025x range. That’s still well below its 5-year average of 39.2x, which tells me there’s some room for re-rating. Even if I take a fairly conservative view and assume a forward P/E of 23x, my rough estimate puts the stock at around $220. That gives me a margin of safety of about 28% from current levels, which I find quite compelling. All in all, I see a pretty good mix of solid growth and valuation support hereenough to stay bullish.

To back up my view, I ran a DCF model using a 10% discount rate and a 5% terminal growth rate, fitting Amazon’s long-term scale over the next 15-20 years. Even with these conservative assumptions, the model gives a fair value of about $199 per shareproviding a 14% margin of safety. While regulatory and political risks might cause some discounting, the strong growth catalysts and improving profitability make Amazon a top buy-and-hold for the long run. I think Mr. Market is being too fearful, underestimating Amazon’s long-term growth and cash-flow potential.

To put it simply, I’m upgrading my Amazon rating to a “strong buy” and putting more skin in the game. Of course, there are risksthis sell-off might continue and geopolitical tensions could worsenbut I’m willing to bet on Amazon.

In conclusion, I believe Amazon’s strong fundamentals fully support its valuation and then some. The company is posting double-digit growth across both its core e-commerce and AWS businesses. While e-commerce still drives about 85% of revenue, AWS is playing an increasingly important role, especially as it expands its footprint outside North America. I’m also very encouraged by the improvements in fulfillment margins through better robotics and automationsmall cost savings here can have a huge impact given Amazon’s massive revenue base. All these factors combined make Amazon an attractive long-term investment, and it’s a key reason why I’m upgrading my rating to a “strong buy.”

This article first appeared on GuruFocus.

Terms and Privacy Policy

Search

RECENT PRESS RELEASES

Related Post