Apple Stock Is Steady as a Rock Amid AI Selloff: How to Play AAPL Stock

February 6, 2026

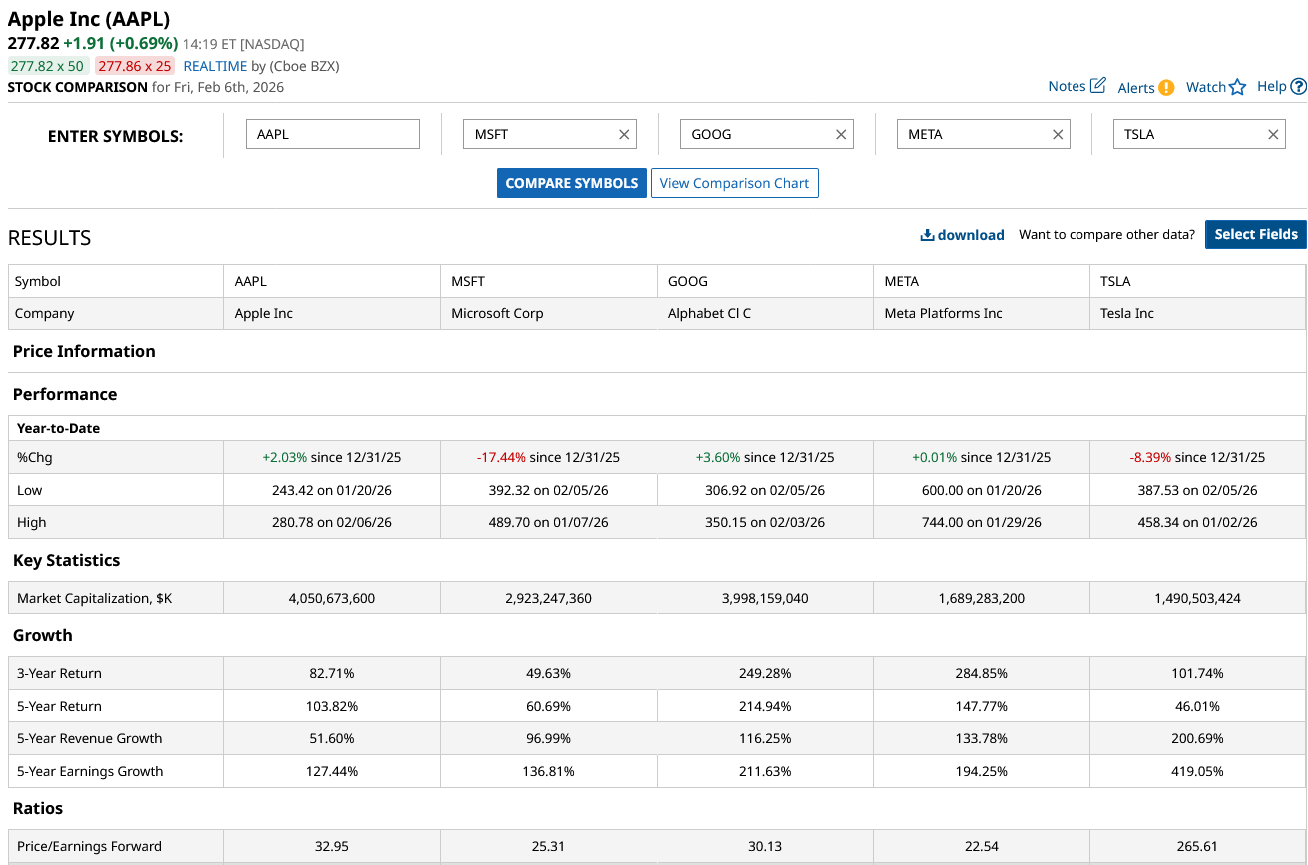

The rally in artificial intelligence (AI) stocks has reversed course as markets get wary about tech companies’ spending spree without commensurate growth in earnings. The apathy is reflected in price action, and three of the “Magnificent 7” constituents, namely Amazon (AMZN), Microsoft (MSFT), and Tesla (TSLA), are trading with nearly or well above double-digit year-to-date (YTD) losses.

