Analyst Highlights 4 Reasons Why Ethereum May Be on the Verge of Breakout

June 10, 2025

Analysts are pointing out that Ethereum (ETH) has now gathered several key factors. These are the very catalysts investors have long awaited to trigger a powerful new rally.

In June, these signals are becoming more evident, forming a solid foundation for short-term price expectations. So, what are these factors? Let’s dive in.

Axel Bitblaze, a well-known analyst on platform X, believes ETH is on the verge of its biggest breakout ever. According to him, four main catalysts are laying the groundwork for ETH’s upcoming strong growth.

One major reason Axel Bitblaze remains bullish on ETH is BlackRock’s aggressive accumulation. Since May 9, 2025, BlackRock has bought 269,000 ETH—worth roughly $673.4 million—without selling a single coin. This signals a long-term investment strategy in ETH.

Previously, BlackRock helped lead Bitcoin’s (BTC) price surge from $76,000 to $112,000, driven by massive inflows into its ETF. Now, with similar moves happening for ETH, many analysts believe this is a strong signal that ETH could soon break out.

Additionally, the latest report from BeInCrypto notes that ETH has recorded the strongest inflow streak since the US elections.

The second factor Axel Bitblaze highlights is the significant increase in Ethereum’s network activity. Last month, the number of transactions on the Ethereum network reached 42 million, the highest since May 2021. At the same time, daily active addresses rose to 440,000—also the highest in the past six months.

This reflects the network’s growing usage, particularly in areas like decentralized finance (DeFi) and stablecoin transactions.

The third factor Axel points out is that the ETH/BTC ratio has dropped to its lowest level in six years. The weekly RSI has also hit a record low, suggesting ETH is currently oversold. This often signals a potential trend reversal.

Moreover, over the past month, the ETH/BTC pair has already recovered by 30%, serving as an early confirmation of a possible reversal.

Finally, he highlighted the institutional demand for ETH as demonstrated by SharpLink Gaming recently raising nearly half a billion dollars to purchase ETH.

Based on these developments, Axel Bitblaze predicts that ETH could reach $9,000 by early 2026.

“By December 2025, ETH could trade around $6,000 to $6,500. The final leg up will happen in Q1 2026, and ETH will most likely trade above $9,000 before a blow-off top,” Axel Bitblaze said.

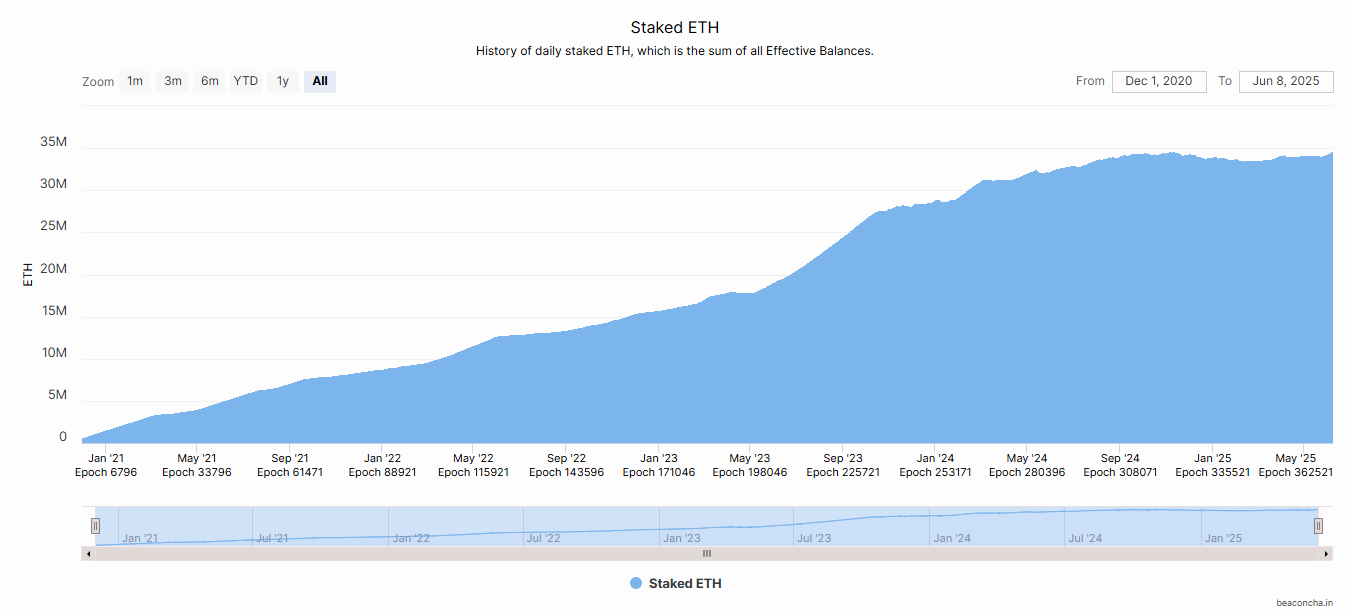

Beyond the catalysts Axel emphasized, the amount of ETH being staked hit a new high in June, with 4.65 million ETH now locked, nearly 30% of the current circulating supply.

This rise in staked ETH has pushed the available exchange supply to new lows in June. With supply tightening and institutional demand rising, pressure is building for upward price movement.

In addition to Axel Bitblaze’s analysis, veteran trader Merlijn The Trader compared ETH’s current price cycle to the 2017 bull run. He believes ETH is now structurally positioned for an even stronger breakout.

“ETH IS COPYING 2017… BAR FOR BAR

2017: Breakout after reclaiming the 50 MA

2025: Same setup. Same level. Same tension.Only difference?

2025 has a bigger engine, more fuel… and no brakes.” – Merlijn The Trader said.

At the time of writing, ETH has recovered more than 50% since early May and is trading above $2,600. However, a recent analysis from BeInCrypto notes that profit-taking has begun. This may act as short-term resistance to ETH breaking out above the weekly 50 MA, as Merlijn predicted.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Search

RECENT PRESS RELEASES

Related Post