Assessing American Bitcoin (ABTC) Valuation After Recent Unexplained Share Price Moves

September 21, 2025

American Bitcoin (ABTC) is once again turning heads among investors as its stock showed unexpected movement lately. There was no single headline or breaking news event to explain the shift. When a stock makes a noticeable move without a clear external catalyst, it tends to spark curiosity, debate, and plenty of armchair analysis. For anyone holding shares or considering jumping in, that unexplained action can feel like either a warning signal or an early opportunity.

Looking back over the year, American Bitcoin’s performance has been underwhelming, sliding around 12% year to date. The stock has faced a nearly 5% dip in the past day alone and dropped 10% over the past week, hinting that momentum is slipping rather than building. With no standout events or dramatic revenue shifts to point to in recent months, volatility appears driven mainly by changes in investor sentiment rather than any visible shift in fundamentals.

So with American Bitcoin trending lower and no fresh news to steer the narrative, is this a rare value opportunity, or is the market simply preparing for slower growth ahead?

Advertisement

Price-to-Earnings of 39.8x: Is it justified?

American Bitcoin currently trades at a price-to-earnings (P/E) ratio of 39.8x, which makes it appear expensive compared to both its peer group and industry averages.

The price-to-earnings ratio is a widely used valuation metric, showing how much investors are willing to pay for each dollar of the company’s earnings. In the software sector, this ratio is closely watched, as it often reflects expectations for future growth and profitability.

However, with American Bitcoin’s P/E at 39.8x, which is substantially higher than the peer average of 14.6x and also exceeds the US Software industry average of 36.3x, the stock looks richly valued relative to its competitors. This suggests the market may be pricing in optimistic expectations for future performance, which current fundamentals do not clearly support.

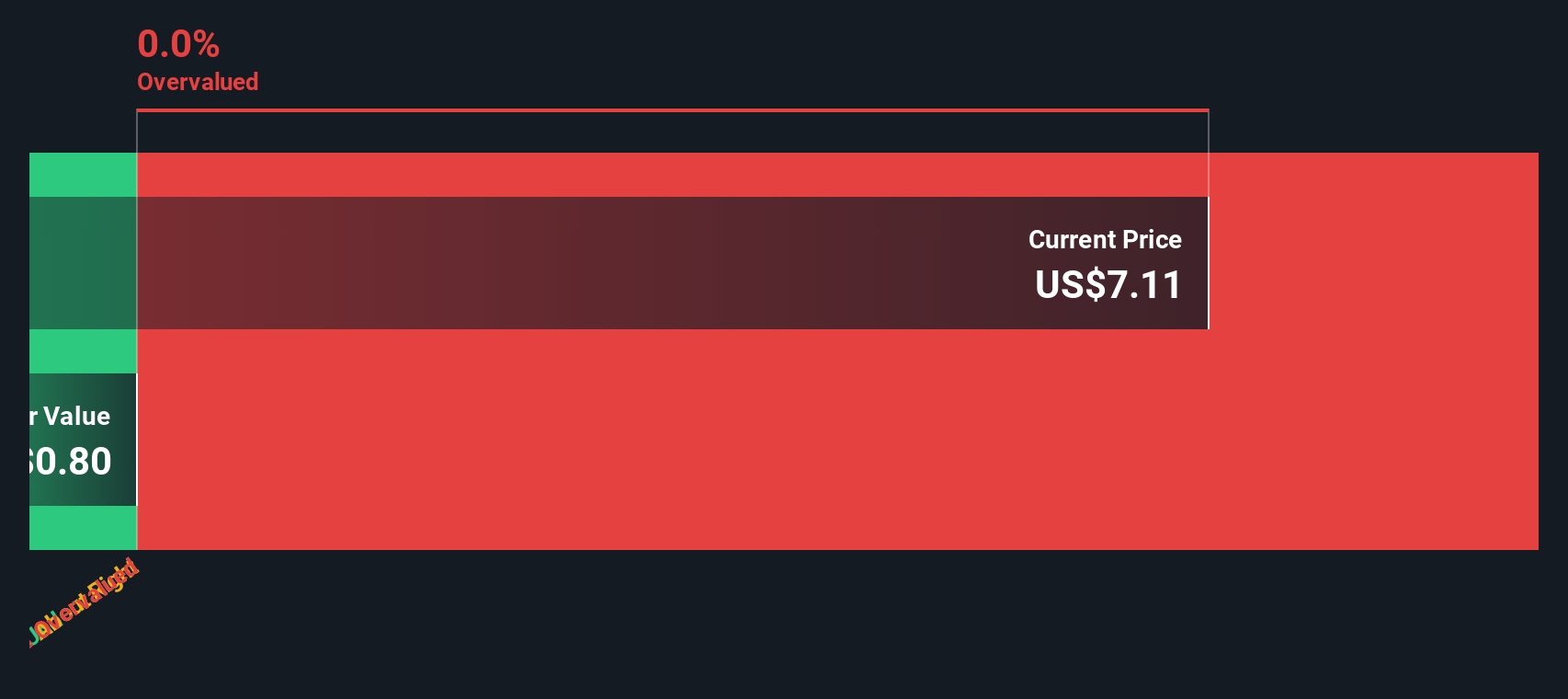

Result: Fair Value of $7.11 (OVERVALUED)

See our latest analysis for American Bitcoin.

However, unexpected regulatory shifts or a sudden drop in cryptocurrency prices could quickly undermine the market’s optimism regarding the valuation of American Bitcoin.

Find out about the key risks to this American Bitcoin narrative.

Another View: What Does the SWS DCF Model Say?

Taking a different approach, the SWS DCF model attempts to value American Bitcoin based on future expected cash flows. This time, it could not produce a clear result due to insufficient data, leaving room for plenty of debate. What does this uncertainty suggest about the stock’s true value?

Look into how the SWS DCF model arrives at its fair value.

Stay updated when valuation signals shift by adding American Bitcoin to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own American Bitcoin Narrative

If you see things differently or want to dig deeper into the numbers yourself, you can quickly build your own perspective in just a few minutes with our tools. Do it your way.

A great starting point for your American Bitcoin research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t settle for yesterday’s trends. Unlock fresh opportunities with powerful tools that put you ahead. See where smart capital is flowing and get inspired to take action.

- Tap into potential high returns by exploring penny stocks with strong financials, where financially solid small-caps could be your next big win.

- Accelerate your portfolio with exposure to next-generation medical breakthroughs. Start with our collection of healthcare AI stocks.

- Grow your income stream with reliable picks offering attractive payouts. Find them efficiently with our dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Search

RECENT PRESS RELEASES

Related Post