Are Apple Shares Worth the Hype After a 3.7% Surge and AI Buzz?

October 23, 2025

If you have ever found yourself wondering whether now is the right time to invest in Apple or hold onto your shares, you are in good company. Apple’s stock has been on a bit of a roll lately, with last week alone adding an impressive 3.7% to its price and closing most recently at $258.45. Over the past year, the share price is up a healthy 12.5%, and if you zoom out to a five-year horizon, Apple has delivered a staggering 138.9% return. Clearly, the long-term story has rewarded patient investors.

What is driving these moves? Recently, sentiment has been nudged by buzz around Apple’s continued investment in AI initiatives and the possible impact on its future product ecosystem. At the same time, ongoing regulatory discussions have not shaken broader market optimism about Apple’s stable consumer base. These factors are shaping how analysts and investors approach Apple’s valuation and contribute to the wide range of opinions on whether the shares are truly a bargain right now or pricing in a lot of future optimism already.

With so much attention on Apple’s growth potential and evolving risk profile, it is important to look beyond the headlines and dig into the core question: is the stock undervalued right now? According to our objective valuation framework, Apple meets just 1 out of 6 checks for undervaluation. While that does not provide a slam dunk answer, it does set a clear stage for exploring how Apple’s price stacks up across different approaches. Let’s dive into the main methods analysts use to value Apple, and keep reading, since we will wrap up with one perspective we think offers a fresh way to judge if the stock is really worth its current price.

Apple scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Advertisement

Approach 1: Apple Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s fair value by projecting its future cash flows and discounting them back to today’s value. This approach gives investors a sense of what the business is worth based on its actual ability to generate cash over time, instead of just market sentiment.

For Apple, the most recent reported Free Cash Flow stands at $97.1 billion. Analysts project strong growth, forecasting Free Cash Flow to reach about $188.9 billion in 2030. While estimates are grounded for the next five years, future numbers are extrapolated to capture Apple’s potential over a decade. These robust projections highlight confidence in Apple’s ability to generate cash, but also reflect optimistic assumptions about ongoing demand and innovation.

