Australia Wind Power Market: Onshore Boom, Offshore Momentum & Clean-Energy Surge

November 30, 2025

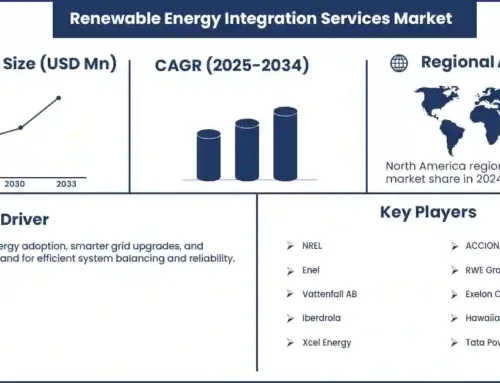

Australia wind power market is on a strong growth trajectory as the nation pushes toward higher renewable-energy penetration, improved turbine technology and expanded grid integration. The market value reached USD 2.72 billion in 2024, and is expected to climb to USD 4.78 billion by 2033, growing at a CAGR of 5.80% during 2025–2033.

This expansion reflects not just increased capacity, but a systematic shift in how Australia generates, distributes and integrates electricity — with wind energy playing a central role in the clean-power transition.

Why the Market Is Growing So Rapidly

Abundant Wind Resources & Favourable Natural Conditions

Australia benefits from vast wind corridors, coastal wind regimes and large tracts of land suitable for onshore wind farms. These geographic advantages — combined with declining land costs in rural and regional areas — make wind power economically attractive. The combination of strong wind resources and lower development overheads supports continuous growth of onshore wind installations.

Government Policy Support & Renewable Energy Targets

National and state-level renewable energy policies, incentives, and renewable-energy targets provide a stable regulatory backdrop supporting wind power investments. As Australia strives to decarbonise energy supply and meet its emissions-reduction commitments, wind energy has become a priority technology — attracting both public and private capital.

Declining Technology Costs & Improved Turbine Efficiency

Technological advances in wind turbines — taller towers, larger rotor diameters, improved aerodynamics, and better control systems — have increased energy yield per turbine and reduced cost per megawatt. Consequently, new projects deliver competitive economics relative to fossil-fuel generation, enhancing investment viability.

Integration with Energy Storage & Hybrid Renewables

The intermittent nature of wind generation is being addressed by coupling wind farms with battery-energy-storage systems (BESS) and hybrid renewable installations (wind + solar + storage). This makes wind power more manageable and reliable for grid operators, reducing intermittency risks and smoothing supply variability — a driver repeatedly cited in the IMARC report for future growth.

Growing Corporate Demand & Clean-Energy Procurement

Corporate buyers, industrial off-takers and large power users are increasingly committing to renewable-power purchase agreements (PPAs) as part of sustainability and ESG goals. This demand — for predictable, clean electricity — fuels new wind-power investments and long-term capacity expansion under stable contracts.

What the Opportunities Are

The trajectory of Australia’s wind power market presents a range of promising opportunities for investors, service providers, technology firms and energy stakeholders:

1. Large-Scale Onshore Wind Farm Development

Developers and infrastructure firms can tap cost advantages and abundant land to build new wind farms — especially in regional areas. As turbine efficiencies rise and development costs fall, onshore wind remains highly investable.

2. Offshore & Floating Wind Deployment

While onshore remains dominant, offshore and floating-wind projects offer vast potential — particularly off Australia’s long coastline. As technology and supply-chain readiness improve, offshore wind could become a substantial growth pillar (supported by trends in similar markets).

3. Hybrid Renewable + Storage Projects

Combining wind with solar and battery storage — forming hybrid clean-energy assets — offers stable supply and higher reliability. Investors and project developers who structure hybrid projects may attract premium pricing under PPAs and grid-stability contracts.

4. Turbine, Component Manufacturing & Maintenance Services

As the market scales, demand for turbines, rotors, towers, cables, maintenance, retrofitting and long-term O&M (operations & maintenance) will rise. Manufacturing, supply-chain and service-providers have growing business potential.

5. Corporate PPAs & Renewable Energy Supply Deals

With more corporates seeking to decarbonise electricity use, wind-power suppliers offering long-term, firm renewable energy contracts stand to benefit. This provides a stable demand base beyond fluctuating wholesale markets.

6. Regional Development, Job Creation & Community-Led Renewable Projects

Wind-farm projects in regional and rural Australia can drive local employment, infrastructure development and community investment — aligning renewable deployment with socioeconomic benefits outside major cities.

• Feb 2025: Australia committed roughly USD 9 billion to large-scale wind and solar energy projects, marking the highest level of investment since 2018. This included financing for 4.3 GW of new renewable capacity, boosting confidence across wind-power developers and investors.

• Jun 2025: The 400 MW Gawara Baya Wind Farm (near Ingham, Queensland) was approved for development. The project — set to power about 240,000 homes — will also generate roughly 1.2 million tonnes of CO₂ savings annually once operational. It’s expected to create ~300 construction jobs and ~20 ongoing roles.

• Oct 2025: The 412 MW Goyder South Wind Farm (near Burra, South Australia) began operations, marking a major addition to national wind capacity. The project is estimated to generate around 1.5 TWh of renewable energy per year and supports long-term power purchase agreements (PPAs) with government and corporate off-takers.

These developments reflect both public and private sector momentum — from greenfield approvals to operational large-scale farms — validating IMARC’s medium-term growth projections.

Why Should You Know About Australia Wind Power Market?

You should know about Australia’s wind power market because it’s becoming a backbone of the country’s clean-energy transformation — crucial for decarbonisation, energy security, and long-term economic growth. With market value set to rise from USD 2.72 billion in 2024 to USD 4.78 billion by 2033, this sector presents sustained potential for:

• Investors seeking stable, regulated returns

• Renewable-energy developers and equipment manufacturers

• Corporates and industries pursuing clean-energy procurement and ESG goals

• Regional economies looking for infrastructure investment and job creation

Wind power is not just about clean electricity — it’s a vehicle for economic development, energy transition, and corporate-sector renewal. Knowing this market puts you at the heart of Australia’s transition to a sustainable, clean-power future.

Search

RECENT PRESS RELEASES

Related Post