Apple Stock Outlook: Is Wall Street Bullish or Bearish?

October 29, 2025

/Apple%20logo%20on%20store%20front%20by%20frantic00%20via%20iStock.jpg)

Apple logo on store front by frantic00 via iStock

Apple Inc. (AAPL), headquartered in Cupertino, California, is experiencing record growth, driven by strong sales of its latest iPhone models and expanding services revenue. The company’s market capitalization is presently very close to the $4 trillion mark ($3.99 trillion to be precise), driven by continual innovation in hardware, software, and artificial intelligence (AI). Apple is also increasing U.S. manufacturing investments as part of its $600 billion commitment, strengthening its supply chain and technological leadership.

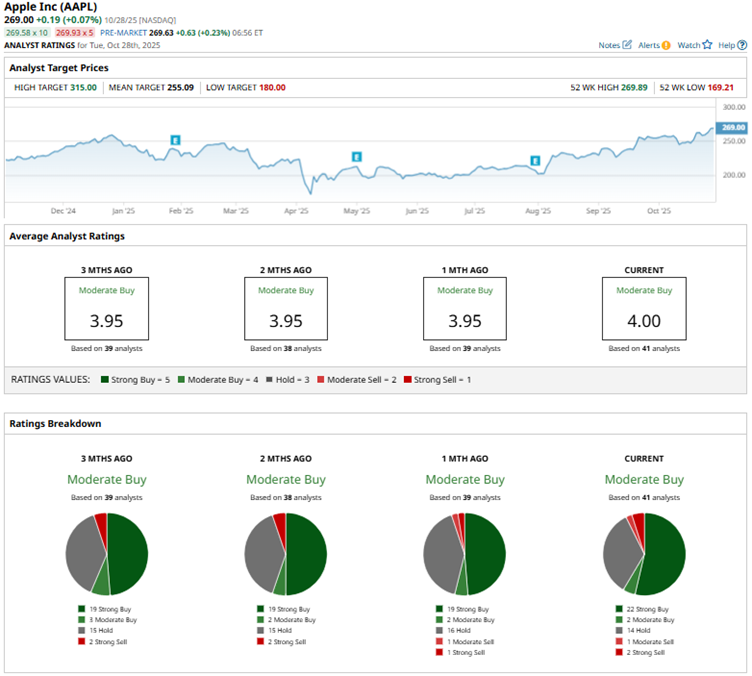

Apple is a Wall Street darling and has coveted this position for a long time. Over the past 52 weeks, the stock has gained 15.3%, while it is up by 7.4% year-to-date (YTD). On Oct. 28, it hit an all-time high of $269.89 and reached a market value of $4 trillion, before closing marginally below that level. This move was driven by the huge popularity of its new iPhones.

Despite these gains, the stock has broadly underperformed the S&P 500 Index ($SPX), which has gained 18.3% over the past 52 weeks and 17.2% YTD. Turning our focus to the company’s own tech sector, we see that the stock has underperformed here as well, while the Technology Select Sector SPDR Fund (XLK) is up 31.2% over the past 52 weeks and 29.9% YTD.

On July 31, Apple reported a stellar third quarter (the quarter that ended on June 28). The company’s revenue grew 9.6% year-over-year (YOY) to $94.04 billion, beating the $89.53 billion Wall Street analysts had expected. Its quarterly EPS was $1.57, up 12.1% YOY and higher than the $1.43 expected.

CEO Tim Cook stated that Apple recorded double-digit growth in iPhone, Mac, and Services, with expansion observed in all segments. Despite this, the stock dropped 2.5% on Aug. 1 amid tariff concerns. Apple reported that it expects to incur about $1.10 billion in tariff costs in Q4.

For the fiscal year to be reported, which ended in September 2025 (set to be reported on Oct. 30 after the market closes), Wall Street analysts expect Apple’s EPS to grow 9% YOY to $7.36 on a diluted basis, and increase by 6.8% to $7.86 in fiscal 2026. The company has a solid history of surpassing consensus estimates, topping them in all four trailing quarters.

Among the 41 Wall Street analysts covering Apple’s stock, the consensus is a “Moderate Buy.” That’s based on 22 “Strong Buy” ratings, two “Moderate Buys,” 14 “Holds,” one “Moderate Sell,” and two “Strong Sell” ratings. The ratings configuration is more bullish than a month ago, with 22 “Strong Buy” ratings now, up from 19 previously.

Post the launch of its new iPhone series, Apple has received some notable price target upgrades. JPMorgan analyst Samik Chatterjee lifted the stock’s price target from $280 to $290, while maintaining an “Overweight” rating on its shares. Baird analyst William Power also raised the price target from $230 to $280, while keeping an “Outperform” rating.

Apple’s mean price target of $255.09 indicates a 5.2% downside over current market prices. However, the Street-high price target of $315 implies a potential upside of 17.1%.

On the date of publication, Anushka Mukherjee did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

Search

RECENT PRESS RELEASES

Related Post