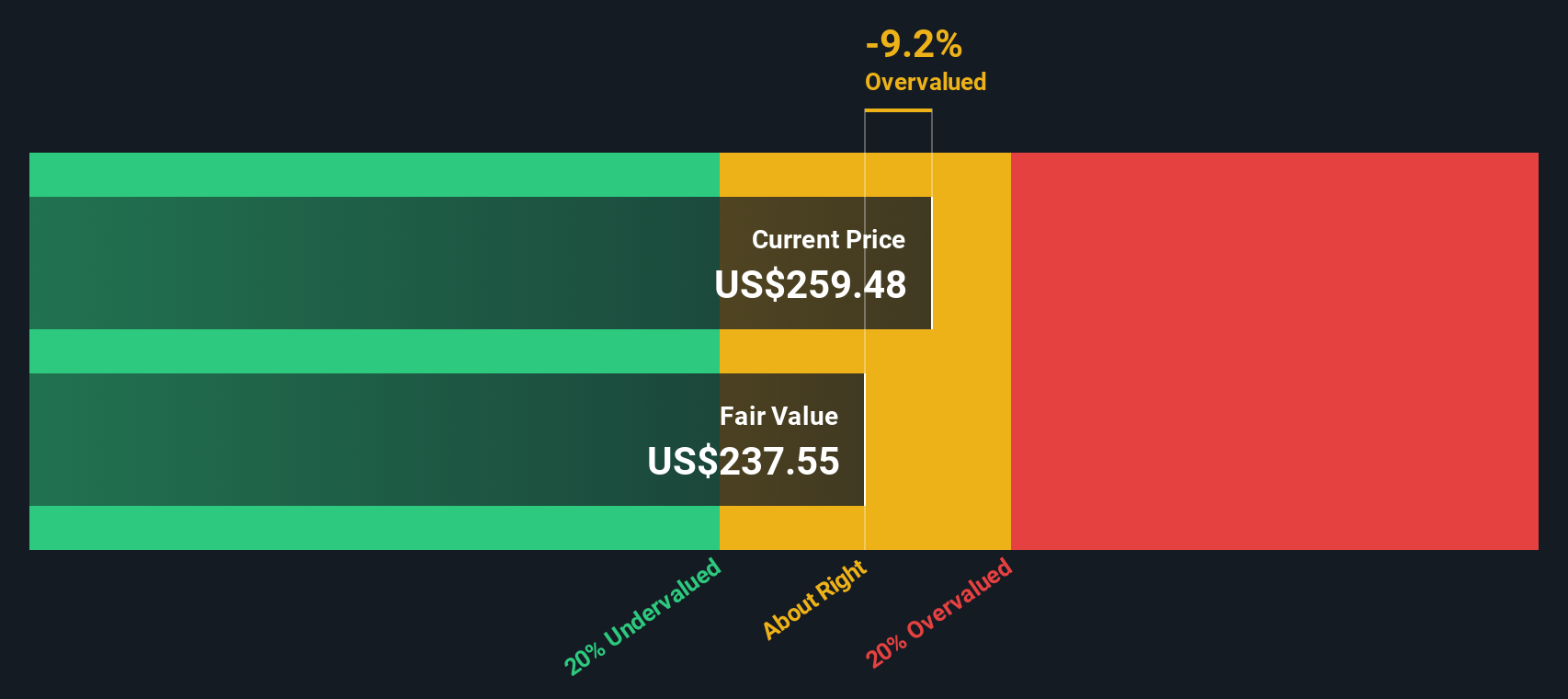

Based on the DCF analysis, Apple’s estimated intrinsic value per share is $219.59. With the current share price at $258.45, this implies that the stock is trading at a 17.7% premium to its fair value using the cash flow forecast.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Apple may be overvalued by 17.7%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Apple Price vs Earnings (PE Ratio)

The Price-to-Earnings (PE) ratio is a widely used metric for evaluating well-established, profitable companies like Apple. The PE ratio reflects how much investors are willing to pay today for each dollar of current earnings, making it especially useful for tech leaders with consistent profitability. Generally, the higher the expected future growth and the lower the risk, the higher a “fair” PE ratio should be.

Currently, Apple trades at a PE ratio of 38.6x. This is above both the technology industry average of 23.9x and the average for its large-cap peers, which sits at 33.9x. At first glance, the premium suggests high market optimism about Apple’s future. However, Simply Wall St’s proprietary “Fair Ratio” model estimates Apple’s fair PE at 42.5x. This model incorporates more than just the raw numbers; it accounts for Apple’s growth prospects, profit margins, size, its industry profile, and potential risks.

Instead of only comparing to peers or the industry, which can miss company-specific drivers, the Fair Ratio approach aims to provide a truer sense of value by considering Apple’s unique overall outlook. With Apple’s current PE ratio of 38.6x only slightly below its Fair Ratio of 42.5x, the stock appears priced about right according to this metric.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Apple Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple yet powerful way to express your personal view of a company by telling the story that connects your assumptions, such as future revenue, profit margins, and fair value, to a clear outlook on whether a stock is a buy or a sell.

Instead of just crunching numbers, Narratives let you articulate the “why” behind them, making your thinking transparent and easier to revisit or revise as the company evolves. On Simply Wall St’s Community page, millions of investors create and share their own Narratives for Apple and other companies, instantly connecting a company’s story to an up-to-date valuation model.

Here’s how it works: with Narratives, your view is transformed into a dynamic financial forecast and a real-time fair value estimate, which updates automatically when new information such as earnings or news comes out. This allows you to instantly see if Apple’s price is above or below your personal fair value, helping you decide if it is time to buy, hold, or sell.

For example, some investors believe Apple’s fair value is far higher, incorporating double-digit revenue growth and predicting a price above $275, while others point to risks and slower growth, estimating fair value as low as $177. Your Narrative can capture whichever perspective you genuinely believe fits Apple’s future.

For Apple, however, we’ll make it really easy for you with previews of two leading Apple Narratives:

Fair Value: $275.00

Current discount to fair value: -6.01%

Expected revenue growth: 12.78%

- Apple is showing resilience despite a 35% share price drop. The company is using tariff exemptions and shifting manufacturing to India and Vietnam to address rising costs.

- Reported Q1 2025 profits beat expectations, and service revenue reached a record level. Analysts maintain a “Moderate Buy” with price targets up to $275, citing AI-driven growth potential.

- Short-term market uncertainty remains, but strategic investments in AI and diversification are positioning Apple for long-term recovery and growth.

Fair Value: $207.71

Current premium to fair value: 24.39%

Expected revenue growth: 6.39%

- Compliance costs from new EU regulations and a weak emerging market strategy could erode margins and limit overall sales growth.

- Heavy reliance on Google service revenue faces regulatory risks, and high iPhone prices hinder significant gains in India and South America.

- Investments in new technology such as Vision Pro and US-based manufacturing could increase R&D costs and introduce additional uncertainty for future profits.

Do you think there’s more to the story for Apple? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Search

RECENT PRESS RELEASES

Related Post