Beyond headlines: The role of markets and states in the U.S. energy transition

March 26, 2025

This January, the new U.S. administration took office and shifted its economic and energy security agenda back toward the fossil fuel sector. Questions have been raised about the future of clean energy in the US following years of growth driven by federal incentives. Despite uncertainties, there are hopes the US energy transition will continue, driven by private sector innovation and cost competitive technologies reinforced by incentives in the Inflation Reduction Act (IRA).

The U.S. energy market continues its cost-driven shift toward renewables in 2025. Onshore wind has been cheaper than fossil fuels since 2013, followed by solar in 2020, with solar PV costs dropping 88% since 2010. With renewable and storage costs falling, clean energy dominates, accounting for 93% of new electricity generation in 2025 while gas contributes just 7%. Given this, utility companies are unlikely to reverse green investments as the economic case for renewables keeps strengthening, reinforced by state-level net zero standards.

However, outdated grids and permitting challenges are slowing clean energy deployment. With over 50% of the U.S. grid aging past 20 years and unfit for rising industry demands, infrastructure remains a major hurdle. Nonetheless, the strong economic case for renewable energy continues to drive project development, delivering economic security, job creation, and improved quality of life through cleaner air and water. While fossil fuels are seen as a critical part of the U.S. economy and remain part of the country’s “all of the above approach to energy”, the U.S. energy market is increasingly trending toward renewables.

State-level policies have played a decisive role in shaping the energy transition. The decentralization of energy policy in the U.S. has allowed states to implement their own industrial strategies, which they have championed since the Covid-19 pandemic when they rediscovered industrial policy as a tool for economic development. This has led to two models of clean industrial development.

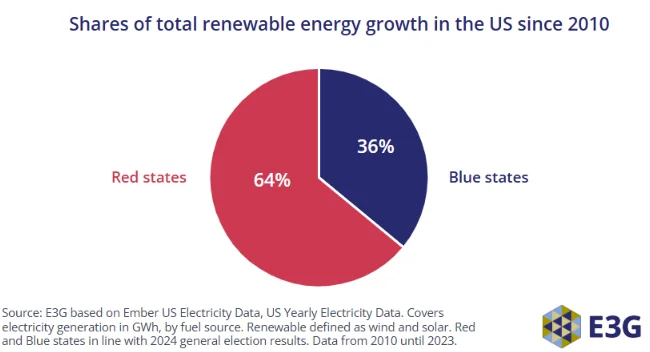

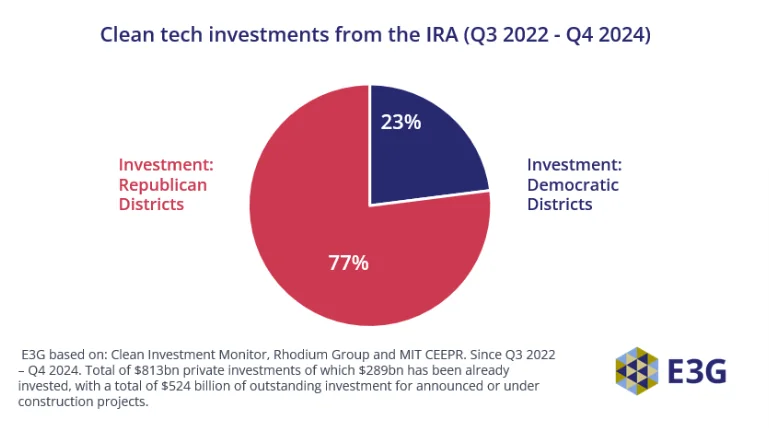

- Red state model (free market-driven, investment-oriented): Republican states have embraced renewables as an economic and industrial opportunity for job creation, energy security, and investment, rather than explicit climate policies. For example, the rapid expansion of wind and solar in Texas which, driven by its deregulated energy market, has also strongly capitalized on IRA tax incentives.

- Blue state model (regulatory-driven, climate-focused): Democratic states, like California, have adopted a more regulatory approach, implementing carbon pricing mechanisms, aggressive renewable mandates, and strict emissions standards. These states are likely to escalate their efforts in response to federal rollbacks on climate policy.

Renewable energy has taken off across the U.S., but with major variation between states. For instance, Oklahoma has quietly become a clean-energy success story. In 2001, coal supplied 63% of Oklahoma’s electricity; by 2023, that figure dropped to 6% with wind power being the driving force behind this shift, growing from 10% in 2010 to 45% in 2023. This makes Oklahoma the third-largest wind producer nationally.

Federal policies, especially the IRA, have reinforced renewable growth nationwide, with funding heavily concentrated in red counties.

There is bipartisan consensus on the need for federal permitting reforms for energy infrastructure and grid modernization. Republicans favor fast-tracking all energy infrastructure, including fossil fuels, while Democrats prioritize clean energy projects. Finding bipartisan solutions could accelerate the transition across the country.

If federal support weakens or permitting delays persist, clean energy expansion could slow. Recent policies have paused permitting and leasing for new onshore and offshore wind projects. Stable policy and infrastructure investment can reduce uncertainties, ensuring market forces – such as cost competitiveness, private investment, and technological advances – to continue driving U.S. clean energy growth.

Market competitiveness is expected to continue helping renewables expand, while state policies provide the framework for localized clean energy strategies for industrial and regional development under a competitive market.

While federal-level battles over emissions standards and energy policy can be expected to persist, the fundamental drivers of the transition – free markets and state-level policies – are expected to remain intact. Whether through Texas’s market-driven expansion of renewables or California’s regulatory climate policies, the U.S. appears likely to continue its path toward a cleaner energy future.

This blog is based on research from E3G’s Political Economy Mapping Methodology for the United States, which will be released later this month.

Search

RECENT PRESS RELEASES

Related Post