Assessing OBBBA’s Impacts For U.S. Renewable Power Developers

November 4, 2025

Navigating a maelstrom

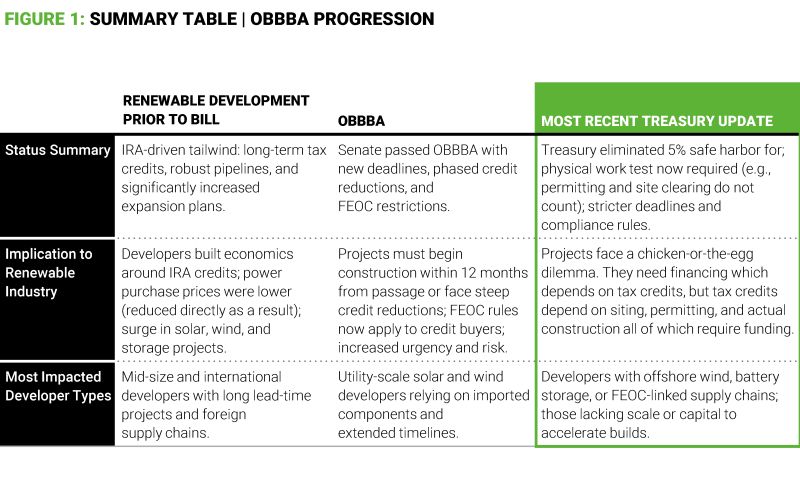

The passage of the One Big Beautiful Bill Act

(“OBBBA”) in July 2025 marked a significant policy

reversal for renewable energy—and only the start of a period

of industry upheaval. Last month, the Treasury Department’s

guidance on the OBBBA’s implementation further tightened the

requirements to qualify for tax credits, most notably eliminating

the “safe harbor” rule that allowed 5% of solar and wind

project spending to stand in lieu of the start of physical

construction. For all of us closely watching the trajectory of

policy over the last year, the potential risks of the spring have

now given way to the hard realities of the fall. This is no longer

business as usual.

After three years of blue-sky expectations and growing project

pipelines following the 2022 passage of the Inflation Reduction Act

(“IRA”), the U.S. renewable power industry must learn to

operate without the certainty of policy tailwinds, and against the

headwinds of uncertain new restrictions.

With utility-scale solar and wind tax credits set to become

constrained over the next several years, now on an accelerated

timeline, developers must urgently reassess their project pipelines

and suspend new origination activities. The focus has shifted to

accelerating viable projects already close to construction, while

mothballing or canceling those that no longer make economic sense

under the current rules. Larger players may see an opportunity to

shift from origination to acquisitions—bringing in mature

projects that should qualify for incentives. Smaller players may

benefit from being nimble, speeding up development to meet

qualification milestones – if they can secure financing and meet

new Foreign Entity of Concern (“FEOC”) content

requirements. Considering OBBBA’s changes, it has become

essential to revisit project economics and investment strategy.

Guidance from the U.S. Treasury and IRS in August established

the Physical Work Test as the exclusive test for

beginning-of-construction, but uncertainty remains, including the

potential for further changes in law and guidance, along with

potential uncertainty for securing permits.

The bright spot remains the seemingly insatiable demand for

electricity, most notably driven by AI data centers. Capitalizing

on this opportunity and weathering this industry maelstrom will

require developers to undertake a careful and structured

reconsideration of all strategies and processes.

The implications of tax credits on project economics

When the Inflation Reduction Act was introduced, solar energy

was expected to produce more electricity per year by 2031 than all

US coal-fired power plants in 2022. Renewable developers built

project investment cases around the expectation of long-term IRA

tax credits, and those incentives resulted in lower Power Purchase

Agreement (“PPA”) prices. As a result, 2023 and 2024 saw

unprecedented solar, wind, and storage additions, with many

developers extending robust project pipelines to the end of the

decade.

Going forward, the OBBBA has fundamentally rewritten the

economics of renewable energy development, with solar and wind

projects facing a cliff of this support. Now, to be eligible for

100% federal tax credits, projects must be placed in service before

December 31, 2027, or they must begin construction within a year of

the OBBBA’s enactment. Projects that were previously projected

to qualify for tax credits could see drastically lower returns and

may not attract financing, especially if there is concern that

construction might not begin before these deadlines. These projects

and their developers face a chicken-or-the-egg dilemma: they need

financing, which depends on tax credits, but tax credits depend on

siting, permitting, and actual construction, all of which require

funding.

