American Bitcoin Adds 1,414 BTC as BlackRock Moves $118M BTC to Coinbase Prime

October 27, 2025

Key Notes

- American Bitcoin Corporation now holds 3,865 BTC after a new 1,414 BTC purchase.

- BlackRock transfers $118 million in Bitcoin to Coinbase Prime.

- Bitcoin rallies past $115,000 as short-term holders move back into profit.

The Trump family-backed American Bitcoin has announced the acquisition of around 1,414 Bitcoin

BTC

$115 356

24h volatility:

1.5%

Market cap:

$2.30 T

Vol. 24h:

$64.60 B

.

As of October 24, the company’s total Bitcoin balance stands at 3,865 BTC, obtained through mining operations and strategic acquisitions.

The latest purchase strengthens its position as one of the world’s largest corporate holders of the asset.

The company, ranked as the 26th largest corporate Bitcoin holder, said part of these assets are held in custody or pledged under an agreement with mining hardware provider Bitmain.

Following the acquisition announcement, ABTC shares surged 11.5% to $5.62, suggesting investor confidence in the company’s long-term Bitcoin strategy.

American Bitcoin has also introduced a new reporting metric, Satoshis Per Share (SPS), which measures the amount of Bitcoin indirectly owned by each shareholder through their stock holdings.

Related article: American Bitcoin Pursues Acquisition Interests in Japan and Hong Kong

This comes after the firm previously announced plans to raise up to $2.1 billion in Class A shares, with funds allocated toward Bitcoin purchases, ASIC equipment, and general corporate growth.

While American Bitcoin’s aggressive accumulation caught headlines, BlackRock also made a notable BTC move. The world’s largest asset manager transferred $118 million worth of Bitcoin to Coinbase Prime.

Market analysts suggest these transfers are part of routine liquidity adjustments or ETF-related rebalancing. However, some believe that it could also be a sign of a major sell-off as the cryptocurrency started the week with a green candle.

At press time, Bitcoin is trading around $115,000, up 1.4% in the past 24 hours. The largest cryptocurrency’s daily trading volume doubled on October 27.

Bitcoin’s price has maintained upward momentum since October 23, climbing beyond $112,000-$113,000 resistance zone. This breakout pushed the cryptocurrency above three key on-chain cost bases, indicating renewed market confidence.

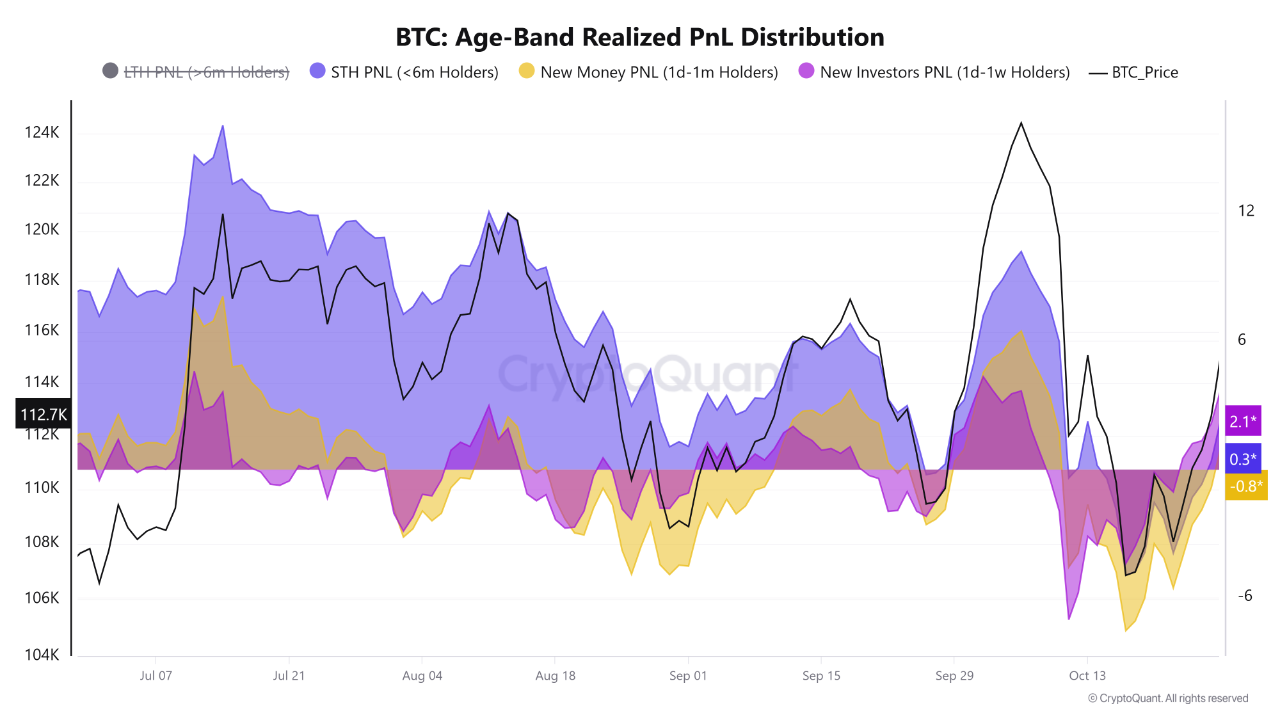

Data from CryptoQuant shows nearly 7 million BTC have returned to profit, including 5.1 million BTC held by investors within six months.

Analysts say that as short-term holders regain profitability, they tend to hold longer and increase positions. This is a classic sign of rising bullish conviction.

Bitcoin age-band realized profit and loss distribution. | Source: CryptoQuant

However, popular analyst Ali Martinez noted on X that the TD sequential indicator is flashing a “sell” signal for BTC. He believes that BTC could soon face profit-taking pressure from short-term holders.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

A crypto journalist with over 5 years of experience in the industry, Parth has worked with major media outlets in the crypto and finance world, gathering experience and expertise in the space after surviving bear and bull markets over the years. Parth is also an author of 4 self-published books.

Search

RECENT PRESS RELEASES

Related Post