Are we in an AI bubble? How to protect your portfolio if your AI investments turn against

November 21, 2025

Despite stellar earnings reports from Nvidia (NVDA) this week and record returns of tech stocks related to artificial intelligence so far this year, there is still a lot of hand-wringing about a possible AI bubble.

The 70 stocks that comprise the Global X Artificial Intelligence & Technology ETF (AIQ) have lost $2.4 trillion in value since Oct. 29, according to an Investor’s Business Daily analysis.

The November 2025 Bank of America Global Fund Manager Survey reported 45% of respondents believe an AI equity bubble is the most significant current market risk. More than half of the money managers believed AI stocks are already in bubble territory.

Are we approaching an AI bubble? And if that’s uncertain, how do you protect your portfolio if your AI investments turn against you?

Read more: Thinking of buying Nvidia stock? Consider buying others just like it.

Past failures often haunt stock market investors. The dot-com bust of the late 1990s and early 2000s is a recurring nightmare for some. Are we approaching a similar stock market cliff? Two noted analysts disagree.

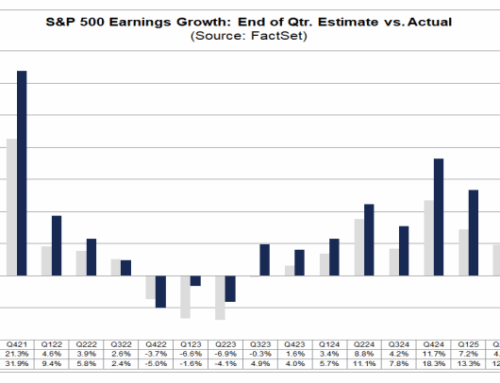

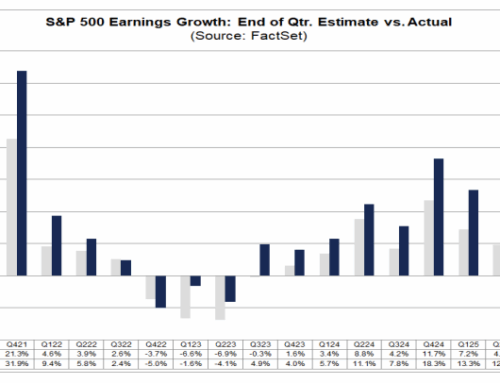

Carolyn Barnette, head of market and portfolio insights at BlackRock, doesn’t see the symptoms of a dot-com crash. Today’s AI investments are “a fundamentally different landscape — one supported by real profitability, disciplined capital allocation, and broad-based adoption,” she wrote in a report to advisors last week.

“Unlike the speculative frenzy of the late 1990s and early 2000s, today’s technology leaders are anchored by fundamental stability. Strong profitability, steady cash generation, and healthy balance sheets provide a foundation for continued investment and growth,” Barnette wrote in the analysis.

Barnette notes that, unlike the dot-coms, AI capital investments are being funded by earnings and cash rather than debt.

“This self-financing makes the sector more resilient to higher interest rates and less vulnerable to liquidity shocks. Many companies are investing from a position of strength, not speculation,” Barnette wrote.

Yet, many experts with their own charts disagree, saying we are in an AI investment bubble.

One is Apollo Global Management chief economist Torsten Sløk.

“The difference between the IT bubble in the 1990s and the AI bubble today is that the top 10 companies in the S&P 500 today are more overvalued than they were in the 1990s,” Sløk wrote in a July analysis.

Sløk believes the overheated AI sector was born out of the zero-interest-rate environment before March 2022. When the Federal Reserve began raising interest rates, tech companies stopped hiring, borrowing costs rose, and investor risk appetites diminished.

“The bottom line is that the bubble in AI valuations was simply the result of a long period with zero interest rates,” Sløk wrote in May. “With upward pressures on inflation coming from tariffs, deglobalization, and demographics, interest rates will remain high and continue to be a headwind to tech and growth for the coming years.” (Disclosure: Yahoo Finance is owned by Apollo Global Management.)

Read more: Create a stock investing strategy in 3 steps

If the experts disagree, perhaps it’s best to prepare for both AI scenarios: boom and bubble.

Kevin Gordon, Schwab’s senior investment strategist, said investors should first determine what kind of AI investments they hold.

“I think one of the ways to hedge and diversify around [the risk] is actually thinking about the difference and the important distinction between the AI creators and the AI adopters,” Gordon said in a Schwab video released in September. “So much of the focus over the past couple of years has been on the creators. We’ve spent a lot of time thinking about who are the ‘adopters’ and who could benefit from the technology.”

He believes adopters are going to become a critical next leg of the investment cycle for industries that don’t have the ability to be an AI creator. Consider diversifying your portfolio with those who benefit from the technology rather than those who create it.

Gordon also believes investors should periodically revisit their investment time horizon and risk tolerance. When will you begin tapping your investments for cash, and are your investments built for that inevitability?

“I think this is one of those moments where you need to look at your portfolio to see where those align,” Gordon said.

The UBS chief investment office recommends international exposure, high-grade bonds, and gold to protect a portfolio.

“We think the equity bull market has further room to run, and have reiterated that an easing Federal Reserve, durable earnings growth, and AI investment spending support our attractive view on US equities. But we also believe investors should diversify their portfolios beyond US equities,” UBS said in a note to clients.

UBS highlighted three “appealing opportunities”:

-

China’s tech sector and Japanese equities: “We particularly like China’s tech sector as we believe Beijing’s push for tech self-sufficiency and innovation creates a foundation for the rally to continue.”

-

Quality bonds: “We would expect quality bonds to rally in the event of fears about the health of the US economy or the durability of the AI rally. With yields still at relatively elevated levels, the risk-return profile for quality bonds is appealing.”

-

Gold: “Gold remains an effective portfolio diversifier and hedge against political and economic risks, and we view this week’s sell-off as a healthy consolidation. While volatility is likely to persist in the near term, lower real interest rates, a weaker US dollar, and concerns over government debt or geopolitical uncertainty should continue to boost demand for bullion.”

Read more: How to invest in gold in 4 steps

Search

RECENT PRESS RELEASES

Related Post