Big Tech Discounts Investors Can Buy Now (GOOGL, AMZN, META)

March 8, 2025

The US stock market has entered correction territory, with the S&P 500 8% off its recent all-time highs and the Nasdaq 100 down 11%. This sharp sell-off has been driven primarily by uncertainty surrounding tariff trade policy and to a lesser extent the effects of large federal spending cuts. Both catalysts have cut economic growth projections and added significant ambiguity for any businesses doing international trade.

While corrections like this can trigger concerns about further downside and lead to emotional reactions, it’s important to keep the bigger picture in mind. The U.S. stock market has been climbing for over a century, and history shows that periods of correction often present excellent buying opportunities. However, the key is to focus on high-quality companies with strong track records of consistent sales and earnings growth over the long term.

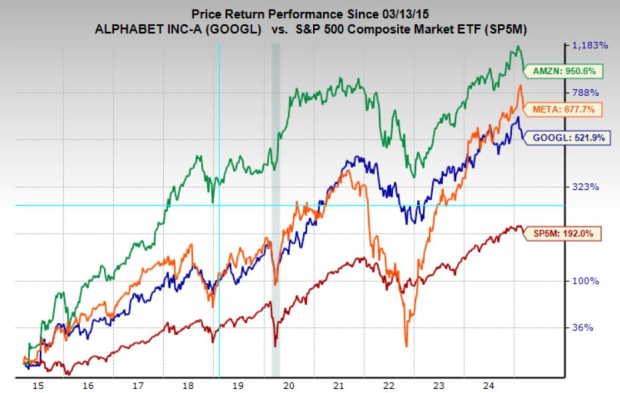

Among the highest-quality businesses in the world, perhaps in history, are the Magnificent 7, a group of tech giants that have demonstrated exceptional resilience and innovation. Today, I’m highlighting three of them: Alphabet ((GOOGL – Free Report) ), Amazon ((AMZN – Free Report) ), and Meta Platforms ((META – Free Report) ). These companies are not only trading at discounts relative to their historical valuations, which helps limit downside risk, but they also offer exceptional long-term return potential due to their dominance in powerful secular trends shaping the future of technology and commerce.

Image Source: Zacks Investment Research

Amazon: Cheapest Valuation in Company History

Amazon has long been a dominant force in e-commerce and cloud computing, two of the most transformative economic trends of the past two decades and which continue to be leading industries. The company continues to reinvent itself as it expands into new, high-growth verticals, including artificial intelligence and digital advertising among others.

Amazon Web Services (AWS) remains the undisputed leader in cloud computing, generating the majority of the company’s operating income while benefiting from long-term secular growth in enterprise cloud adoption. Additionally, Amazon is aggressively investing in AI infrastructure and services, including a major stake in Anthropic, the developer of one of the most widely used large language models (LLMs). With AI adoption accelerating across industries, Amazon is well-positioned to capitalize on cloud-based AI workloads and enterprise AI integration.

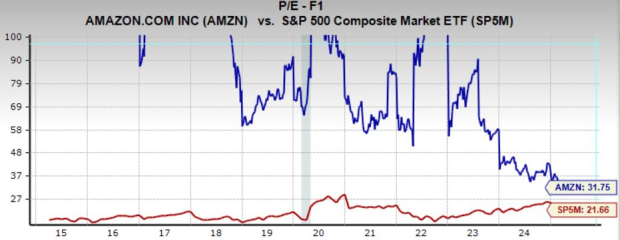

From a valuation standpoint, Amazon is trading at historically low levels, making it an attractive opportunity for long-term investors. The stock’s 10-year median forward price-to-earnings (P/E) ratio is 87.6x, yet it currently trades at just 31.8x forward earnings, marking the cheapest valuation in the company’s recent history. Given that earnings are projected to grow at an annualized rate of 22.85% over the next three to five years, this sharp multiple compression significantly limits downside risk while setting the stage for strong long-term returns.

Image Source: Zacks Investment Research

Alphabet: Historical Discount and Huge Growth Opportunities

Alphabet remains a fundamental pillar of the digital economy, with its core business, Google Search, continuing to deliver steady sales and earnings growth despite investor concerns that AI could disrupt traditional search volume. In reality, Alphabet is proactively integrating AI into its ecosystem, with early data suggesting that AI-powered search summaries are enhancing user engagement rather than eroding traffic. The company has also teased a next-generation AI search product, reinforcing its commitment to staying at the forefront of innovation in online search.

