Assessing Meta After Its AI Infrastructure Push and 466% Three Year Share Price Surge

December 16, 2025

-

If you are wondering whether Meta Platforms is still a smart buy after its huge run up, or if you are late to the party, you are in the right place to unpack what the current share price really implies.

-

Despite a small pullback of 3.4% over the last week, the stock is still up 5.7% over 30 days, 7.5% year to date, 3.4% over 1 year, 466.2% over 3 years, and 137.6% over 5 years.

-

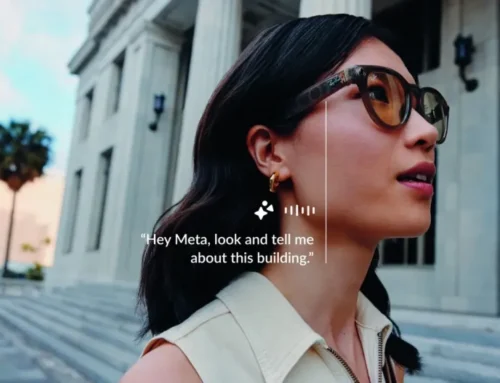

Recent headlines have focused on Meta doubling down on AI infrastructure, expanding its Reels and advertising tools across Facebook and Instagram, and continuing to invest in its Reality Labs and metaverse initiatives. These developments all shape how investors think about its long term growth prospects. At the same time, regulators and policymakers are closely monitoring data privacy, content moderation, and competition, which adds a layer of risk that markets are constantly repricing.

-

Right now, Meta scores a strong 5/6 on our valuation checks, suggesting the market might still be underestimating parts of the story. Next, we will break down what different valuation methods say about the stock before finishing with a more intuitive way to think about its fair value.

Find out why Meta Platforms’s 3.4% return over the last year is lagging behind its peers.

A Discounted Cash Flow model estimates what a company is worth today by projecting its future cash flows and then discounting them back to the present.

For Meta Platforms, the latest twelve month Free Cash Flow is about $58.8 billion. Analysts and internal estimates project this to rise steadily over the coming decade, reaching roughly $162.0 billion by 2035, based on a two stage Free Cash Flow to Equity framework that blends analyst forecasts with Simply Wall St extrapolations.

When all those projected cash flows are discounted back to today, the intrinsic value comes out at around $841 per share. That implies the stock is trading at about a 23.4% discount to this estimate, suggesting the market is still pricing Meta cautiously despite its strong cash generation and growth profile.

On this view, Meta appears meaningfully undervalued rather than fully priced.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Meta Platforms is undervalued by 23.4%. Track this in your watchlist or portfolio, or discover 911 more undervalued stocks based on cash flows.

For a mature, highly profitable business like Meta, the price to earnings ratio is a useful way to judge whether the market is paying a reasonable price for each dollar of current profits. Investors are generally willing to pay a higher PE for companies with stronger growth prospects and lower perceived risk, while slower growing or riskier businesses tend to trade at lower multiples.

Meta currently trades on a PE of about 27.7x. That is higher than the broader Interactive Media and Services industry average of around 17.4x, but below the peer group average of roughly 35.6x. To refine this comparison, Simply Wall St estimates a Fair Ratio of about 37.1x for Meta, which reflects what its PE might be given its earnings growth outlook, profitability, size, industry position, and risk profile. This company specific Fair Ratio is more informative than a simple peer or industry comparison because it adjusts for Meta’s particular strengths and risk factors.

With the current PE of 27.7x sitting well below the 37.1x Fair Ratio, the multiple based view suggests Meta’s earnings are still being priced conservatively.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1446 companies where insiders are betting big on explosive growth.

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of a company’s story with the numbers behind its future revenue, earnings, margins, and fair value, all within the Community page on Simply Wall St, where millions of investors already share their perspectives.

A Narrative starts with your thesis about Meta Platforms, links that story to a set of forecasts, and then turns those forecasts into an explicit fair value that you can continuously compare to the current share price to help you assess whether it looks like a buy, a hold, or a sell at any moment.

Because Narratives are updated dynamically as new information such as earnings, AI investment plans, or regulatory news comes in, they stay aligned with reality rather than becoming a static snapshot that quickly goes out of date.

For example, one Meta Narrative on Simply Wall St might assume strong AI driven growth, premium margins, and a fair value closer to the higher analyst target range near $1,086. In contrast, a more cautious Narrative might focus on heavy AI capex, metaverse uncertainty, and regulatory risks, landing nearer the lower target around $658. That spread helps you see where your own view sits on the spectrum before you act.

For Meta Platforms, we will make it really easy for you with previews of two leading Meta Platforms Narratives:

🐂 Meta Platforms Bull Case

Fair value: $841.42 per share

Implied undervaluation vs current price: 23.5%

Forecast annual revenue growth: 16.45%

-

AI driven ad targeting, content recommendations, and new ad formats are expected to lift conversions, engagement, and advertiser ROI across Facebook, Instagram, and messaging.

-

Meta’s scale, ecosystem advantages, and growing monetization of WhatsApp and Messenger are projected to support durable revenue growth even as margins normalize from current highs.

-

Heavy AI and metaverse investment raises near term cost and regulatory risks, but analysts still see meaningful upside from today’s price if revenue and earnings track current forecasts.

🐻 Meta Platforms Bear Case

Fair value: $538.09 per share

Implied overvaluation vs current price: 19.8%

Forecast annual revenue growth: 10.5%

-

The narrative expects Meta to remain a social media and advertising leader, but sees Reality Labs, AR or VR, and metaverse bets as expensive, uncertain, and slow to monetize.

-

Even with user and ARPU growth, high capex on AI infrastructure and metaverse projects, plus execution and regulatory risks, could keep margins and free cash flow below optimistic scenarios.

-

On these more cautious assumptions, today’s share price already incorporates a lot of future success, leaving limited upside and a meaningful risk of multiple compression if growth disappoints.

Do you think there’s more to the story for Meta Platforms? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include META.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Terms and Privacy Policy

Search

RECENT PRESS RELEASES

Related Post