AT&T, Palantir, Nvidia, Apple, Intel: What Sparked Heavy After-Hours Trading In These 5 St

August 22, 2025

AT&T’s strong momentum and Palantir’s losing streak attracted investor attention to these stocks.

The tech sell-off continued on Wednesday, dragging the broader market lower, even as traders looked ahead to the week’s key catalyst, namely the Jackson Hole Symposium that kicks off on Thursday.

As the lean trot continues, the following stocks saw brisk activity in Wednesday’s after-hours session:

AT&T, Inc. (T)

After-hours move: -0.03%

Trading volume: 6.81million

AT&T stock hit an all-time closing high as the telecom giant rides on its defensive appeal amid the surrounding uncertainties. The stock gained 1.04% before settling at $29.28 on Wednesday.

AT&T stock has gained nearly 33% this year, outperforming the broader market. According to Wolfe Research analyst Peter Supino, “The starting condition for this outperformance in telecom stocks was extremely low valuation that implied investor skepticism about the sustainability of profits and therefore dividend yields,” MarketWatch said in a March report.

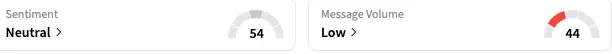

On Stocktwits, retail sentiment toward AT&T stock improved to ‘neutral’ (54/100) by late Wednesday, from ‘bearish’ a day ago. The message volume, however, was at ‘low’ levels.

Palantir Technologies, Inc. (PLTR)

After-hours move: +2.07%

Trading volume: 5.77 million

Palantir extended its losing streak to the sixth straight session, as the artificial intelligence (AI)-powered data analytics company’s stock fell 1.1% to $156.01 on Wednesday.

The ongoing skepticism regarding the AI boom and worries concerning Palantir’s bloated valuation continued to weigh down.

Palantir’s stock, however, rebounded in the after-hours.

Citron’s Andrew Left continued to pile misery on the stock by re-upping his view that Palantir stock is only worth $40, this time making a comparison between the valuation of the Alex Karp-led company and Databricks.

Retail sentiment toward the stock flipped to ‘bullish’ (70/100) from ‘bearish’ a day ago, as the stock lost about 17% over the past six sessions. The message volume also picked up pace to ‘extremely high’ levels.

Palantir stock has more than doubled this year.

Nvidia Corp. (NVDA)

After-hours move: +0.23%

Trading volume: 5.06 million

Nvidia stock has fallen for two sessions now amid AI skepticism and as the company works on ways to sidestep the U.S.’ China chip curbs. Activity in the stock stayed brisk as the Jensen Huang-led company prepares to release its quarterly results next week.

The stock weakness came despite KeyBanc analysts raising the price target to $215 from $190, citing their expectations for a strong quarterly report. The analysts, however, expect the third-quarter guidance to be in line or slightly below the consensus.

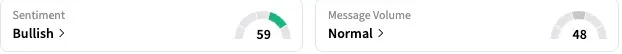

The stock elicited ‘bullish’ sentiment (59/100) from retail traders on Stocktwits, an improvement from the ‘neutral’ mood seen a day ago. The message volume increased, but only to ‘neutral’ levels.

For the year-to-date period, the stock is up over 30%.

Apple, Inc. (AAPL)

After-hours move: -0.16%

Trading volume: 4.85 million

After shedding nearly 2% on Wednesday, Apple’s stock fell further in the extended session. The weakness came amid the sell-off seen in the broader tech space, and the pullback was despite a Bloomberg report suggesting the company has moved the assembly of a greater proportion of its upcoming iPhone 17 lineup to India.

In another positive development, U.S. Director of National Intelligence, DNI, Tulsi Gabbard, confirmed that she has negotiated the cancellation of the backdoor mandate the U.K. had imposed on the company concerning user data.

On Stocktwits, retail sentiment toward Apple stock worsened further, into the ‘extremely bearish’ territory (18/100), with the message volume at ‘extremely low’ levels.

Apple stock is down 9.5% this year, with the company’s additional $100 billion U.S. investment announced earlier this month, helping to trim losses.

Intel Corp. (INTC)

After-hours move: +0.04%

Trading volume: 4.27 million

The buoyancy in the stock gained momentum after White House press secretary Karoline Leavitt confirmed to reporters that the U.S. was looking to buy a 10% stake in Intel. “The president wants to put America’s needs first, both from a national security and economic perspective,” she said.

Intel’s stock is up about 17.5% this year, with the retail sentiment toward the stock staying ‘extremely bullish’ and the message volume at ‘extremely high’ levels.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Apple’s Watch War Heats Up: Masimo Takes Customs To Court Over Blood-Oxygen Feature

Search

RECENT PRESS RELEASES

Related Post