Best Stock to Buy Now: Alphabet vs. Amazon

February 16, 2026

Amazon and Alphabet saw huge growth in cloud computing during Q4.

Alphabet (GOOG 1.10%) (GOOGL 1.08%) and Amazon (AMZN 0.41%) are two of the largest companies in the world, and each is heavily investing in artificial intelligence (AI). However, each is also making a fair bit of money from it, too, thanks to their cloud computing services.

Several investors are bullish on both companies (including myself), but which is the better buy right now? Let’s take a look at what each business is doing and see the better stock to own over the next few years.

Image source: Getty Images.

AI is powering growth in cloud computing

Alphabet and Amazon are more similar than you may think. Each has a base business. For Amazon, it’s base business is its e-commerce platform; for Alphabet, it’s Google Search. But they also have several other business units on the side, including cloud computing and several other bets that could pay off big time.

Cloud computing is one of my top reasons to own both stocks, because it’s a division that’s actually making money for both companies. Amazon Web Services (AWS), the largest player in the cloud computing space, got to that point by being the first mover in this space. Its growth rates compared to its peers have been comparatively low, but that’s starting to change. In the fourth quarter (Q4), AWS grew its revenue at a 24% pace — the fastest in 13 quarters. That’s a huge deal and shows that generative AI workloads are starting to increase on AWS.

Amazon

Today’s Change

(-0.41%) $-0.81

Current Price

$198.79

Google Cloud had a similarly impressive quarter. In Q3, Google Cloud’s revenue growth was a strong 34% year over year. However, it experienced a massive spike during Q4 with revenue increasing 48% year over year. Google Cloud is clearly emerging as a top option in this space and is capturing a lot of new business.

Alphabet

Today’s Change

(-1.08%) $-3.35

Current Price

$305.65

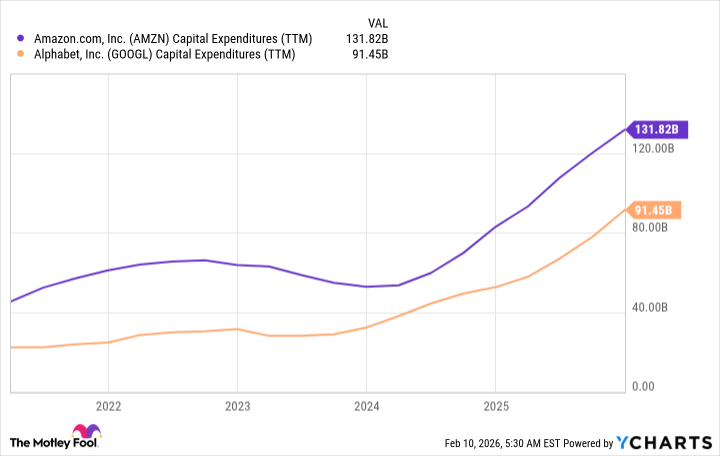

Each company is also spending a huge amount of money on its computing infrastructure in 2026. Alphabet gave guidance for $175 billion to $185 billion, while Amazon told investors to expect $200 billion in capital expenditures. Compared to what each company spent over the past 12 months, this marks a huge spending increase.

AMZN Capital Expenditures (TTM) data by YCharts.

While the market is worried about an AI bubble forming, there’s clearly a lot of demand for companies that are more in the know than the average investor. As long as AWS and Google Cloud are delivering growth rates like they are, I think this massive spending is warranted even if the market is a bit more skeptical.

A lot will change over the next 12 months in terms of AI and spending, but which is the better buy now?

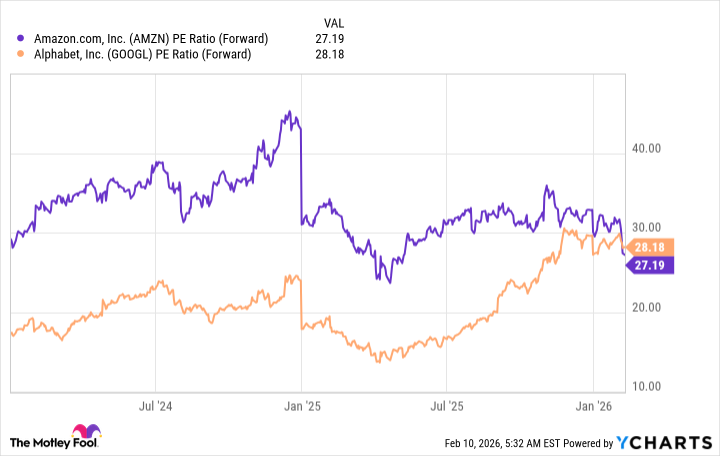

Both stocks carry a premium valuation

Because each company is at the top of its respective industry, it shouldn’t come as a surprise that each carries a premium valuation. Although Amazon is technically cheaper, I don’t consider their valuations to be different enough to say that one is truly cheaper than the other.

AMZN PE Ratio (Forward) data by YCharts.

The real question is which company will have the better 12 months moving forward. If we turn to Wall Street analysts’ growth expectations, Amazon’s revenue is expected to grow at a 12% pace, while Alphabet’s projection is 16%. That gives Alphabet a slight edge in the growth department, although I’m still unsure if it’s that much of an advantage.

The reality is that both stocks are great buys right now, although I do lean slightly toward Alphabet as the better buy. Each company is in a great position to excel this year, and I believe that each will outperform the market over the next few years even with the massive amount of money they’re spending on AI computing.

Search

RECENT PRESS RELEASES

Related Post