Billionaire Ken Griffin Sells Amazon Stock and Buys an AI Stock Up 1,030% Since 2024 (Hint

December 26, 2025

Top hedge fund manager Ken Griffin sold Amazon and bought Palantir in the third quarter.

Ken Griffin runs Citadel Advisors, the most successful hedge fund in history as measured by net gains since inception. Additionally, Citadel outperformed the S&P 500 (^GSPC +0.32%) by 8 percentage points over the last three years. That makes Griffin an excellent source of inspiration for retail investors.

In the third quarter, Citadel sold 1.6 million shares of Amazon (AMZN +0.10%) and purchased 388,000 shares of Palantir Technologies (PLTR +0.02%), a stock that has advanced 1,030% since January 2024. Comparatively, Nvidia stock is up 281% over the same period.

Here’s what investors should know about Amazon and Palantir Technologies.

Image source: Getty Images.

Amazon: The stock Ken Griffin sold

Amazon has a strong presence in three growing industries: e-commerce, digital advertising, and cloud computing. The company is leaning on artificial intelligence (AI) to increase sales and improve profitability across each operating segment, as detailed below:

- E-commerce: Amazon runs the largest online marketplace in North America and Western Europe. It has developed generative AI tools for customer service, inventory placement, and last-mile delivery, as well as models that make its industrial robot fleet more efficient. Amazon has also developed an AI shopping assistant called Rufus that is on pace to deliver $10 billion in sales this year.

- Advertising: Amazon is the third-largest ad tech company and the largest retail advertiser, which is one of the fastest-growing categories in the broader digital advertising market. The company has built generative AI tools that let brands create images, video, and audio; Amazon has also developed an agentic AI tool that can research products and create campaigns.

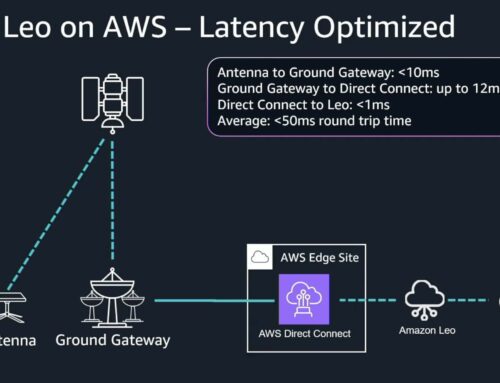

- Cloud computing: Amazon Web Services (AWS) is the largest public cloud. It has added new platform services, like Bedrock for generative AI application development. AWS has also designed custom AI chips for training and inference workloads that provide clients with a less expensive alternative to Nvidia GPUs. More recently, AWS introduced AI agents that automate software development, security operations, and performance monitoring.

Investments in AI are bearing fruit. In the third quarter, Amazon’s revenue increased 13% to $180 billion, driven by accelerating sales growth across its advertising and cloud computing segments. Meanwhile, operating margin expanded 60 basis points (excluding two one-time charges) and operating income increased 23% to $21.7 billion.

Advertisement

Wall Street estimates Amazon’s earnings will increase at 18% annually over the next three years. That makes the current valuation of 33 times earnings look reasonable. So, why did Ken Griffin sell Amazon? Perhaps he was simply taking some profits. Whatever the reason, it would be wrong to assume he lost confidence in the company. Amazon is still one of Citadel Advisors’ top 10 positions.

Palantir Technologies

Today’s Change

(0.02%) $0.04

Current Price

$194.17

Palantir Technologies: The stock Ken Griffin bought

Palantir develops data analytics and artificial intelligence platforms for customers in the public and private sectors. Its key differentiator is ontology-based software, meaning its products are designed around a decisioning framework made more effective over time by machine learning (ML) models. Use cases span supply chain management, retail inventory optimization, financial fraud detection, and battlefield analytics.

Last year, Forrester Research recognized Palantir as the most capable AI/ML platform on the market, ranking it above Alphabet‘s Google, Amazon Web Services, and Microsoft Azure. The analysts wrote, “Palantir is quietly becoming one of the largest players in this market.” Earlier this year, Forrester ranked Palantir as a leader in AI decisioning platforms.

That recognition from industry analysts has come alongside strong financial results. In the third quarter, Palantir’s revenue rose 63% to $1.1 billion, the ninth straight acceleration, and non-GAAP earnings more than doubled to $0.21 per diluted share. Management said strong demand for its artificial intelligence platform was key to its strong performance.

The problem with Palantir is valuation. Shares currently trade at 119 times sales, which makes it the most expensive stock in the S&P 500 by a wide margin. AppLovin is the next-closest stock at 45 times sales. That means Palantir could lose more than 60% of its value and still be the most expensive stock in the index.

Consider this: Palantir’s stock price has increased 11x since January 2024, but its revenue has increased less than 2x. That means the primary reason the stock price has increased is that investors are happily paying higher price-to-sales multiples. Indeed, the stock traded at 18 times sales in January 2024.

That figure cannot keep expanding indefinitely. Valuation will matter at some point. When that day comes, Palantir is likely to crash. I’m not sure why Griffin bought shares of Palantir in the third quarter, but investors should not assume he has a great deal of conviction in the company: Palantir does not rank among his top 300 holdings.

Search

RECENT PRESS RELEASES

Related Post