Assessing Vistra (VST) After Its Long Term Nuclear Energy Deal With Meta

January 14, 2026

Vistra (VST) is back in focus after signing a 20 year deal to supply more than 2,600 megawatts of zero carbon nuclear power to Meta, targeting the tech company’s data center needs.

See our latest analysis for Vistra.

At a share price of US$171.42, Vistra has had a mixed year, with a 3.75% year to date share price return and a modest 1.08% total shareholder return over 12 months. Its three and five year total shareholder returns are both around 7x, suggesting long term momentum that contrasts with a recent 18.7% 90 day share price pullback as the company announces the Meta nuclear agreement and prices US$2.25b in new senior secured notes to help fund the Cogentrix acquisition.

If this kind of power demand from data centers has your attention, it could be a good time to look at high growth tech and AI stocks as potential next candidates for your watchlist.

With the stock trading at US$171.42 and screens flagging a sizeable gap to some valuation estimates, the key question now is whether Vistra is still undervalued or if the recent AI and nuclear optimism is already fully priced in.

Advertisement

Most Popular Narrative: 26.5% Undervalued

With Vistra last closing at US$171.42 against a narrative fair value of about US$233, the current price sits well below that implied level, which puts extra weight on the growth and margin assumptions sitting underneath the model.

Analysts expect earnings to reach $3.4 billion (and earnings per share of $10.94) by about September 2028, up from $2.2 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $2.6 billion.

Curious what kind of revenue ramp, margin lift, and shrinking share count are needed to support that valuation gap, using a 7.9% style discount rate and a lower future P/E than today? The full narrative lays out the earnings path that needs to line up for that upside case to hold together over time.

Result: Fair Value of $233 (UNDERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, there is still real execution risk, with high debt from acquisitions and significant exposure to coal and gas assets that could pressure earnings if conditions tighten.

Find out about the key risks to this Vistra narrative.

Another View: Earnings Multiple Flags Rich Pricing

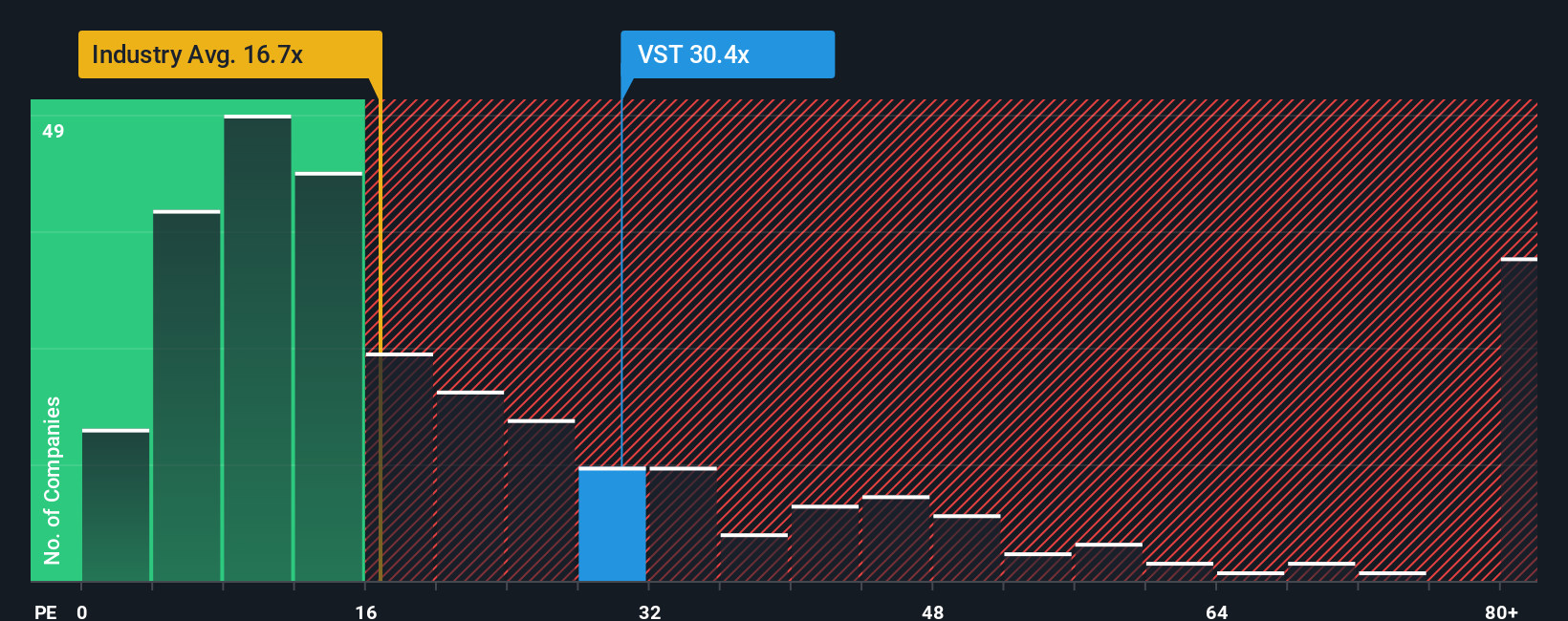

While our narrative fair value suggests upside, the current P/E of 60.5x tells a very different story. It sits well above the peer average of 29.5x, the global renewable energy industry at 16.9x, and even the 42.9x fair ratio the market could move toward.

Put simply, the share price already assumes a lot of future earnings strength, which raises valuation risk if the story does not play out as expected. The question for you is whether the current premium feels like a margin of safety or a margin for error.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Vistra Narrative

If you see the numbers differently or prefer to test the assumptions yourself, you can create your own view in minutes with Do it your way.

A great starting point for your Vistra research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready For Your Next Investing Idea?

If Vistra has sharpened your thinking, do not stop here; your next strong idea could be sitting in plain sight if you know where to look.

- Target income first by scanning these 13 dividend stocks with yields > 3% that could help you focus on companies prioritising regular cash returns to shareholders.

- Hunt for growth by reviewing these 25 AI penny stocks that are tied to AI themes capturing investor attention across markets.

- Focus on value by assessing these 888 undervalued stocks based on cash flows that screens for companies where price and estimated cash flows may not fully line up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Search

RECENT PRESS RELEASES

Related Post