Bit Digital Announces Transition from Bitcoin Mining to Ethereum-Focused Strategy

June 26, 2025

Bit Digital (BTBT), a publicly traded digital asset firm, has announced that it will wind down its Bitcoin (BTC) mining operations and transition into an Ethereum (ETH) staking and treasury management company.

This decision marks the end of an era for the firm, which has Bitcoin mining operations across the US, Canada, and Iceland. The shift reflects a growing recognition of Ethereum’s economic advantages.

According to the press release, Bit Digital’s strategic pivot also involves selling off its BTC holdings and redeploying the proceeds into Ethereum. The firm has gradually increased its Ethereum holdings and also operated staking infrastructure since 2022.

“As of March 31, 2025, the Company held 24,434.2 ETH and 417.6 BTC, valued at approximately $44.6 million and $34.5 million, respectively, as of that date. Bit Digital intends to convert its BTC holdings into ETH over time,” the firm noted.

As part of the transition, the firm has started evaluating strategic options for its Bitcoin mining operations. This may result in their sale or shutdown. Moreover, Bit Digital will invest any funds from this process into Ethereum.

That’s not all. The company announced a public offering of its ordinary shares in a separate press release. Bit Digital plans to use the funds to acquire Ethereum.

Nonetheless, the final terms and size of the offering are still uncertain. The decision comes amid rising Bitcoin mining costs and record-high hashrate.

“Bitcoin mining is energy-intensive, hardware-dependent, and increasingly margin-constrained. Ethereum staking, by contrast, offers cleaner economics — yield without the expensive energy costs and rapidly depreciating assets. This is why I believe Bit Digital made this transition,” BTCS CEO Charles Allen wrote.

Recently, BeInCrypto reported that the cost of mining a single Bitcoin rose to $64,000 in Q1 2025, up 23% from $52,000 in Q4 2024. Furthermore, the production costs are projected to exceed $70,000 this quarter.

There is also increased competition, as evidenced by rising Bitcoin mining difficulty. It reached 126.98 trillion, fueled by a 14-day average hashrate of 913.54 EH/s. Despite this, transaction fees have remained low, constituting only 1.3% of block rewards in May and dropping to under 1% in June.

Allen explained that Bitcoin mining faces diminishing returns due to high costs and constant infrastructure investment. Miners often need to sell their Bitcoin to cover these expenses, reducing their exposure and adding volatility to their holdings.

On the other hand, Bitcoin treasuries provide exposure to BTC but generate little to no revenue. According to him, an Ethereum-focused strategy presents a hybrid approach.

It offers asset exposure and recurring yield without the high costs of mining equipment and depreciation.

“This is likely just the beginning. As the economic reality of proof-of-stake becomes more widely understood, more crypto-native companies — especially miners — will begin to rethink their strategies,” Allen added.

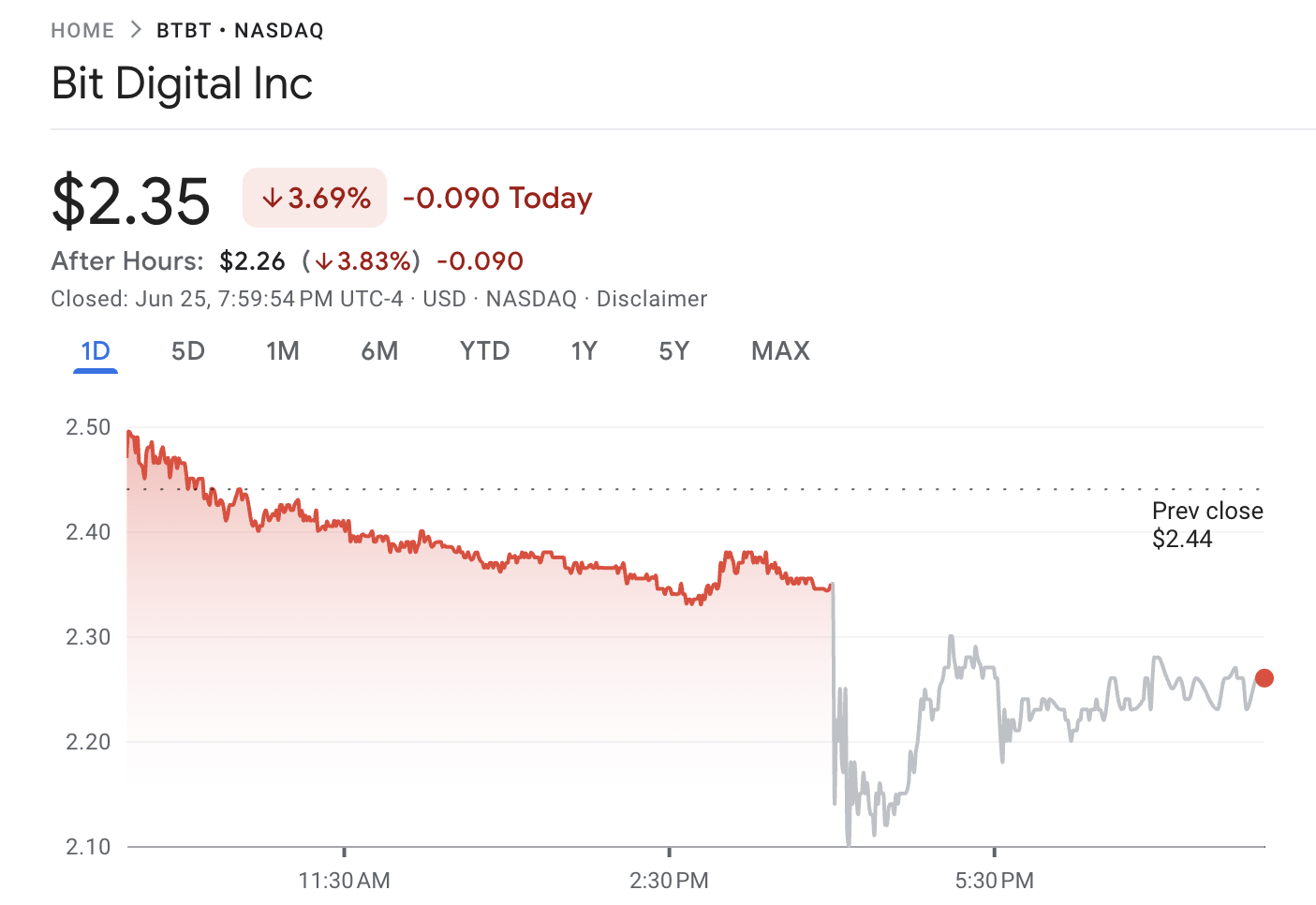

Meanwhile, Bit Digital’s move did not impact its stock prices positively. Google Finance data showed that BTBT was down 3.69% at the market close.

The stock prices fell further by 3.83% in after-hours trading. Nevertheless, the decline is not new. BTBT has been in a prolonged downtrend, declining 29.4% over the past year.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Search

RECENT PRESS RELEASES

Related Post