Other constituents have also been quite volatile, and Meta Platforms (META), which surged after reporting an impressive set of numbers for Q4 2025, has also pared gains. Apple’s stock (AAPL), meanwhile, has remained steady and is up around 2% for the year. The price action looks all the more reassuring as it comes amid the brutal tech sell-off. Let’s explore Apple’s outlook after its YTD outperformance.

Go behind Wall Street’s hottest headlines with Barchart’s Active Investor newsletter.

Why Has Apple Outperformed in 2026?

As I have previously noticed, Apple’s outperformance and its chances of becoming the biggest company hinged on two key aspects. The first was a crash in AI stocks, and the second was the company stepping up its game in the emerging technology, both of which seem to have played out.

AI stocks have plummeted, and since Apple never really benefited from the AI rally, it is sitting pretty. At the same time, the company has gradually raised its game in AI, including through third-party partnerships, most recently with Google Gemini.

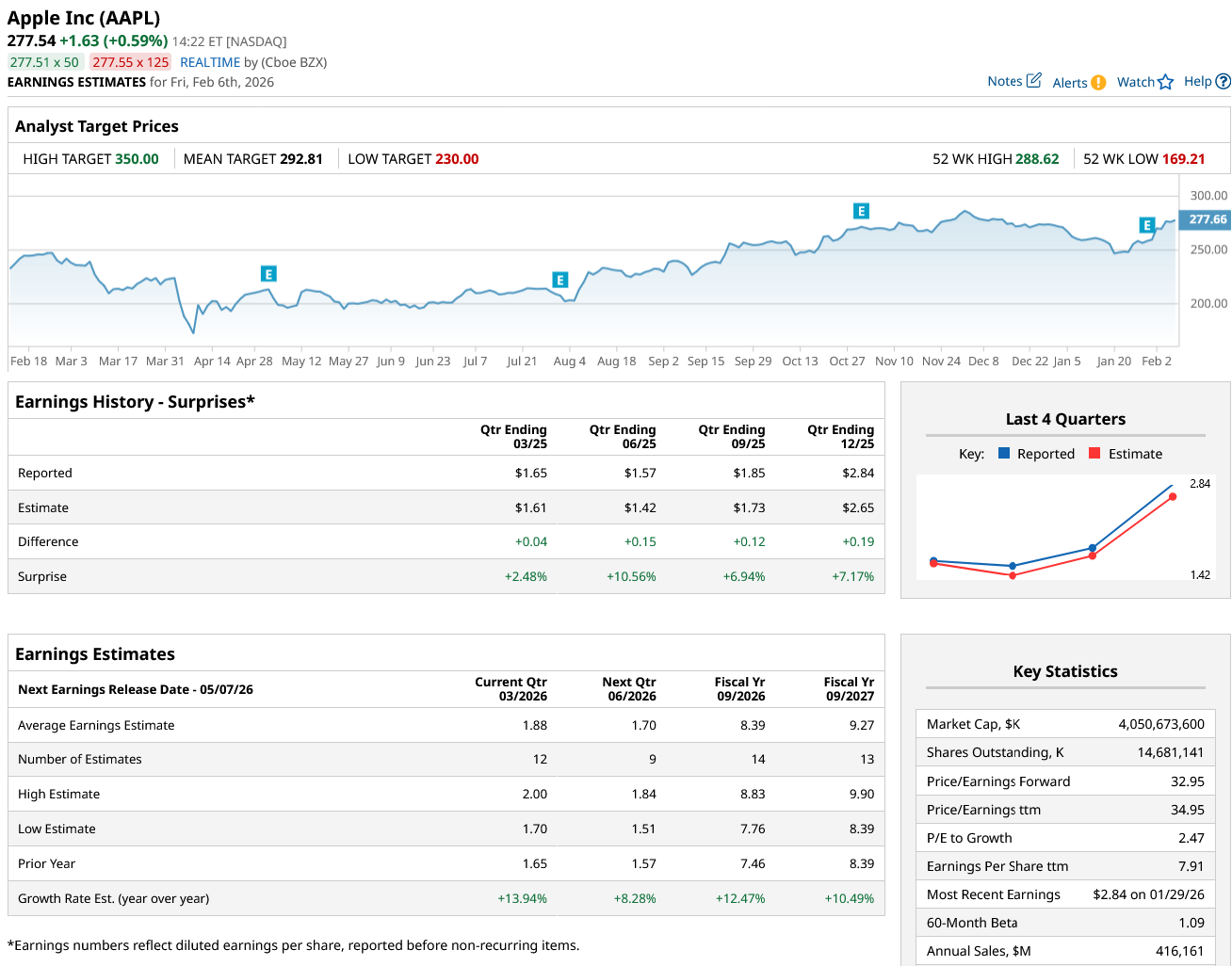

The company’s recent financial performance has also been stellar, led by iPhone, whose demand, CEO Tim Cook aptly said during the fiscal Q1 2026 earnings call, was “simply staggering” in the quarter, with sales rising 23% and hitting records in all geographies. Greater China—which has lately been a challenging market for Apple—reported a 38% rise in revenues thanks to the surge in iPhone sales.

Strong iPhone sales helped Apple report a 16% year-over-year (YoY) rise in its revenues, and it expects its revenues in the current quarter to rise by between 13% and 16%, which is quite healthy as the company hasn’t really been posting double-digit topline growth in recent quarters.

