AMD’s Growth Rate is Declining. Should Investors Be Worried?

February 9, 2026

Expectations are high for the stock given its elevated valuation.

Advanced Micro Devices (AMD +3.70%) recently posted its latest quarterly earnings numbers, which were strong. But there was a problem, as the growth rate was down from the previous period. The company has been launching new chips, and it’s expecting a lot more growth due to artificial intelligence (AI). The recent results and guidance, however, may raise some question marks about the business and just how strong its growth prospects really are.

Is this slowdown in AMD’s growth rate a cause for concern for investors, or could the tech stock still be a good long-term investment today?

Image source: Getty Images.

AMD expects another quarter of slowing growth in Q1

Shares of AMD rose by 77% in 2025, as growth investors saw a lot of potential in the company as it rolled out its latest AI chips. Its growth rate did accelerate last year, and while it’s still generating some solid growth, the rate has been slowing down a bit.

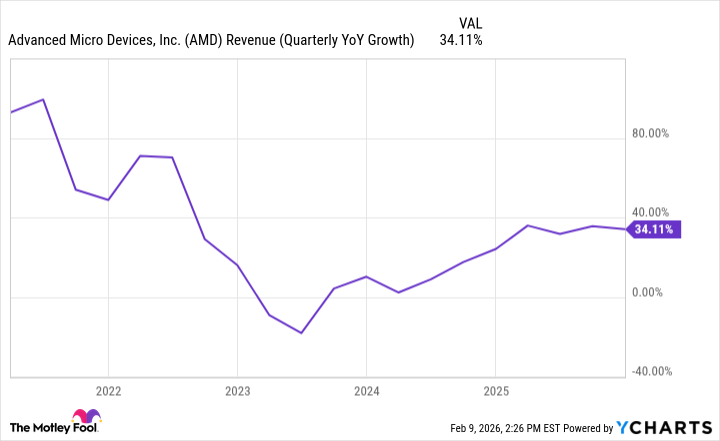

AMD Revenue (Quarterly YoY Growth) data by YCharts

In its most recent quarter, which covered the last three months of 2025, AMD’s revenue rose by 34%, to $10.3 billion. A period earlier, its growth rate was around 36%. And its forecast for the current quarter calls for the growth rate to fall to 32%. This is even with including $100 million in Instinct MI308 chip sales to China.

Advanced Micro Devices

Today’s Change

(3.70%) $7.72

Current Price

$216.16

Is this a problem for AMD’s stock?

A growth rate north of 30% is impressive, and it’s difficult to continually improve upon it. In the big picture, what may matter most is that the business is still performing well and demand for its chips remains strong. However, rival Nvidia generates far more in revenue, and its growth rate was over 60% in its most recent quarter.

Given that the stock’s valuation isn’t terribly cheap, with AMD trading at around 80 times its trailing earnings, it could be due for a decline in the near term if its growth fails to impress investors. There may not be a compelling reason to invest in AMD over its main rival, Nvidia, if its growth rate is lower, and its valuation is higher (Nvidia trades at around 47 times its earnings).

While AMD may still be a good long-term investment to hang on to, investors should brace for the possibility of some volatility in the short term due to its high price tag, especially if there’s a downturn in the markets.

Search

RECENT PRESS RELEASES

Related Post