As Apple Turns the Corner With the iPhone 17, Should You Buy AAPL Stock for 2026?

October 31, 2025

The earnings season for the “Magnificent 7” essentially wrapped up yesterday, Oct. 30, as Nvidia (NVDA) reports outside of the usual season. Both Apple (AAPL) and Amazon (AMZN) are up in today’s price action, but the former’s rise is quite muted compared to the e-commerce giant, whose shares are up in double digits.

In my pre-earnings analysis, I had noted that Amazon might see a post-earnings bump given the tepid valuations and YTD underperformance. As for Apple, I had noted that the stock might not see a major rally, given that much of the good news related to the iPhone 17 was already priced into the stock.

That said, Apple’s fiscal Q4 2025 performance and guidance for the current quarter were slightly stronger than what I had anticipated. In this article, we’ll examine whether the stock is a buy for 2026 as the Cupertino-based company seems to be turning the corner with its iPhone 17 lineup. Let’s begin with a brief overview of Apple’s Q4 earnings and fiscal Q1 guidance.

Fiscal Q4 Was a Record Quarter for Apple

The word “record” was used over three dozen times during Apple’s Q4 earnings. The company’s revenues and earnings per share (EPS) were a record high for the September quarter, while it set an all-time revenue record for iPhone and Services, with the latter delivering stellar 15% year-over-year growth. The company’s installed base of devices, which acts as a flywheel for the services business, also rose to an all-time high in the quarter.

While iPhone sales grew less-than-expected in the quarter, which the company said was due to supply constraints, it guided for sales to rise in double digits in the current quarter. The Q1 guide was well ahead of estimates, and management expressed optimism over returning to growth in China, a market where it is facing intense competitive pressure from homegrown brands like Huawei.

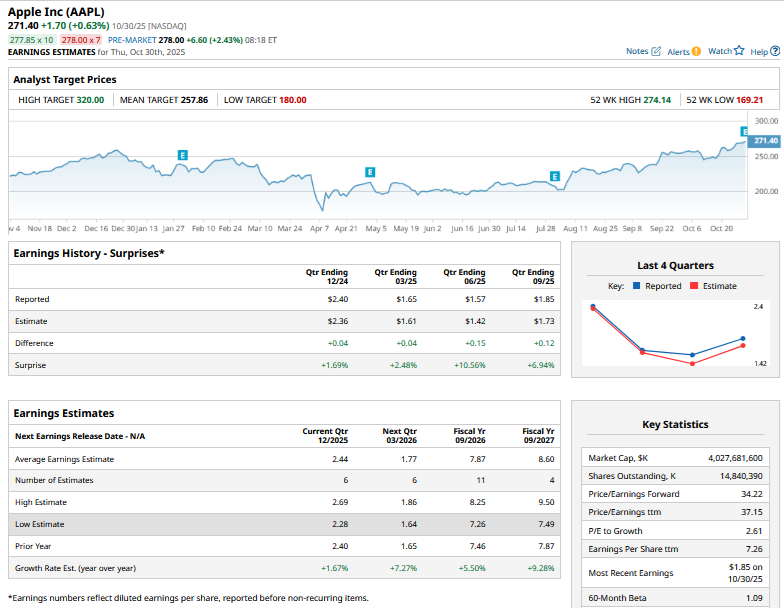

One of the key highlights of Apple’s Q4 earnings was the gross margin, which came in at 47.2% versus the 46% to 47% that the company had guided for. For the current quarter, the company guided for gross margins to be between 47% to 48% after accounting for a $1.4 billion hit from the tariffs.