Beyond search, Alphabet has several underappreciated growth engines, the most notable being Waymo, its self-driving car subsidiary. While many competitors in autonomous driving are still in testing phases, Waymo is already operating at scale, providing over 200,000 rides per week. As the technology advances and expands into more cities, Waymo could become a major profit center that is barely factored into Alphabet’s current valuation.

Alphabet is also a key player in cloud computing, where Google Cloud is growing at an impressive 30% annually. With increasing demand for AI-driven workloads and enterprise cloud services, Google Cloud is becoming an increasingly important driver of the company’s overall revenue growth.

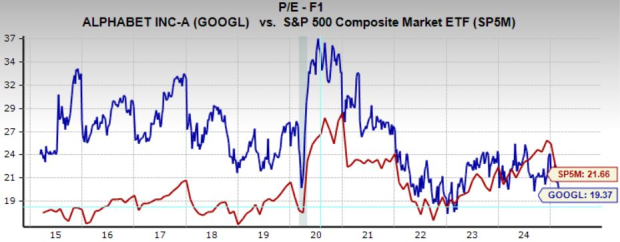

Despite these powerful long-term growth catalysts, Alphabet is trading at a historical discount. The stock’s 10-year median forward P/E ratio is 25.8x, yet it currently trades at just 19.4x forward earnings. With earnings expected to grow at 15.5% annually over the next three to five years, this valuation compression presents a compelling opportunity for investors looking for both stability and upside.

Image Source: Zacks Investment Research

Meta Platforms: Among the Best Stocks in the Market

Meta Platforms has cemented itself as one of the most dominant forces in digital advertising and social media, with an astounding 3.35 billion daily active users across its platforms, including Facebook, Instagram, and WhatsApp. Despite concerns about competition and shifting digital trends, Meta continues to thrive, proving itself to be an underappreciated cash-generating machine. Over the last decade, the company has grown earnings at an annualized rate of 36%, and today, it generates $1 billion in free cash flow every week, a staggering figure that highlights the strength of its business model.

Meta has also been at the forefront of AI integration in digital advertising, using it to automate ad creation and optimize targeting across its platforms. By leveraging AI, Meta has made its ad network more efficient, allowing businesses to achieve better results while driving higher monetization and ad revenue growth for the company. This AI-powered approach is helping Meta stay ahead in an increasingly competitive digital landscape.

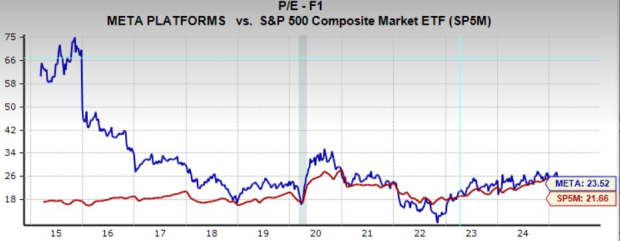

Looking ahead, earnings are forecasted to grow at an annualized rate of 18.3% over the next three to five years, reinforcing the company’s long-term expansion potential. Despite its incredible financial performance and robust growth outlook, Meta is trading at a historically reasonable valuation, with a forward earnings multiple of 23.5x, just below its 10-year median of 24.8x.

Image Source: Zacks Investment Research

Should Investors Buy Shares in META, GOOGL and AMZN?

With the market pulling back, investors have an opportunity to buy three of the highest-quality tech stocks at rare discounts. Alphabet, Amazon, and Meta Platforms continue to dominate their respective industries, and each is well-positioned for long-term growth thanks to powerful secular trends in AI, cloud computing and digital advertising.

Unlike many growth stocks, these companies are trading below their historical valuation averages, which not only limits downside risk but also enhances long-term return potential as earnings continue to expand. While short-term volatility may persist, investors with a long-term mindset could see this correction as a chance to accumulate shares in industry leaders with strong balance sheets, durable competitive advantages, and impressive earnings growth.

For those looking to buy the dip in big tech, these three names stand out as some of the best opportunities in the market today.

Search

RECENT PRESS RELEASES

Related Post