Apple Stock Is Interesting, but Here’s What I’d Buy Instead

February 16, 2026

Apple stock has posted respectable gains on the market over the past six months, but its supplier partner has been a better investment.

Shares of tech giant Apple (AAPL 2.20%) have clocked respectable gains of 11.6% on the market in the past six months, outpacing the 5.8% jump in the S&P 500 index over the same period.

The “Magnificent Seven” stock benefits from the robust demand for its latest iPhone offering. Strong iPhone sales helped Apple’s revenue in the first quarter of fiscal 2026 rise by 16% from the year-ago period to almost $144 billion, while adjusted earnings per share increased by 19%.

Apple could continue to outperform the broader market in the future thanks to the growing adoption of generative AI smartphones, as well as the strong performance of its high-margin services business. However, there may be a better way to capitalize on the AI smartphone market’s growth: Apple supplier Cirrus Logic (CRUS +1.81%).

Let’s see why that may be the case.

Image source: Getty Images.

Cirrus Logic is cheaper than Apple and is growing at a steady pace

Cirrus Logic stock has jumped 33% in the past six months, almost double the gains clocked by Apple stock over this period. It is worth noting that Apple is Cirrus’ largest customer, accounting for 94% of the latter’s revenue in the third quarter of fiscal 2026 (which ended on Dec. 27, 2025).

Cirrus Logic

Today’s Change

(1.81%) $2.58

Current Price

$144.63

Cirrus supplies audio codecs, haptics, power management, and camera controller chips for smartphones. The chip company’s reliance on Apple is turning out to be a catalyst for the stock. Shares of Cirrus jumped over 8% following the release of its latest quarterly results on Feb. 3.

Investors cheered the company’s better-than-expected results, as Cirrus’ revenue exceeded the higher end of its guidance due to “stronger-than-anticipated demand for components shipping into smartphones and a favorable mix of end devices.” Cirrus’ revenue increased by 4.4% year over year, while the stronger product mix led to an 18% jump in earnings to $2.97 per share.

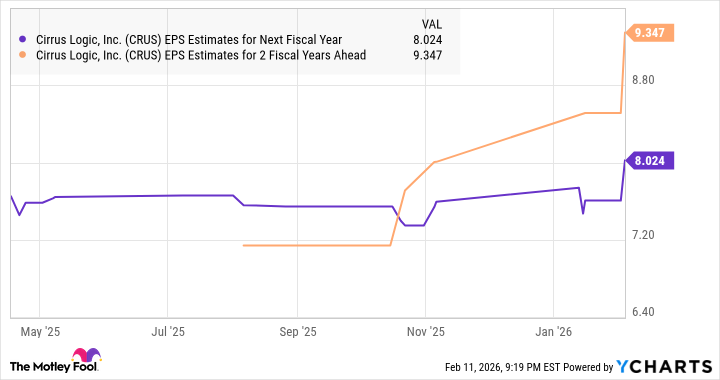

The company is poised to end the current fiscal year with a 20% increase in earnings to $9.05 per share, exceeding the 16% average growth that S&P 500 companies are estimated to clock. What’s more, Cirrus is trading at 19 times earnings right now. That’s a discount to the S&P 500’s average earnings multiple of 25.

What’s more, Cirrus stock is significantly cheaper than Apple’s as well, which trades at nearly 35 times earnings. Given that Cirrus can be considered a proxy for Apple due to its near-total reliance on the latter for its revenue, and its earnings growth was almost in line with the tech giant in the previous quarter, it is a better value play.

Apple’s solid prospects should rub off positively on Cirrus stock

Dan Ives of Wedbush Securities pointed out last year that Apple’s iPhone shipments in the current fiscal year could land well ahead of Wall Street’s estimate of 230 million units. The tech giant could end up shipping as many as 250 million iPhone units in fiscal 2026, primarily because around 315 million iPhones haven’t been upgraded in the past four years.

However, the large number of users in the upgrade window suggests Apple could exceed Ives’ 250 million estimate. That’s probably why analysts have become bullish about Cirrus’ growth prospects.

Data by YCharts.

The uptick in Cirrus’ growth could lead the market to reward it with a higher earnings multiple, paving the way for more upside. That’s why it would be a good idea to buy this tech stock right now.

Search

RECENT PRESS RELEASES

Related Post