Apple Stock Forecast After Q4 Earnings

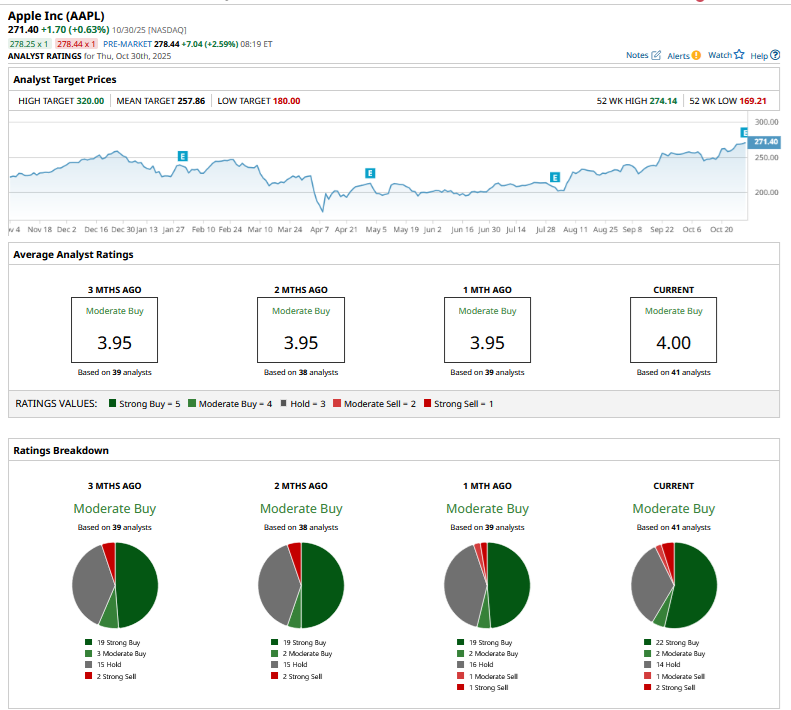

While Apple has had a love-hate relationship with sell-side analysts for the last couple of years, brokerages were quite impressed with its Q4 earnings, and several raised the stock’s target price. Goldman Sachs, for instance, raised its target from $279 to $320 as it sees a “multi-year upgrade cycle” for iPhones. Among other brokerages, Evercore ISI and Baird raised the target price to $300 while TD Cowen raised its target by $50 to $325, which is the Street-high target price at the time of writing.

Why Apple Stock Looks Like a Good Buy

I believe, after underperforming Big Tech peers in 2025, Apple is now setting the stage for a comeback. Here’s why I believe Apple’s rally might continue.

- iPhone Sales Have Revived: Apple’s growth has revived, led by a surge in iPhone 17 sales. For the last many quarters, Apple was plagued by sluggish top-line growth, but things have now started looking up. The long-awaited iPhone replacement cycle finally seems to be gaining traction, which would gain further momentum from the iPhone 17.

- Growth in China and Other Emerging Markets: Apple expects its China business to return to growth in the December quarter, which is an encouraging sign given the challenges the U.S. tech giant has faced in that country. The company is also witnessing a surge in sales in emerging markets, particularly India. Growth in emerging markets will help Apple increase its installed device base, as many buyers in these regions are new to the Apple ecosystem.

- Gross Margin Expansion: Apple’s gross margins have expanded despite the hit from tariffs. The margins might stay strong next year also, as the contribution from the high-margin Services business continues to rise.

- Apple Has Raised the Game in AI: Long seen as a laggard in artificial intelligence (AI), Apple has raised its game, and the much-delayed personalized Siri is set to debut next year. Apple has also been adding new “Apple Intelligence” features, and per CEO Tim Cook, going forward, these will become a “greater factor” in driving iPhone demand.

All said, while I still don’t find Apple a table-thumping buy given its rich valuations, I believe the stock’s rally still has some heat left, and it looks like a reasonable buy for 2026.

On the date of publication,

Mohit Oberoi

had a position in: AAPL

, AMZN

, NVDA

. All information and data in this article is solely for informational purposes.

For more information please view the Barchart Disclosure Policy

here.

More news from Barchart

- 3 Options Strategies. 3 Unusually Active Options. 3 Long-Term Stocks to Buy.

- Amazon Stock Popped on Earnings. Options Data Tells Us AMZN Could Be Headed Here Next.

- Tesla’s New Focus Isn’t on Cars, But on ‘Sustainable Abundance.’ What Does That Mean for TSLA Stock and Buy-and-Hold Investors?

- Amazon’s Revenue Beat Surprises Analysts and Its Cash Flow Surges (Not FCF) – AMZN Stock Could Still Be Undervalued

Search

RECENT PRESS RELEASES

Related Post