Billionaires cash out shares early before Trump’s tariff plunge

April 21, 2025

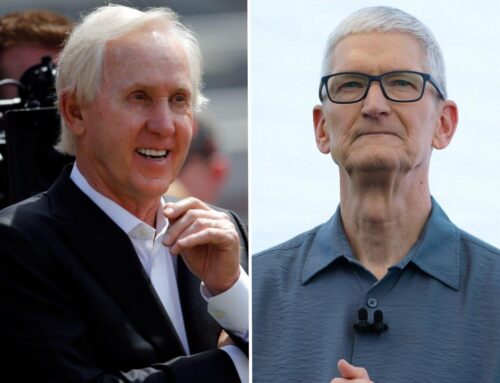

Insiders including Meta Platforms’ Mark Zuckerberg, Oracle Corp’s Safra Catz and JPMorgan Chase & Co’s Jamie Dimon cashed out shares worth billions of dollars before President Donald Trump’s tariff announcements roiled markets.

Zuckerberg sold 1.1 million shares worth $US733 million ($1.1 billion) in the first quarter through his Chan Zuckerberg Initiative and its related foundation, according to an analysis by the Washington Service, which tracks insider buying and selling. All the sales were in January and February when Meta’s stock was still trading above $US600, hitting a peak of more than $US736 on Valentine’s Day. The social-media company’s share price has since slid 32 per cent amid the broader market sell-off.

Another top seller was Safra Catz, Oracle’s chief executive officer, who unloaded 3.8 million shares worth $US705 million before the tech giant’s stock fell more than 30 per cent. Those proceeds, combined with her remaining stake and investment portfolio, give her a fortune of $US2.4 billion, according to Bloomberg Billionaires Index, which is valuing her net worth for the first time.

Dimon, CEO of the largest US bank, sold about $US234 million of stock during the quarter. He has a net worth of $US3 billion, according to Bloomberg’s wealth index.

The first quarter was a volatile period for markets. While technology stocks surged early in Trump’s presidency, the uncertainty over tariffs in the lead-up to April 2 – his so-called “Liberation Day” – helped prompt a sell-off that chopped trillions of dollars off global markets.

Elon Musk, the world’s richest person, has seen his wealth tumble $US129 billion so far this year as uncertainty over tariffs, which could affect everything from phones to semiconductors, have hit tech industry stocks hard. Already, some billionaire insiders are using the opportunity to buy shares at depressed prices and increase their stakes.

Insider selling overall was down compared with the first quarter of 2024, when 4702 insiders unloaded shares worth a total of $US28.1 billion, compared with $US15.5 billion from 3867 sellers this year, according to Washington Service.

The bulk of last year’s sales came from Jeff Bezos, who disposed of Amazon.com shares worth more than $US8.5 billion in February. This year’s first-quarter totals were more evenly distributed with 10 sellers unloading stock worth more than $US3.8 billion.

Bloomberg

The Market Recap newsletter is a wrap of the day’s trading. Get it each weekday afternoon.

Search

RECENT PRESS RELEASES

Related Post