Are Ethereum Whales A Major Threat for Its Price?

April 18, 2025

Ethereum (ETH) continues to struggle below the $2,000 mark, a level it hasn’t reclaimed since March 28, as bearish momentum lingers across both technical and on-chain indicators. Despite attempts to stabilize, recent data reveals rising concentration of ETH among whale wallets, alongside persistent weakness in trend indicators like EMA lines.

At the same time, retail and mid-sized holders are gradually losing share, further skewing ownership toward large players. This combination of declining retail participation and heavy whale dominance may leave ETH increasingly vulnerable to sharp corrections if sentiment turns.

The amount of ETH held by whale addresses—wallets controlling more than 1% of the total circulating supply—has reached its highest level since 2015, sitting at 46%.

This marks a significant shift in Ethereum’s ownership data, as whales surpassed the holdings of retail investors back on March 10 and have continued to grow their share since. In comparison, investor-level addresses, which hold between 0.1% and 1% of supply, and retail wallets, which hold less than 0.1%, have both seen declines in their share of ETH.

The jump from 43% to 46% in just a few months reflects a sharp accumulation trend among the largest holders, suggesting a growing concentration of ETH in fewer hands.

Whales typically represent institutional investors, funds, or early adopters, and their behavior can significantly impact price due to the volume they control. Investor-level addresses often reflect high-net-worth individuals or smaller institutions, while retail addresses include everyday traders and holders.

While some might see the rise in whale holdings as a vote of confidence, it also increases the risk of sudden volatility if large holders begin offloading.

With retail and investor participation shrinking, the market may become more fragile and vulnerable to sharp, unexpected price movements driven by a few dominant players.

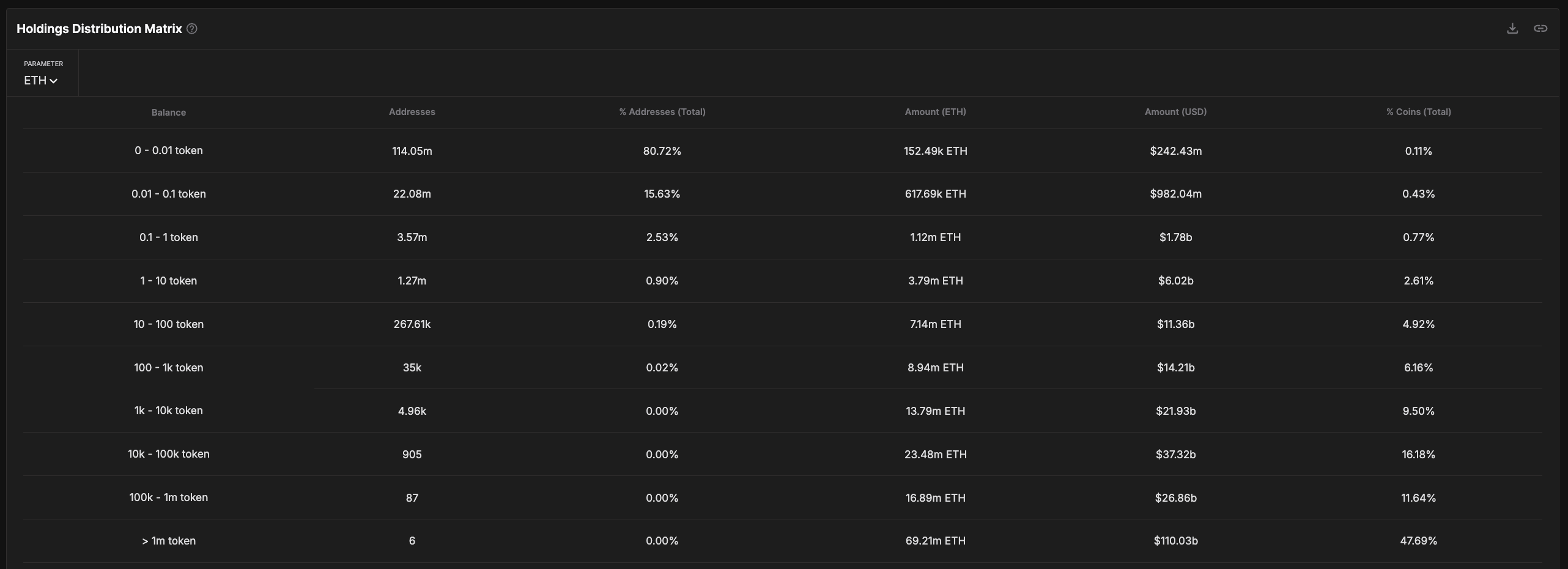

Analyzing the ETH Holdings Distribution Matrix reveals concerning signs of deepening concentration.

When excluding addresses with over 100,000 ETH—typically linked to centralized exchanges—whale addresses holding between 1,000 and 100,000 ETH now control roughly $59 billion in ETH, representing around 25.5% of the circulating supply.

This group has steadily accumulated more of the network’s supply, reinforcing a power shift toward large entities operating outside of exchanges but still commanding immense influence over the market. Recently, Galaxy Digital moved $100 million in Ethereum, raising questions about whether it was a strategic shift or a sell-off signal.

While some might interpret this trend as strategic positioning by confident holders, it also exposes Ethereum to significant downside risk.

With over a quarter of supply concentrated in the hands of these whales, any coordinated or panic-driven selling could trigger sharp price drops, especially in an environment with weakening retail participation.

Rather than a sign of long-term stability, this level of concentration may make the ETH market increasingly fragile and prone to volatility if these holders start to rotate their capital to other assets.

Ethereum’s EMA lines continue to flash bearish signals, with short-term averages still positioned below the long-term ones—indicating downward momentum remains in play.

If a new correction happens, Ethereum could first test support at $1,535. A breakdown below that level opens the door to deeper declines toward $1,412 or even $1,385.

Should these supports also fail to hold, Ethereum would edge dangerously close to the $1,000 mark, a level some analysts have flagged as a potential downside target in the event of an extended market correction.

Still, a bullish reversal is not entirely out of the question. If buying pressure returns and Ethereum reclaims short-term momentum, it could test the resistance level at $1,669.

A breakout above that would be a significant technical signal, potentially pushing Ethereum price toward $1,749 and even $1,954.

However, with EMAs still tilted to the downside, the burden remains on bulls to prove that momentum has shifted decisively in their favor.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Search

RECENT PRESS RELEASES

Related Post