AWS Partnership and Bedrock AI Integration Might Change The Case For Investing In Pegasyst

July 19, 2025

- Pegasystems recently announced a five-year strategic collaboration with Amazon Web Services (AWS) to accelerate enterprise legacy modernization through the integration of generative AI technologies, including Amazon Bedrock and AWS Transform, into Pega’s platforms.

- This partnership enables Pega clients to utilize leading large language models securely within their workflow applications, while strengthening Pega’s ecosystem with enhanced cloud migration tools and procurement through AWS Marketplace.

- We’ll now explore how the new AWS collaboration and Bedrock AI integration could influence Pegasystems’ future growth outlook and investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Advertisement

Pegasystems Investment Narrative Recap

To be a Pegasystems shareholder, you need conviction in the company’s AI-driven transformation of enterprise workflows and its ability to deliver recurring cloud revenue growth. The new AWS partnership directly supports Pega’s short-term catalyst, accelerating client adoption of cloud-native, AI-powered solutions, but does not immediately resolve earnings volatility, which remains the primary risk for near-term financial predictability. In my view, this agreement should enhance Pega’s position in automating legacy modernization, though the impact on quarterly revenue consistency will take time to measure.

Of the recent company announcements, the appointment of Daniel Kasun as head of global partner ecosystem stands out for its relevance. Kasun’s leadership, especially with his AWS background, may amplify the AWS partnership’s reach and help drive faster adoption of Pega’s agentic AI and modernization tools through an expanded partner network, potentially fueling the very catalysts that matter most to investors right now.

Yet despite these promising moves, investors should be aware of the ongoing unpredictability in term license revenue, which means…

Read the full narrative on Pegasystems (it’s free!)

Pegasystems’ narrative projects $1.8 billion revenue and $286.7 million earnings by 2028. This requires 3.8% yearly revenue growth and a $90 million earnings increase from $196.7 million today.

Uncover how Pegasystems’ forecasts yield a $50.33 fair value, a 4% downside to its current price.

Exploring Other Perspectives

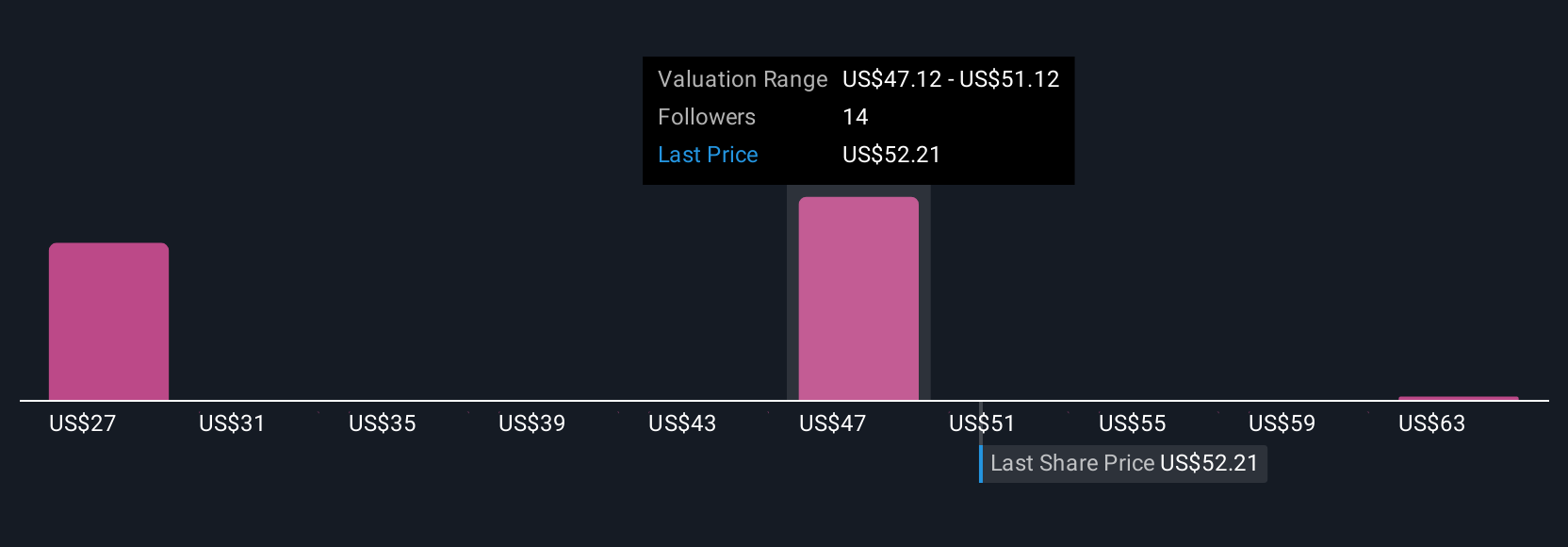

Three fair value estimates from the Simply Wall St Community span from US$27.08 to US$67.15. Amid this broad range, many are weighing whether the company’s shift to agentic workflows and cloud-based models can support sustainable, less volatile revenue streams.

Build Your Own Pegasystems Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

- A great starting point for your Pegasystems research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Pegasystems research report provides a comprehensive fundamental analysis summarized in a single visual – the Snowflake – making it easy to evaluate Pegasystems’ overall financial health at a glance.

Interested In Other Possibilities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don’t delay:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Search

RECENT PRESS RELEASES

Related Post