Better Analyst Ratings and Activist Interest Might Change the Case for Investing in Health

October 5, 2025

- In recent days, analyst firms including Cantor Fitzgerald and Scotiabank issued positive coverage on Healthcare Realty Trust, citing improvements in the company’s balance sheet, dividend policy, operational structure, and property occupancy rates.

- An increase in activist investor activity, along with new CEO leadership, signals heightened attention to corporate governance and the potential for future operating or strategic shifts at Healthcare Realty Trust.

- We’ll explore how analyst recognition of the company’s improved property occupancy rates may influence Healthcare Realty Trust’s investment narrative going forward.

We’ve found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Advertisement

Healthcare Realty Trust Investment Narrative Recap

To be a shareholder in Healthcare Realty Trust, you need to believe in its ability to capture stable demand for medical office space as the healthcare sector shifts to outpatient care. Recent positive analyst coverage reflects improved occupancy rates and capital structure, which supports the path to higher rental income, but the largest catalyst, sustained occupancy gains, remains exposed to execution risks around ongoing operational changes. The biggest current risk is that delays or missteps in restructuring could hinder cost savings and margin recovery; the news does not materially remove that risk.

The extension of Healthcare Realty Trust’s US$1.5 billion credit facility, reducing near-term debt maturities, is especially relevant given the analyst focus on balance sheet improvements. This financial move adds flexibility for operational initiatives, helping support the company’s efforts to boost property occupancy and reposition its portfolio, which are among the near-term catalysts the news event highlights.

Yet, while there is optimism surrounding new leadership and activist attention, investors should be aware that if integration of operational changes falls short…

Read the full narrative on Healthcare Realty Trust (it’s free!)

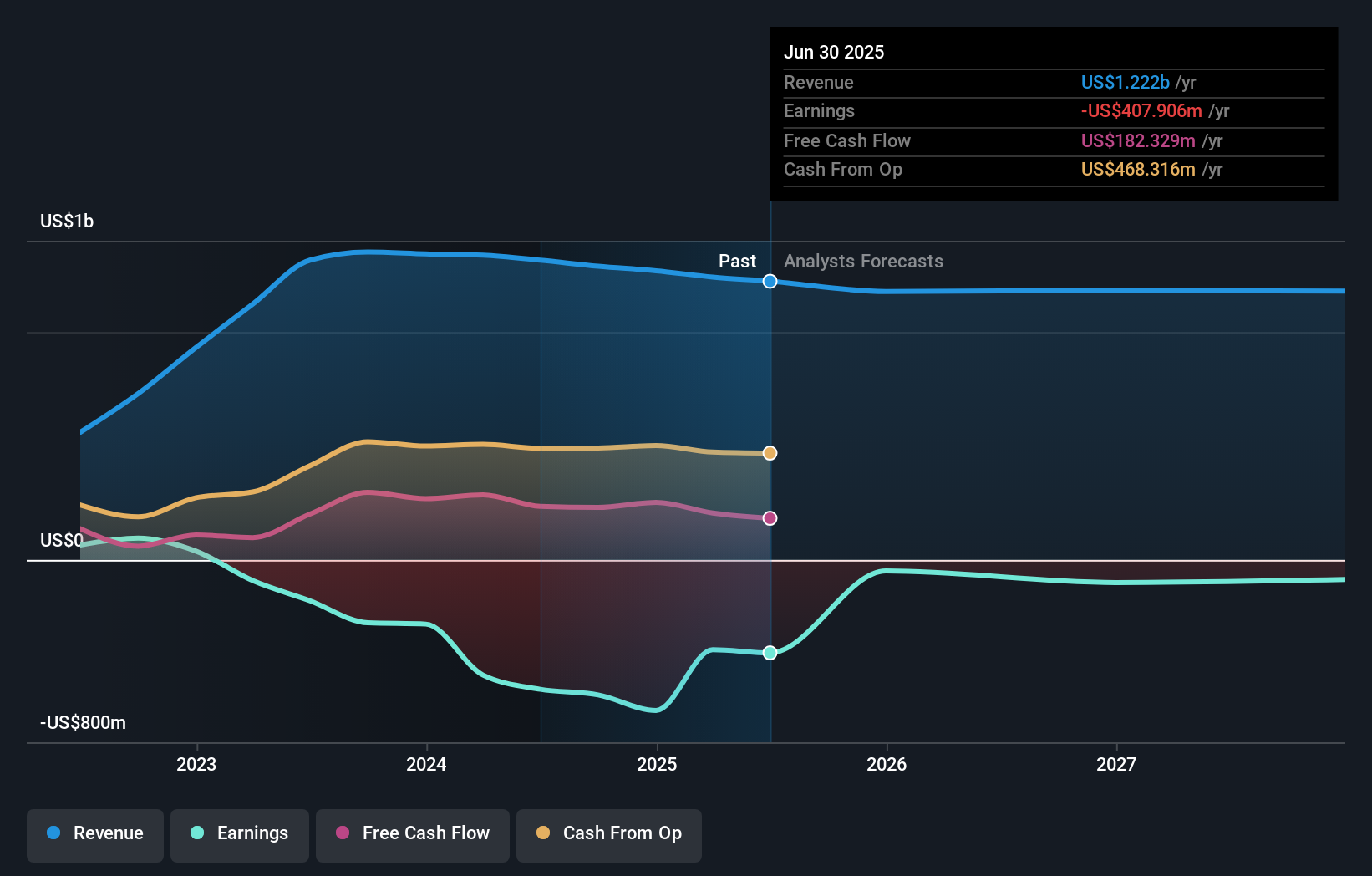

Healthcare Realty Trust is projected to reach $1.2 billion in revenue and $275.4 million in earnings by 2028. This outlook assumes a 1.2% annual decline in revenue and an increase in earnings of $683.3 million from current earnings of $-407.9 million.

Uncover how Healthcare Realty Trust’s forecasts yield a $18.56 fair value, a 4% upside to its current price.

Exploring Other Perspectives

Private investors in the Simply Wall St Community currently estimate Healthcare Realty Trust’s fair value between US$18.56 and US$23.34, based on two perspectives. However, execution risk around restructuring and asset management remains a key consideration that could influence whether these valuations are realized, so reviewing several viewpoints is worth your time.

Explore 2 other fair value estimates on Healthcare Realty Trust – why the stock might be worth as much as 31% more than the current price!

Build Your Own Healthcare Realty Trust Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

- A great starting point for your Healthcare Realty Trust research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Healthcare Realty Trust research report provides a comprehensive fundamental analysis summarized in a single visual – the Snowflake – making it easy to evaluate Healthcare Realty Trust’s overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don’t delay:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Healthcare Realty Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Search

RECENT PRESS RELEASES

Related Post