Apple’s Services business continues to do well, with revenues rising 14% YoY in the December quarter to a record high. Apple’s installed base of devices has topped 2.5 billion, which bodes well for the future growth of the company’s Services business.

Despite all the noise over higher memory prices taking a toll on margins, Apple’s fiscal Q1 gross margin came in at 48.2%, which was 100 basis points higher than the sequential quarter and above the top end of the company’s guidance. Apple expects gross margins to remain between 48% and 49% in the current quarter, also. An overall stellar performance drove a 19% YoY rise in Apple’s earnings per share (EPS), and the metric rose to an all-time high of $2.84.

As for AI, Apple has released dozens of Apple Intelligence features, which Cook said are “personal, private, integrated across our platforms and relevant to what our users do every day.” I would emphasize the “private” here, as many users are wary of using AI, given the massive amount of user data it feeds upon, pushing privacy to the backseat.

Notably, while U.S. Big Tech companies are spending on AI as if there’s no tomorrow, Apple has been quite measured in its approach. The company repurchased shares worth $25 billion in the quarter, whereas names like Amazon and Meta Platforms have stopped buybacks amid massive capital needs towards building AI infrastructure.

Apple Could Soon Become the World’s Biggest Company

Apple’s market cap is now slightly below that of Nvidia (NVDA), and it has raced well ahead of Microsoft, whose market cap has fallen to around $3 trillion as the sell-off has shown no signs of abating, even as it looks like a good buy at these price levels.

