Billionaire Bill Ackman Just Sold These 2 Stocks After They Disappointed in 2025. Here’s W

December 22, 2025

Sometimes it makes sense to cut losses and invest in better opportunities.

Bill Ackman is one of the most widely followed billionaire hedge fund managers in the world. Not only does his fund, Pershing Square Capital Management, perform well relative to its benchmarks, he’s also very outspoken and shares his reasoning behind his fund’s investments. The fund typically holds just a dozen or so high conviction investments, and Ackman and his team like to take long-term views on the stocks they buy.

But sometimes it makes sense to sell an investment. If an investment thesis fails to play out or no longer rings true, it can be better to ditch the stock and redeploy the capital in other companies. Such was the case recently when Pershing Square exited its positions in two stocks. Heading into 2026, the team can focus on a few big investments driving returns for its shareholders.

Image source: Getty Images.

Dropping one of its longest held stocks

Pershing Square finally sold the rest of its shares of Chipotle (CMG +0.74%) earlier this quarter.

The hedge fund initially invested in Chipotle in 2016, following two separate outbreaks of E. coli linked to its restaurants. Ackman and the team were confident Chipotle could recover and return to the strong same-store sales growth it saw before the incidents. Indeed, under CEO Brian Niccol, Chipotle averaged 9% same-store sales growth from his start through the end of 2024.

But the restaurant has struggled in 2025. Comparable store sales declined through the first half of the year. For the third-quarter, comparable sales improved just 0.3%, but management warned it expects same-store sales to decline again in Q4 in the mid-single-digit range.

Advertisement

Chipotle Mexican Grill

Today’s Change

(0.74%) $0.28

Current Price

$37.92

Meanwhile, with its declining same-store sales, Chipotle isn’t in a position to raise prices to offset the rising food costs of the last few years. As a result, it’s faced pressure on its margins. Operating margin fell 800 basis points through the first nine months of the year to 16.9%.

Pershing Square investment analyst Anthony Massaro pointed out the stock now trades for around 25 times forward earnings, which makes it historically cheap. However, the analysts don’t have enough confidence it can return to its historical growth trends to justify staying invested in the stock.

The turnaround story that’s not turning fast enough

Ackman and his team saw an opportunity to invest in Nike (NKE 2.44%) last year, as the company looked to turn things around after a few managerial blunders. With the installation of veteran exec Elliott Hill at the end of 2024, Pershing Square saw fit to double down on Nike by selling its shares in the stock in exchange for deep in the money call options. That also freed up some capital for investment elsewhere. But the hedge fund exited those options contracts this quarter, as they’re no longer confident in the turnaround.

The biggest concern for the investment team is Nike’s ability to return to its pre-COVID profit margins. It built a high margin business based on its brand strength and innovations, two areas of focus for Hill in his turnaround plans. However, the new tariffs implemented by President Trump will have a huge impact on Nike’s profitability. And while management believes it can mitigate most of those costs, it’ll be hard to offset them entirely. Meanwhile, the athletic wear company faces a growing amount of competition, which could weigh on margins indefinitely.

Today’s Change

(-2.44%) $-1.44

Current Price

$57.27

The turnaround progress so far has been slow. Sales for fiscal 2025 fell 10%, and its earnings before interest and taxes (EBIT) margin shrank from 12.7% to 8.2%. Margins are starting to rebound in fiscal 2026, but sales remain on the decline, and there’s still a lot of uncertainty about what the long-term run rate will be for the company. Management said it expects to return to double-digit margins. But as Massaro pointed out, there’s a big difference between a 10% margin and a 13% or 14% margin.

With the uncertainty around the margin outlook for Nike, Pershing exited the position, losing 30% on its initial investment, in just about a year and a half.

Where Ackman’s investing instead

With the disposal of the Chipotle and Nike positions and no announcement regarding new investments, Pershing Square’s equity portfolio is getting more concentrated. Its biggest holdings are now Alphabet (GOOGL +0.85%) (GOOG +0.88%) and Brookfield (BN +1.97%) (BN +1.63%).

Pershing Square has held both stocks throughout 2025, and they’ve been strong performers for the fund. Even so, the stocks still look attractive today.

Alphabet has seen very strong momentum in recent months following a ruling on its antitrust case that came with much more lenient remedies than expected. Followed by strong earnings results and momentum in its cloud computing business, shares have climbed considerably.

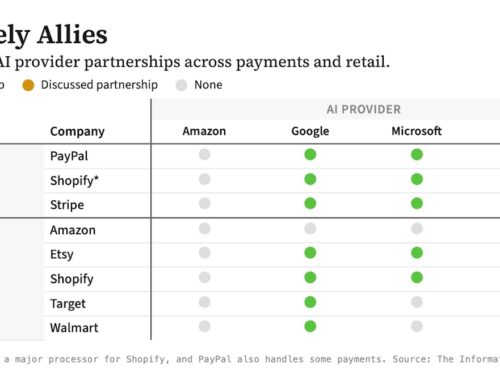

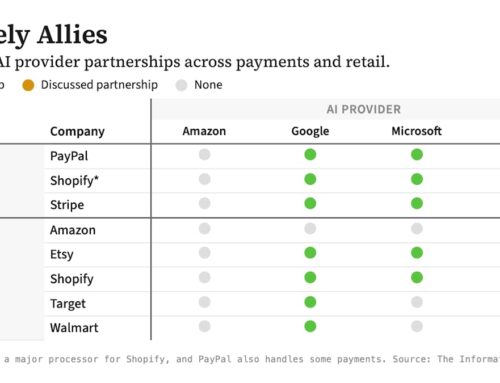

Alphabet is a leading AI service provider across both software and hardware. Its recently released Gemini 3.0 foundation model tested extremely well against benchmarks, and it’s seeing greater adoption of its custom AI accelerators. Importantly, Alphabet benefits from advancements in both areas as it integrates its LLM into its core search product, advertising services, and YouTube. As a result, Google’s revenue has continued to climb despite fears of AI chatbots displacing it. Meanwhile, the cloud computing business has shown strong operating leverage as it scales at a rapid pace.

That momentum should continue well into 2026. As a result, there’s still value in the stock despite its earnings multiple expanding into the upper 20s.

Alphabet

Today’s Change

(0.85%) $2.62

Current Price

$309.78

Brookfield, meanwhile, is poised to generate strong results in 2026. Subsidiary Brookfield Asset Management is set to launch several large funds next year, which should attract significant capital. Meanwhile, Brookfield should start to recognize a growing amount of carried interest. Management said it expects to generate $6 billion in carried interest over the next three years after taking in just $4 billion in the previous decade. That should accelerate as the new funds mature over the next few years.

Management also projected 25% compound annual growth in distributable earnings over the next five years. That makes the stock look extremely cheap at its current valuation of about 15 times forward earnings expectations. Pershing Square remains confident in both Brookfield and Alphabet, so it’s no wonder they combine to make up around 40% of its remaining equity portfolio.

Search

RECENT PRESS RELEASES

Related Post