As Bitcoin Hits Record High, UK Investors Gain Access to Crypto ETNs

October 8, 2025

Key Takeaways

- Four-year ban on cryptocurrency exchange-traded notes lifted for UK retail investors.

- Latest data shows net inflows of EUR 972 million in Q3, a new quarterly high.

- Decision on holding crypto ETNs in ISAs expected by year-end.

UK retail investors will be able to invest in cryptocurrency exchange-traded notes from today after the financial regulator lifted a four-year ban on the sale and distribution of these products.

The move coincides with the price of bitcoin hitting a new all-time high on Oct. 6 as well as record European demand for crypto exchange-traded products in the third quarter of 2025.

In January 2021 the UK’s Financial Conduct Authority imposed a ban on the sale of crypto ETNs, citing concerns over poor investor understanding of cryptoassets, price volatility and opaque valuation methods.

“The Financial Conduct Authority will reverse its stance on allowing crypto ETNs to be sold to retail investors. This marks another step in crypto’s long journey into the financial mainstream. However, just because the FCA permits these products does not mean they are suitable for most investors,” says Madeleine Black, associate analyst, manager research at Morningstar.

“Crypto’s extreme price volatility often fuels overtrading and gambling-like behavior, which has historically led to poor investor outcomes. Sensible investors should only consider crypto exposure if they adopt a long-term horizon and keep it as a small allocation within a broadly diversified portfolio.”

Why Are UK Investors Now Allowed to Access Crypto Assets?

The FCA’s stance on direct cryptocurrency investment remains the same as it has for many years: The asset class is highly volatile, vulnerable to scams and could lead to investors losing all of their money.

Still, lifting the four-year ban “reflects the increased maturity and prevalence of crypto ETNs”, Black says.

“The regulator also aims to expand retail investor choice while maintaining appropriate safeguards,” she adds.

Offering crypto ETNs aligns UK retail investor access with that of professional investors, moving bitcoin and ether into liquid, regulated exchanges. UK investors can already access cryptocurrencies indirectly via global platforms like Coinbase and Binance, but UK investors have none of consumer protection offered to those buying and selling shares, funds and investment trusts. Direct access is available via hardware or software wallets.

What Are the Rules on Buying Crypto ETNs?

Professional investors were able to buy crypto ETNs in May 2024 and this access is being widened to retail investors, providing the ETNs are traded on a regulated, recognized exchange like the London Stock Exchange.

Black says that the FCA still restricts retail access to cryptoasset derivatives, which provide leveraged price exposure to an asset.

ETFs typically hold the underlying securities in an index such as stocks and bonds and are subject to tracking error, in that their price can diverge from the performance of the index. ETNs are debt securities that track the underlying price of assets, expose investors to credit risks but have no tracking error

What Are the Pros and Cons of Owning Crypto Through ETNs?

Black lays out multiple pros and cons of owning the asset class through ETNs.

Advantages

- Easy to buy and monitor via a brokerage account.

- Minimized counterparty risk as custodians are regulated.

- Avoids the risks of direct ownership.

- Fees for ETNs are more transparent than investing via platforms.

Disadvantages

- Indirect access: some investors prefer to hold cryptocurrency assets separate from the regulated financial system.

- Most ETNs have regular and ongoing management fees, which can mount up over time.

Can I Buy a Crypto ETF in the UK?

Unlike in the US, UK investors can’t yet buy cryptocurrency exchange-traded funds, which are different from exchange-traded notes.

Morningstar’s Black says the next watershed moment for the crypto asset class will be the ability to hold it in an Individual Savings Account. The FCA is still consulting on allowing crypto ETNs within ISAs, with a decision due in the coming months.

“The real catalyst for mass adoption in the UK may be the possible approval of crypto ETNs within ISAs later this year. The tax advantages of such a change could prove far more influential in driving uptake,” she says.

European Investors Flock to Crypto

Investors in continental Europe have already been able to buy cryptocurrency exchange-traded products or ETPs for a number of years, depending on their location.

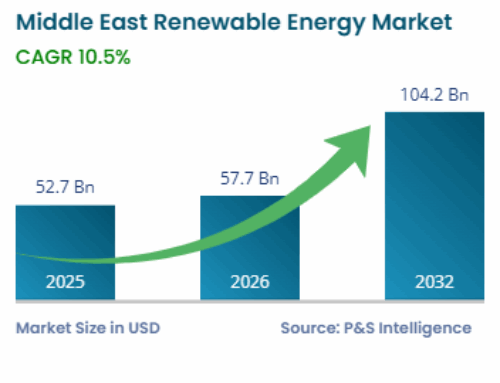

The FCA’s UK move coincides with the latest data showing net inflows into ETPs reaching EUR 972 million in Q3, a new quarterly high, according to Morningstar data.

In 2025, total flows were EUR 1.7 billion, which tees up a likely annual record for this product. Total assets were EUR 19.3 billion at the close of the third quarter, up from EUR 16.7 billion in 2024 and EUR 7.9 billion in 2023.

The crypto ETP market in Europe has more than doubled in the past two years in Europe.

CoinShares, 21Shares, and WisdomTree were the leading providers of Europe-domiciled crypto ETPs by assets under management.

Bitcoin remains the top coin in the cryptocurrency space, Black adds.

“Bitcoin’s dominance as the primary cryptoasset is clear in the European crypto ETP market, where single-asset bitcoin products represent nearly half of total assets under management.”

This article was taken from a Morningstar report Crypto ETPs in Europe, published in October and written by Madeleine Black, associate analyst, manager research.

The author or authors do not own shares in any securities mentioned in this article. Find out about

Morningstar’s editorial policies.

Search

RECENT PRESS RELEASES

Related Post