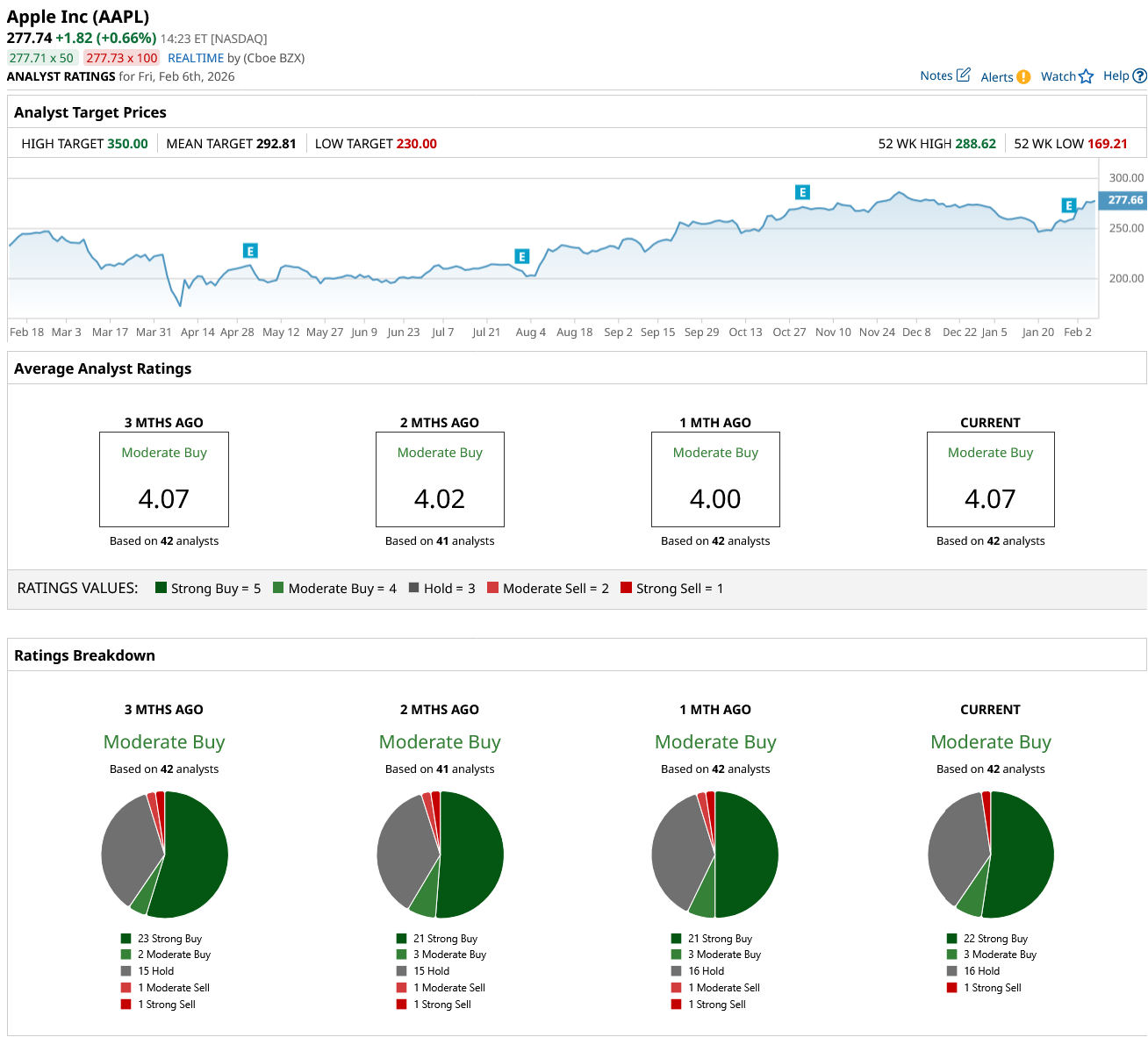

Given markets’ apathy towards tech names whose free cash flows have nosedived as they continue to spend aggressively on AI, Apple might find favor with investors looking for defensive bets. After Apple’s fiscal Q1 2026 earnings release, there were some cursory target price hikes from brokerages, even though there wasn’t any major shift in sentiment, and the iPhone maker is rated as a “buy” or higher by only about 60% of the analysts polled by Barchart. Only Tesla—arguably one of the most, if not the most, polarizing stocks—is rated lower.

All said, at a forward price-to-earnings (P/E) multiple of 32.1x, I don’t see much upside for Apple, at least in the short to medium term. However, while I won’t add more Apple shares, I continue to hold my existing ones as a hedge against the tech selloff.

On the date of publication,

Mohit Oberoi

had a position in: AAPL

, GOOG

, MSFT

, NVDA

, TSLA

. All information and data in this article is solely for informational purposes.

For more information please view the Barchart Disclosure Policy

here.

More news from Barchart

- Should You Buy the Dip in This Oversold Michael Burry Stock?

- Are Medical Device Stocks Flatlining? Where To Look for Signs of Life.

- Palantir May Be ‘Truly Iconic.’ Overvalued, High-Risk PLTR Stock Isn’t.

- Amazon Stock Just Entered Oversold Territory. Should You Buy the Dip?

Search

RECENT PRESS RELEASES

Related Post