Assessing Amazon (AMZN) Valuation After Reporting US$691.3b Revenue And US$76.5b Net Incom

January 30, 2026

Amazon.com (AMZN) continues to attract attention after posting annual revenue of US$691.3b and net income of US$76.5b, prompting investors to reassess how its current share price lines up with these fundamentals.

See our latest analysis for Amazon.com.

At a share price of US$241.73, Amazon.com has posted a 6.72% year to date share price return. Its 3 year total shareholder return of 114.09% contrasts with a more modest 3.02% total shareholder return over the past year, hinting that earlier momentum has cooled recently.

If strong results at a large tech name have caught your eye, this can be a moment to scan for other growth stories across high growth tech and AI stocks.

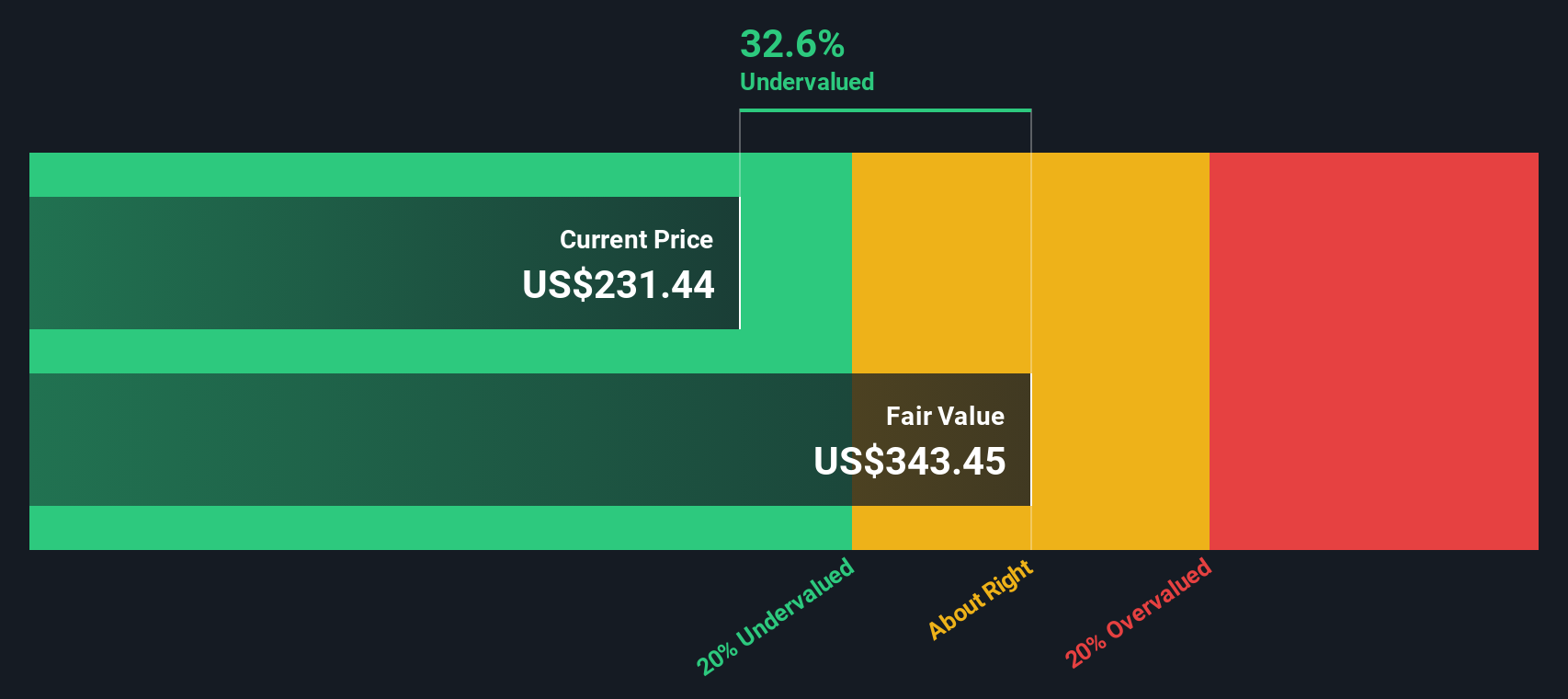

With US$691.3b in revenue, US$76.5b in net income and a recent share price that has cooled compared to its 3 year run, is Amazon.com undervalued today, or is the market already pricing in its future growth?

Advertisement

Most Popular Narrative: 46.3% Undervalued

At a last close of $241.73 versus a narrative fair value of $450, the most followed thesis on Amazon.com argues that current pricing does not reflect its full earnings potential.

Amazon is sacrificing short-term margins to secure long-duration dominance in AI infrastructure, advertising, and automated commerce. These investments are already working, and margins are positioned to inflect upward by the end of 2026.

Curious what kind of revenue mix and margin profile could support a $450 fair value, and how long that earnings ramp is assumed to run? The narrative leans heavily on compounding operating income from cloud, advertising, and a more efficient retail engine, plus a profit multiple usually reserved for premium growth names. If you want to see exactly how those levers combine to justify that price, the full breakdown is where the numbers start to get interesting.

Result: Fair Value of $450 (UNDERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, this depends on heavy AI and infrastructure spending paying off as expected, and on AWS and advertising sustaining their roles as key profit engines.

Find out about the key risks to this Amazon.com narrative.

Another Lens On Value

Our DCF model points to a fair value of $411.49 per share, which is higher than the current price of $241.73 and implies Amazon.com is undervalued. This result differs from the $450 narrative fair value. Which set of assumptions do you think is more realistic?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Amazon.com Narrative

If you see the assumptions differently or simply prefer to test the numbers yourself, you can build a custom thesis in just a few minutes: Do it your way

A great starting point for your Amazon.com research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you are serious about building a stronger portfolio, do not stop with one stock. Use focused screeners to quickly surface other opportunities that fit your approach.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Search

RECENT PRESS RELEASES

Related Post