That bracing reality requires a re-evaluation of each

project’s investment decision, as well as a holistic look at

project pipelines to identify where to fast-forward, where to

pause, and where to stop altogether. In effect, developers face a

binary decision: cancel projects, or accelerate them to capture the

tax credit before becoming ineligible? For larger organizations

with numerous projects spread across geographies, often each with

its own investors and off-takers, the range of options

expands—creating a complex quandary.

In rare cases, a technological pivot may also be an option. The

OBBBA’s preference of some generation types over others

(notably storage, nuclear, and geothermal), raises the possibility

of leveraging sunk permitting costs towards alternative

technologies. Some companies may be able to seek diversity in areas

still backed by the bill—like hydrogen, biofuels, and carbon

capture—to hedge against policy changes. But the challenge of

continuing with business as usual is significant. Already, more

than $20 billion in clean energy investments were cancelled in the

first half of 2025.

Navigating concerns over Foreign Entities of Concern

(FEOC)

The FEOC provision in the OBBBA creates an additional layer of

complication. It fundamentally reshapes equipment sourcing

strategies, forcing renewables developers to both adapt to new

suppliers and overhaul their oversight processes. While the

industry broadly expected these rules to be relaxed from the

initial House bill, final passage and the Treasury guidelines added

stringent new requirements barring clean energy projects from

claiming tax credits if they are owned, controlled, or materially

supplied by entities linked to certain nations (notably China,

Russia, Iran, or North Korea). This last-minute tack demonstrated

resolve for cutting off supply chains for those nations—it

also guaranteed near-term project disruption for developers.

Navigating FEOC concerns will not be easy. The provision

operates through three mechanisms:

- Ownership-based exclusion, which makes projects owned by a

Specified Foreign Entity or Foreign-Influenced Entity ineligible

starting in 2026. - Effective control rules, where licensing or contractual

agreements that allow FEOC influence may disqualify projects, even

retroactively. - Material sourcing constraints require FEOC-sourced component

costs to remain below decreasing thresholds.

The implications of these changes will ripple through project

economics. Developers will have to shift to domestic or non-FEOC

sources (potentially increasing costs). They will need to build new

processes for ongoing transparency, and dramatically increase due

diligence requirements. Ownership structures will need to be

audited, contracts reviewed, and supply chains mapped—all

while racing against tight deadlines that do not necessarily align

with the tax changes. To qualify for credits under FEOC provisions,

projects must begin construction by July 4, 2026, or be placed in

service by December 31, 2027.

In many cases, developers will ultimately need to restructure

ownership, while working within a reduced pool of credit purchasers

(as FEOC-linked buyers are prohibited). The need is immediate and

critical for developers to assess their exposure levels, enhance

due diligence, and explore all potential sourcing alternatives. It

is the regulatory equivalent of completing a puzzle in the middle

of a hurricane.

Organizational change is inevitable

Given the magnitude of uncertainty that the OBBBA has introduced

into the industry, a fundamental shift in the growth calculus of

renewable energy firms is inevitable. In some lights, this is a

swing of the pendulum following the rapid growth of the last

half-decade. Many renewable companies have expanded through

fragmented acquisitions, resulting in compounded overhead and

administrative costs with duplicated functions and inconsistent

systems. As this moment of industry turmoil accelerates, firms will

be forced to confront these inefficiencies and rethink how SG&A

expenses are structured and scaled.

M&A activity will increase

M&A activity may be a faster and more cost-effective path

through the uncertainty. Rising costs from tariffs, labor

inflation, and interconnection delays were already making organic

growth less viable. The project economics of the post-IRA world

increase that drag even further. For some firms, this could mean

opportunity. Given that a large share of solar and wind projects

depend on tax credits to remain competitive, disruptions are

triggering distress and asset sales, creating an environment for

consolidation. Private equity firms are actively pursuing renewable

platforms with strong pipelines and established grid access, adding

to the possibility of an M&A wave. For those who move

decisively, there are likely to be first-mover advantages.

Distressed or undervalued assets may also become opportunities

before the market resets.

Going forward

Much has been made of the AI data center boom and its associated

demand for electricity, but the industry had already been planning

for increasing load and shifting generation. No doubt the arrival

of the OBBBA era marks a shift away from the enthusiasm for

carbon-free solutions of the last several years. With fewer

renewable projects coming online (and increasing demand), there

will inevitably be a shift to keeping fossil fuel energy sources

longer—and, most likely, an increase in overall generation

prices. Given these factors, further shifts in the economic models

driving energy investment decisions may be on the horizon.

Canceling projects and rolling up pipelines requires a clear

understanding of the path from the specifics of the OBBBA to an

individual decision point.

The content of this article is intended to provide a general

guide to the subject matter. Specialist advice should be sought

about your specific circumstances.

Search

RECENT PRESS RELEASES

Related Post